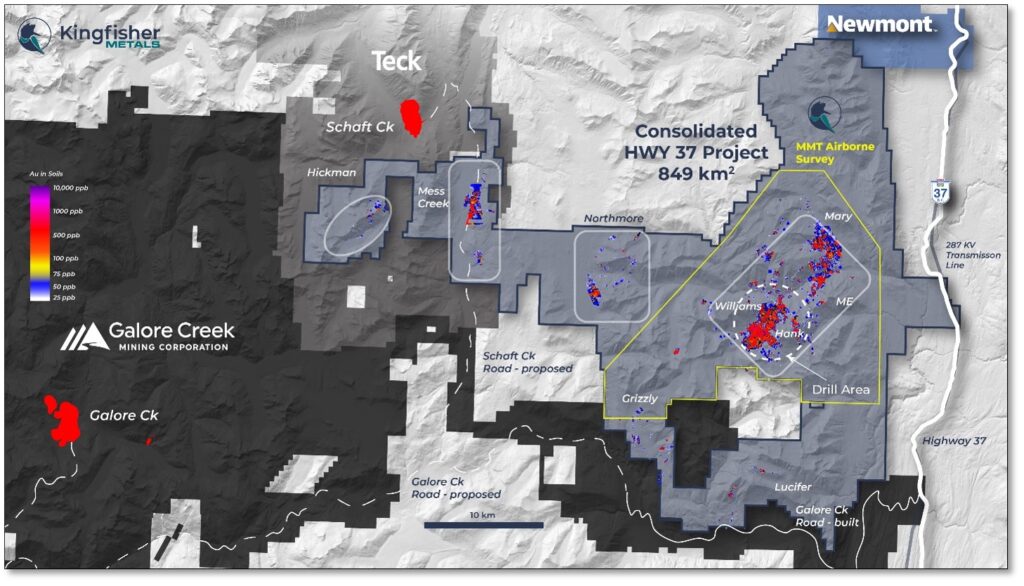

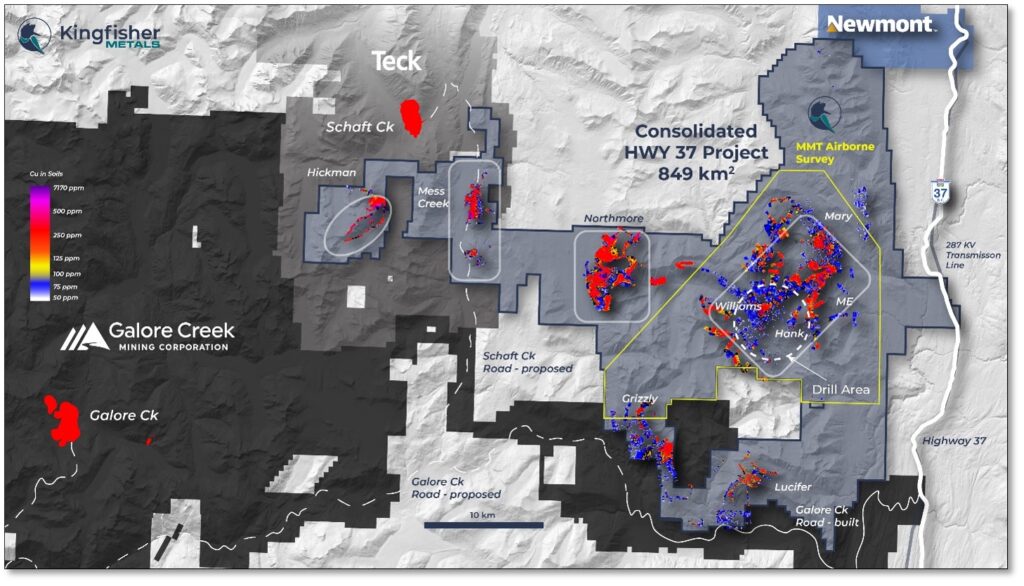

Kingfisher Metals Corp. (TSX-V: KFR) (FSE: 970) (OTCQB: KGFMF) (“Kingfisher” or the “Company”) is pleased to announce an extensive exploration program including 7,500 metres of diamond drilling at the HWY 37 Project. Field crews arrived on site last week with camp construction underway and the first of two drills are expected to arrive in approximately one week. The 849 km2 HWY 37 Project is located within the Golden Triangle, British Columbia.

Summary of 2025 Exploration Program

The 2025 program is focused on the discovery of porphyry copper – gold deposits and will include 7,500 metres of diamond drilling, a ~1,700-line kilometre airborne mobile magnetotelluric geophysical survey (MMT), ~30-line kilometres of ground based induced polarization geophysics survey (IP), 150 days of geological mapping, geochemical sampling (>1,500 samples), and a LiDAR survey.

Dustin Perry, CEO, states “The 2025 drill program at HWY 37 is the culmination of two years of consolidation, exploration, target generation, and a recently closed $10.9 million financing. The Hank-Williams porphyry Cu-Au targets represent the most compelling early-stage porphyry targets I have encountered in my career. The target area is host to a regionally significant mineral system with porphyry mineralization at valley-bottom elevations (347 metres of 0.33% copper and 0.39 g/t gold) that have only seen ~6,000 metres of historical drilling, and epithermal gold-silver mineralization up to 27.1 metres of 8.68 g/t gold up-slope at higher elevations. Except for Williams, historical exploration on this extensive mineral system has previously focused on outlining shallow precious metal mineralization. This program marks a turning point for the project where we will test multiple porphyry copper-gold targets as well as expanding upon what has already been discovered at Williams.”

Table 1 and Figures 1 and 2 outline the proposed areas of work for 2025 and a detailed breakdown of the largest ever exploration program on the extensive HWY 37 Project follows.

| Target | Drilling | IP Geophysics | Geological Mapping | Geochemical Sampling | MMT Airborne Survey | LiDAR |

| Hank-Williams-Mary | 7,500m | ~30-line km | X | X | ||

| North More | X | X | ||||

| Mess Creek | X | X | ||||

| Hickman | X | X | ||||

| Regional | X | X | X | X |

Table 1: 2025 Exploration Program – HWY 37 Project

Diamond Drill Program

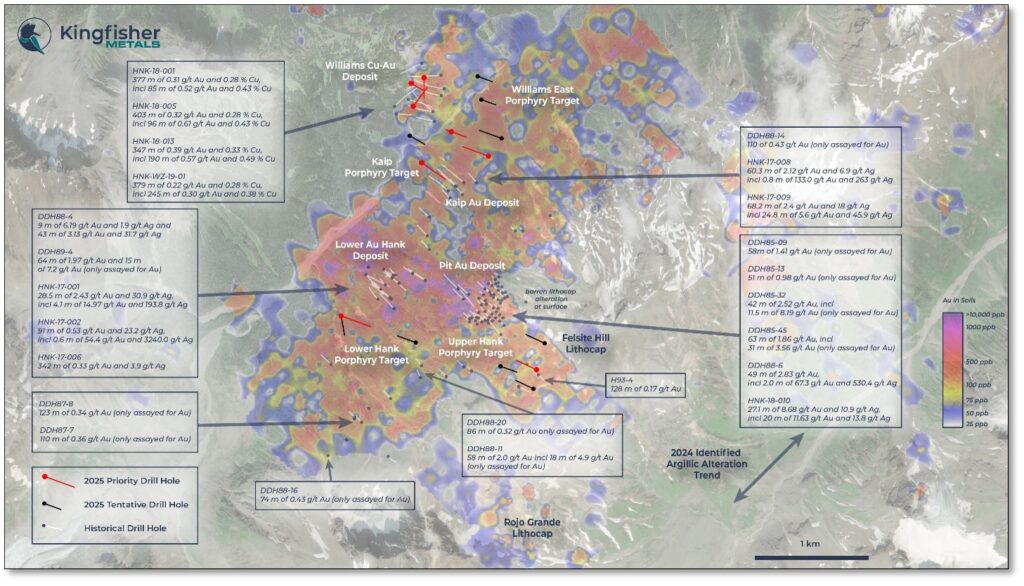

The 7,500 metres diamond drill program will be supported with two diamond drills focused within the Hank-Williams area of the project (Figure 3). Additional targets may be tested beyond this area if additional high-conviction drill targets are identified within the course of the field program.

The drill program will begin with one drill arriving on approximately June 18, 2025, and the second drill arriving approximately one week later.

Summary of Porphyry Drill Targets

Williams Deposit

Initial drilling at Williams will test for extensions of mineralization both above and below the limits of historical drilling as well as providing additional information on the orientation of the porphyry copper-gold system. Historical drilling at Williams encountered regions with intense potassic alteration hosting significant higher-grade intercepts including 190 metres of 0.49% copper and 0.57 g/t gold. Despite excellent initial grades, with limited historical drilling, the previous operator did not fully determine the orientation of the causative porphyry intrusions.

The Company’s working hypothesis for the Williams porphyry copper-gold deposit is that historical drilling only partially tested the structurally focused upper-levels of a broader porphyry system with potential for broadening at depth within a more intrusive dominated domain.

The three initial planned drill holes range from 700 metres to 900 metres in length and are designed to determine the scale and grade potential of the Williams porphyry system at depth prior to initiating a more substantial step-out drill program.

Williams East

Drilling is planned east of the Williams Deposit to test a coincident chargeability and conductivity anomaly that shares the same sub vertical characteristics observed at Williams. Three holes are planned in this area ranging from 400-650 metres in length and drilled to the northwest and southeast. The furthest west hole is designed to test the broad chargeability anomaly located at depth and centered on Hank Creek.

Additional Williams Area Drill Holes

Additional drill holes are proposed within the Williams area to the northeast and south of the Williams deposit. These holes are based on a combination of coincident IP geophysics, magnetics, copper-gold geochemistry in soils and/or rocks, and the regional structural model developed by Kingfisher’s exploration team.

Kaip

An initial 600 metre drill hole is proposed at the Kaip target, and it is designed to test for porphyry copper-gold mineralization below a near surface epithermal gold-silver mineralized zone that returned 24.8 metres of 5.6 g/t gold and 45.9 g/t silver as well 0.8 metres of 133 g/t gold and 263 g/t silver which contained visible gold. Prospecting and mapping in 2024 discovered copper mineralization cropping out in the valley bottom grading up to 0.23% copper. The initial drill hole will target an area over 300 metres below the area tested by historical drilling that focused on epithermal Au-Ag mineralization.

Upper Hank

The Upper Hank Target is upslope of the Pit Gold Deposit and includes intercepts grading up to 27.1 metres of 8.68 g/t gold. The target at Upper Hank is centered on a lithocap containing vuggy silica and advanced argillic minerals (dickite, alunite, diaspore). IP chargeability outlines a sub vertical pipe like anomaly that broadens at depth. The feature extends to surface and is represented by a ~500 x 600 metre breccia body that is cored by a 100 x 75 metre pyritic milled breccia. The Company’s hypothesis is that this represents the top of a porphyry system.

An initial 800 metre drill hole is designed to cross the pyrite breccia body and enter the broad chargeability anomaly at depth. The potential exists for intersecting high-sulfidation epithermal gold-silver mineralization enroute to the porphyry target. Follow up drilling contingent on initial results will test lateral extent as well as areas of favourable structural patterns which have the potential to focus hydrothermal ore forming fluids.

Lower Hank

The Lower Hank Target is located on trend and to the southwest of historical drill tests of epithermal gold-silver mineralization. The nearby Lower Au Hank Deposit epithermal results include 43 metres of 3.13 g/t gold and 31.7 g/t silver (DDH88-4), 64 metres of 1.97 g/t gold and 15 metres of 7.2 g/t gold (DDH89-4), and 342 metres of 0.33 g/t gold. Metal patterns in the Lower Hank Deposit plunge gently to the SW, interpreted by the Company to reflect direction of fluid flow and high exploration potential. The initial planned hole is designed to test a 700-metre gap in historical drilling where recent geological mapping has identified several hallmarks of a porphyry system. Geological mapping in 2023-24 identified large-scale zoned alteration patterns cored by copper grades up to 0.37% at surface. The Lower Hank Porphyry Target is located below these zoned alteration patterns, on the northern shoulder of a large chargeability anomaly and down plunge of the projected fluid pathway.

Regional Surveys

Mobile Magneto Telluric (MMT) Airborne Geophysical Survey

A ~1,700-line kilometre MMT survey is planned to cover the Hank-Williams-Mary region as well as lateral and on-strike continuations of this highly prospective trend. The survey will be completed at 200 metre line spacing in order to provide high-resolution resistivity data across this trend that will aid in identifying additional porphyry centers as well as assisting with drill targeting within these regions.

The Company is also considering extending the geophysical survey further to the west to cover the Northmore, Mess Creek, and Hickman targets.

IP Geophysical Survey

Approximately 30-line kilometres of IP geophysics is planned within the Hank-Williams-Mary trend. The survey is designed to further refine targets proximal to the area of drilling as well as extending coverage northwest, southeast, and along strike of the mineralized trend to the northeast towards Mary and the ME zone.

Geological Mapping

A geological mapping team led by Dr. Roy Greig and Dr. Stephanie Sykora will initially focus on the Hank-Williams-Mary trend and extend coverage to the NE from the 2025 drill area. Additionally, Northmore, Mess Creek, and Hickman will be assessed with the goal of refining drill targets for future drill programs.

Geochemical Survey

Geochemical sampling will be completed across a broad area in 2025. High priority soil sampling will begin by infilling gaps in historical sampling between Hank-Williams and Mary-ME. Initial sampling will take place northeast of Hank-Williams and south of Ball Creek to the cover a ~2.5 x 1.5-kilometre region and north of Ball Creek where a ~1.5 x 0.6-kilometre area with no historical sampling.

Additional sampling will take place in the valley southeast of Hank Creek, along ridge and spurs within the greater Hank-Williams-Mary trend, and at Mess Creek.

Rock sampling, prospecting, and collection of spectral data will take place alongside mapping across all target areas.

LiDAR Survey

A high-resolution LiDAR survey is planned for approximately half of the HWY 37 Project focused on the Hank-Williams-Mary area. The survey is being completed to provide structural data for 3D modelling, providing accurate topography, and baseline surface disturbance data.

Qualified Person

Dustin Perry P.Geo., Kingfisher’s President and CEO, is the Company’s Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has prepared the technical information presented in this release.

Webinar

Kingfisher’s President and CEO, Dustin Perry, will be participating in a Webinar hosted by Adelaide Capital, which is scheduled for Wednesday, June 18, 2025, at 2:00 pm EDT.

Please click the following link to Register.

About Kingfisher Metals Corp.

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on copper-gold exploration in the Golden Triangle, British Columbia. Through outright purchases and option earn in agreements (Orogen Royalties and Golden Ridge Resources) the Company has quickly consolidated one of the largest land positions in the region at the contiguous 849 km2 HWY 37 Project. Kingfisher also owns (100%) two district-scale orogenic gold projects in British Columbia that total 641 km2. The Company currently has 88,661,810 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 778 606 2507

E-Mail: info@kingfishermetals.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property. This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the projects, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.