VANCOUVER, British Columbia, August 14, 2023 – Kingfisher Metals Corp. (TSX-V: KFR) (FSE: 970) (OTCQB: KGFMF) (“Kingfisher” or the “Company”) is pleased to announce diamond drilling has begun at the HWY 37 Project for the planned ~2500 m drill program. The project is located in Northwest British Columbia within the Golden Triangle.

Highlights

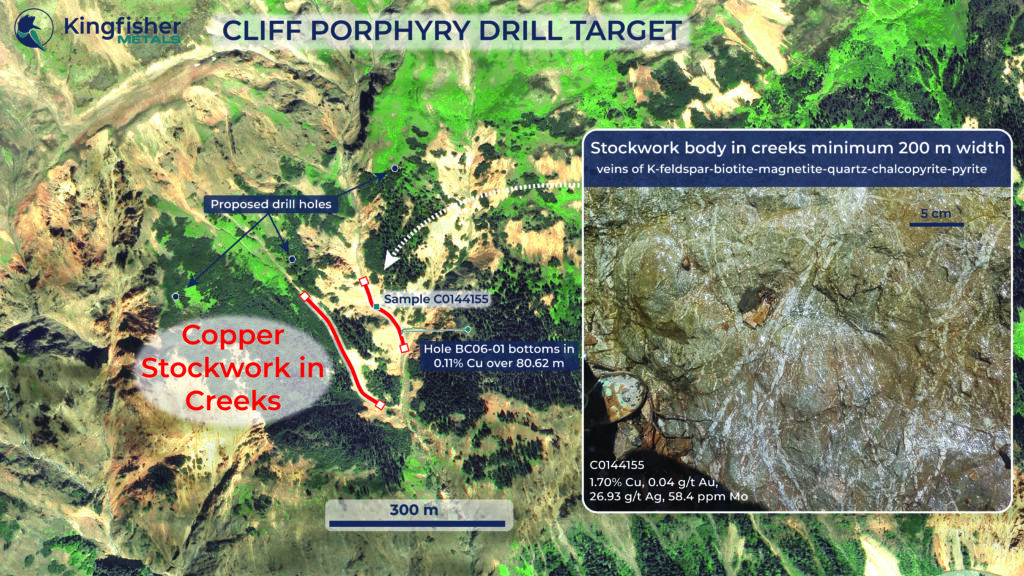

- Drill test of the Cliff porphyry target follows-up on untested significant stockwork on surface adjacent to a single historical drill hole that bottomed in 0.11 % Cu over 81 m (Hole BC06-01) in flanking alteration.

- Sampling by Kingfisher in 2023 returned 1.70% Cu from the Cliff porphyry stockwork body.

- Drilling south along trend from the Mary deposit targets open mineralization adjacent to hole BCK-MZ-19-01 with 0.48 g/t Au and 0.14% Cu over 291.5 m.

Dustin Perry, CEO states “We are beginning an exciting drill program at the relatively underexplored HWY 37 Project within the prolific Golden Triangle. This program is focused on new copper-rich porphyry discoveries with drilling at the untested Cliff stockwork body and the Mary Root Zone which are part of a large 6×6 km alteration zone that includes the Mary deposit. Drilling will also focus on expanding the footprint of the Mary deposit.”

The ~2500 m diamond drill program at the HWY 37 Project is currently underway with initial drilling at the Cliff porphyry target. The drill contractor is Konaleen Drilling, a Tahltan based company.

Cliff Porphyry Drill Target

The Cliff porphyry is part of a ~4 km-long Cu-Au-Ag-Mo soil anomaly on trend with the Mary deposit and is the first drill target of the program. Two creek gullies in the core of the soil anomaly (Figure. 1) provide narrow exposures of copper-bearing stockwork. Mapping delineated a >200 m trace in the western gully and >100 m trace in the eastern creek. The stockwork body is host to 5-30% by volume veins of magnetic K-feldspar-biotite-magnetite-quartz-chalcopyrite-pyrite-galena. Kingfisher sampled the stockwork on surface (Sample C0144155, Figure 1) returning 1.70% Cu, 0.04 g/t Au, 26.93 g/t Ag, 58.4 ppm Mo. Historical rocks in the stockwork grade up to 0.7% Cu.

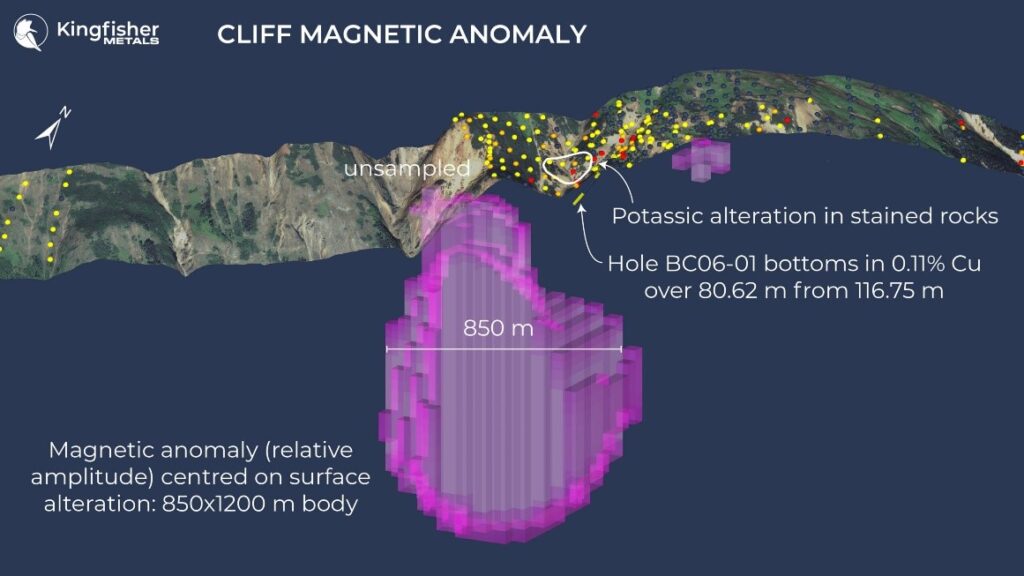

Only one historical drillhole at Cliff porphyry (Hole BC06-01) collared east of the stockwork body (Figures 1&2). The hole bottomed in 0.11% Cu over 80.62 m, where quartz-sulfide veins increase to 2-5% by volume. The stockwork body mapped on surface hosts a higher volume of veins (5-30%) and was not tested by hole BC06-01.

This stockwork body lies above a large, untested magnetic anomaly (Figure 2). Hole BC06-01 bottomed in 0.11% Cu over 80.62 m but did not intersect the intense zone of stockwork outlined in Figure 1. The bottom of BC06-01 is ~170 m from a large magnetic anomaly.

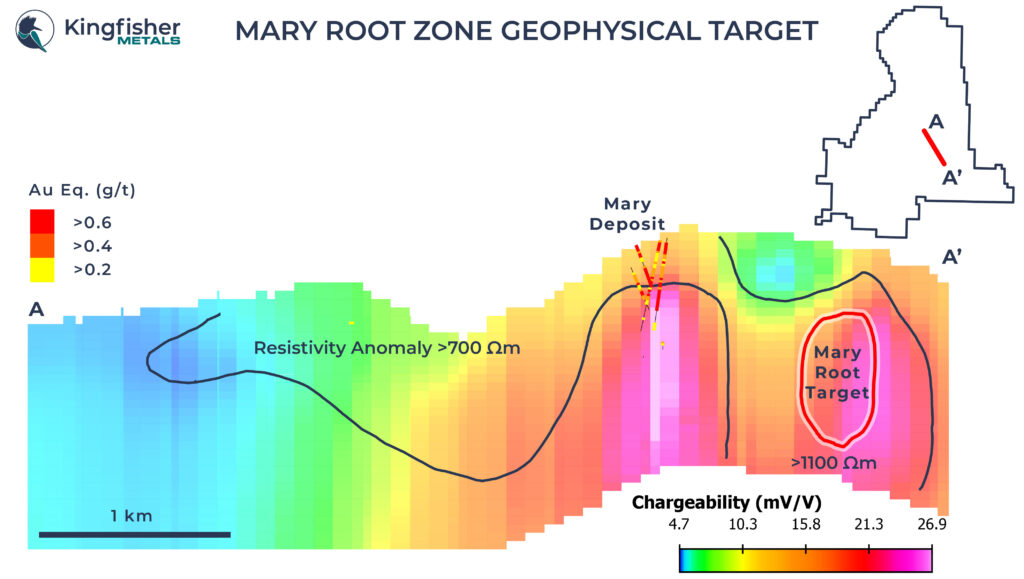

Mary Root Zone Geophysical Target

Between the Mary and Cliff porphyry centres is an untested large alteration expression cored by a coincident chargeability-resistivity geophysical anomaly (Figure 3). Gold grade at Mary is coincident with a resistivity high, draped around a subvertical chargeability anomaly. Highest relative copper grade is hosted along the upper boundary and within the core of the chargeability anomaly. The Mary Root Zone target similarly hosts a subvertical chargeability anomaly enclosed by a resistivity anomaly with continuity to the Mary deposit.

A conceptual root zone is inferred to have high relative copper compared Mary due to the deeper level. The geophysical anomaly indicates that the root zone target is larger in vertical and lateral scale than Mary.

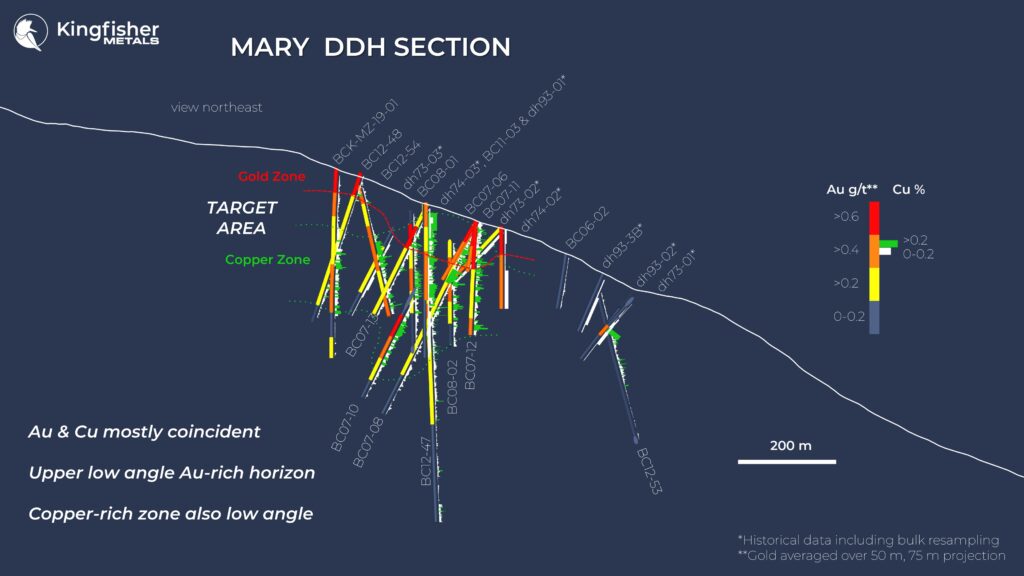

Mary Deposit Step-out

The upper levels of the Mary deposit are marked by open-ended low angle metal patterns in Au and Cu. Deeper drill delineation below the Mary deposit is limited to one hole along the northeastern flanks of the deposit. The projection of the low angle metal patterns remains untested to the west, south and east. The at-depth extent of the system below the low angle metal pattern is tested by just one hole (BC12-47) that drilled ~130 m to the north of the top three intercepts, all located in the southern drilled extent.

One step-out hole is planned to test the southern continuation of the Cu-Au intercepts. Delineating the full lateral extent of the upper metal patterns is key to future targeting of the at-depth projection of metal patterns. The planned hole follows-up on a drillhole from 2019, which intersected 0.5 g/t Au, 0.1% Cu over 291.5 m from 15.5 m (BCK-MZ-19-01).

Options Issuance

Kingfisher also announces the grant of 3,650,000 stock options that are exercisable for a period of five years at a price of $0.12 per share to its directors, officers, various staff members, and an investor relations consultant (Adelaide Capital Markets Inc.).

Quality Assurance/Quality Control (QAQC)

Rock samples were shipped to MSALABS, located in Langley, British Columbia for preparation and analysis. MSALABS is an ISO17025 and ISO9001 accredited laboratory and is independent of Kingfisher and its Qualified Person. Samples were prepped using the PRP-915 and analyzed for 48 major and trace elements with ICP-MS after a four-acid digestion (method code IMS-230). A 30 g split from assay sample was analyzed for Au using a lead collection fire assay fusion that was digested and analyzed using AA (method code FAS-111). Overlimit (>10,000 ppm) copper was determined using a 0.2 gram sample, four-acid digestion and ICP-AES finish (method core ICF-230).

Qualified Person

Dustin Perry, P.Geo., Kingfisher’s CEO, is the Company’s Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has prepared the technical information presented in this release.

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on underexplored district-scale projects in British Columbia, including the Golden Triangle region. Kingfisher has three 100% owned district-scale projects and an option to earn 100% of the HWY 37 Project, that offer potential exposure to gold, copper, silver, and zinc. The Company currently has 130,586,151 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 778 606 2507

E-Mail: [email protected]

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property. This news release contains forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. All statements, other than statements of historical fact, are forward-looking statements or information. Forward-looking statements or information in this news release relate to, among other things: formulation of plans for drill testing; and the success related to any future exploration or development programs.

These forward-looking statements and information reflect the Company’s current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include; success of the Company’s projects; prices for gold remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company’s projects; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour- related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: risks related to the COVID-19 pandemic; fluctuations in gold prices; fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation); fluctuations in currency markets (such as the Canadian dollar versus the U.S. dollar); operational risks and hazards inherent with the business of mineral exploration; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards; our ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; changes in laws, regulations and government practices, including environmental, export and import laws and regulations; legal restrictions relating to mineral exploration; increased competition in the mining industry for equipment and qualified personnel; the availability of additional capital; title matters and the additional risks identified in our filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described, or intended. Investors are cautioned against undue reliance on forward-looking statements or information. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances.