Kingfisher Metals Corp. (TSX-V: KFR) (FSE: 970) (OTCQB: KGFMF) (“Kingfisher” or the “Company”) is pleased to initiate phase 1 exploration for the 2024 field season at the HWY 37, LGM, and Thibert projects in British Columbia.

Highlights

- 1253 line-km ZTEM airborne geophysical survey at HWY 37 and LGM projects starting late June

- VRIFY AI machine learning across HWY 37 and LGM projects underway

- ZTEM results will see follow-up mapping and IP surveys on priority targets at HWY 37 and LGM

- Soil and till sampling campaign at Thibert Project in June to follow up on prospectivity modeling completed over winter 2023-2024

Dustin Perry, CEO states “We are excited to get started with our 2024 field programs in northern BC. The goal of the ZTEM survey is to fingerprint the known porphyry centers at HWY 37 and LGM projects and discover new systems with the help of VRIFY AI. Following this survey, we will rate and rank targets and follow up with focused mapping and IP surveys. This will all lead into drill targeting for potential new discoveries within our large land position in the prolific Golden Triangle.”

HWY 37 Project and LGM Project Summary

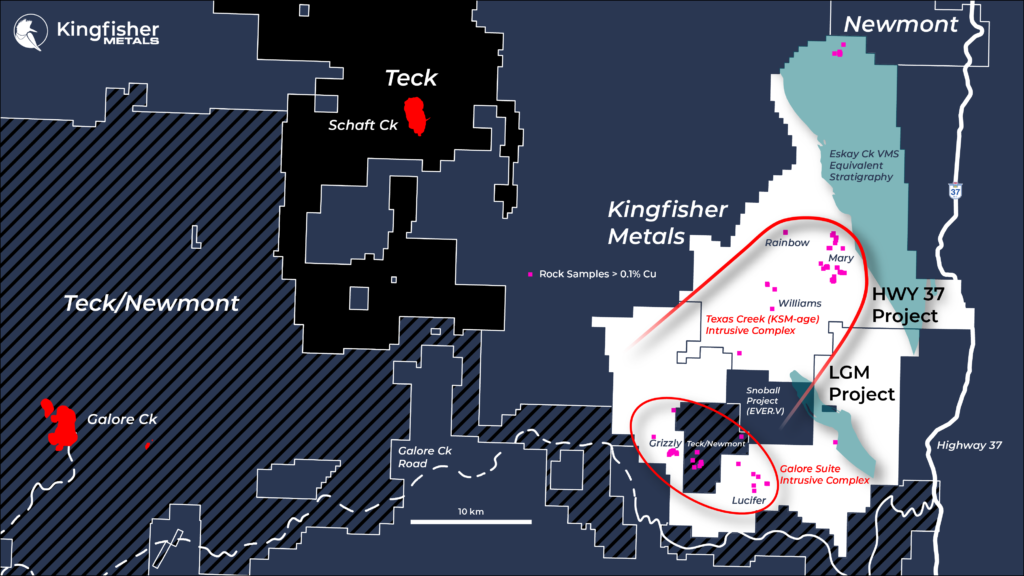

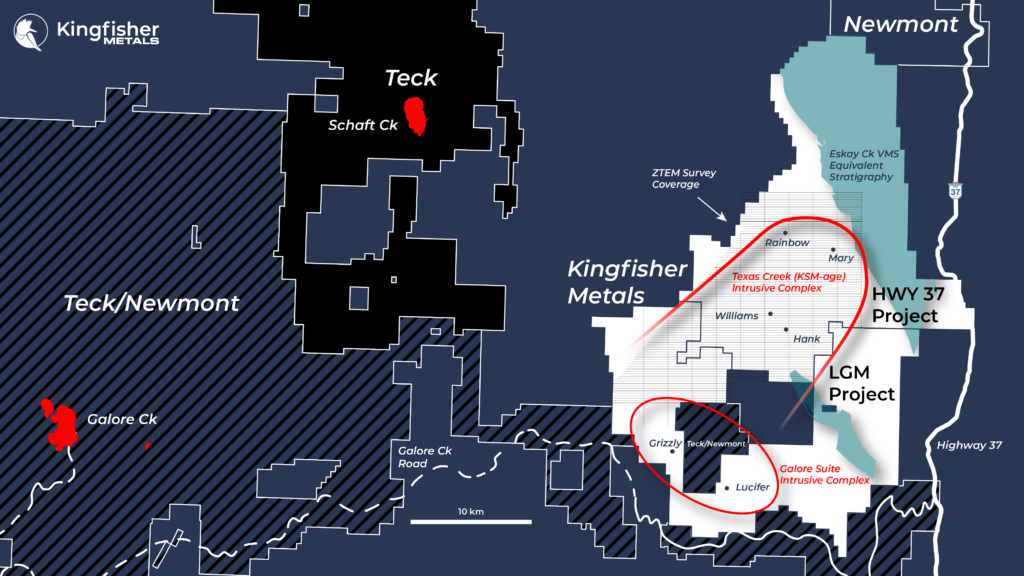

The contiguous HWY 37 and LGM projects cover 630 km2 within the prolific Golden Triangle and are host to porphyry, epithermal, and VMS mineralization spanning from the Late Triassic to Mid-Jurassic.

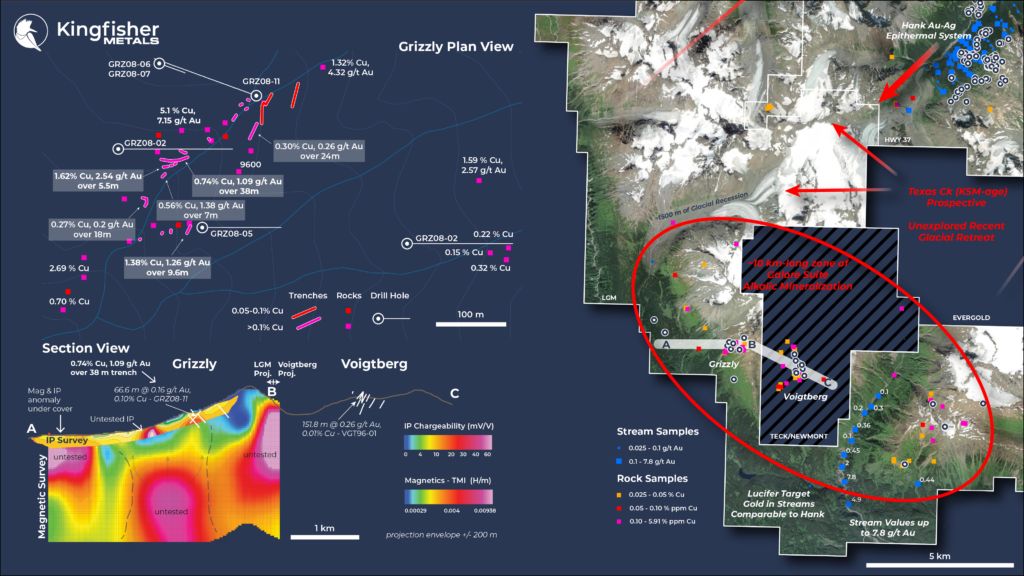

The oldest mineralization on the combined projects belongs to the Galore Creek Suite intrusions (Late Triassic) with silica-undersaturated porphyry Cu-Au mineralization at the Grizzly Target. Galore Creek Suite intrusions are also responsible for the world-class Galore Creek deposit (Teck/Newmont) located 50 km to the west. Historical trenching at Grizzly returned 0.74% Cu and 1.09 g/t Au over 38 m.

Texas Creek intrusions (Early Jurassic) are the most widespread intrusive bodies at the project covering over 25 km accompanied by widespread geochemical anomalies and alteration. Mary, Williams, Rainbow, and Hank mineral systems are all related to these intrusive bodies which are also responsible for mineralization in the Sulphurets District (KSM, Treaty Creek, and Brucejack) and the Snip-Iskut District. The Company notes that mineralization on nearby projects or metal districts is not indicative of mineralization on the HWY 37 or LGM projects. Historical drilling on the HWY 37 Project outlined three porphyry centers and one epithermal center.

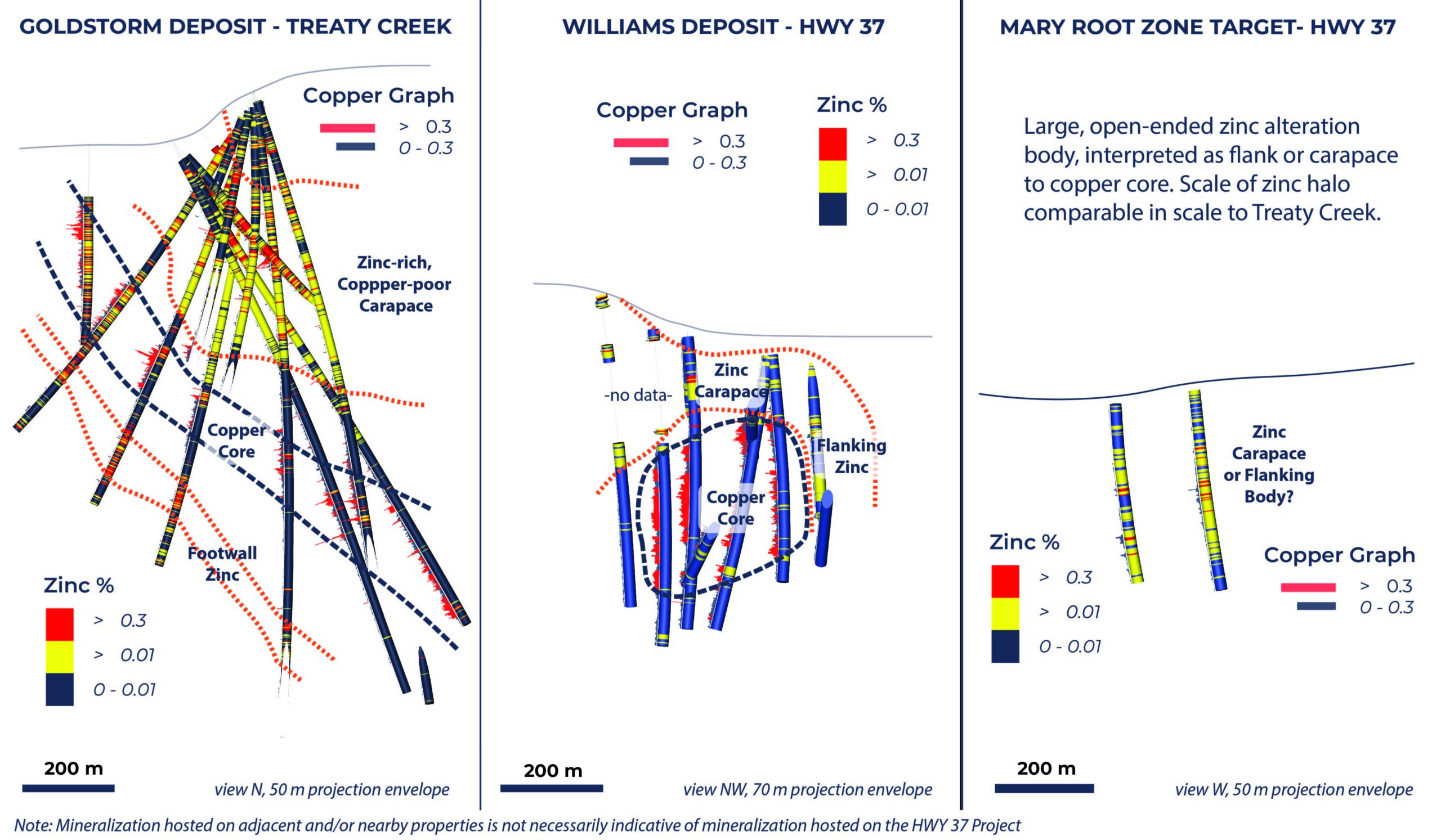

Williams Cu-Au

The Williams porphyry deposit was discovered from 2017-2019 and is highlighted by intercepts such as 0.39 g/t Au and 0.33% Cu over 346.7 m. Williams sits adjacent to the 6 km-long Hank epithermal Au-Ag deposit and outcrops in the valley bottom with potassic alteration at surface. The increased copper to gold ratios at Williams, situated at a low elevation relative other porphyry targets in the district, demonstrates the potential for higher copper grades at depth across the project. Williams lies within a

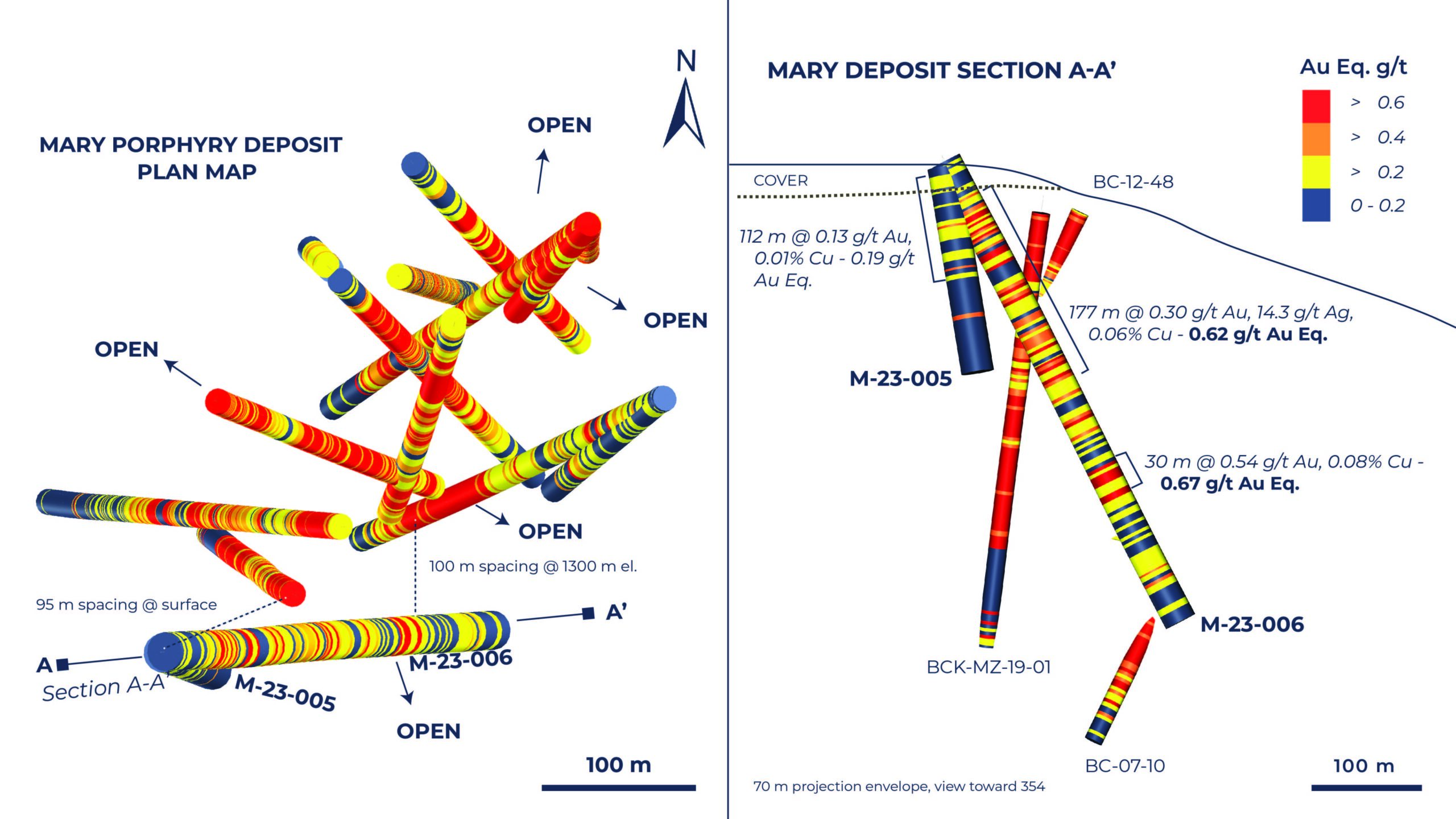

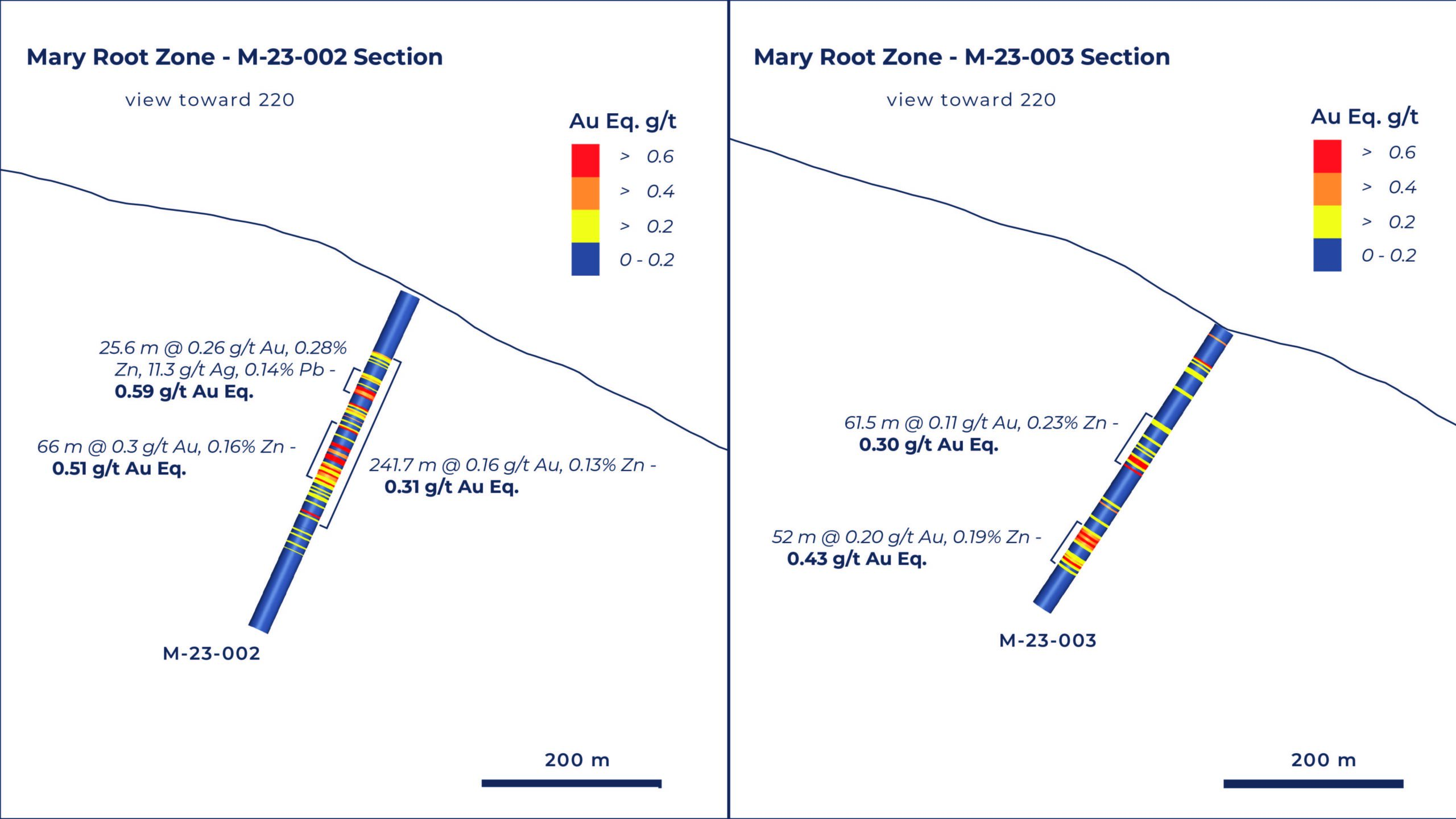

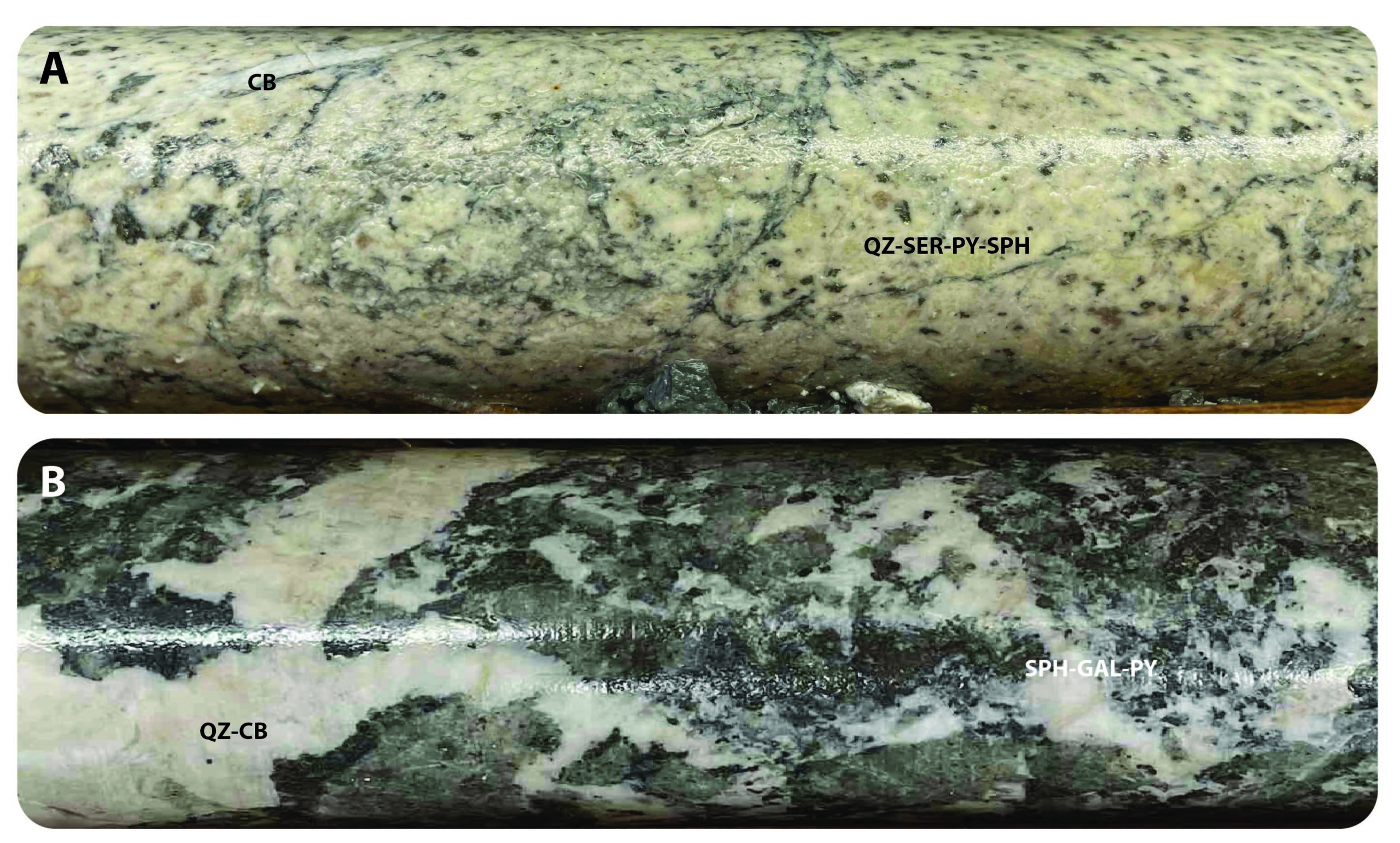

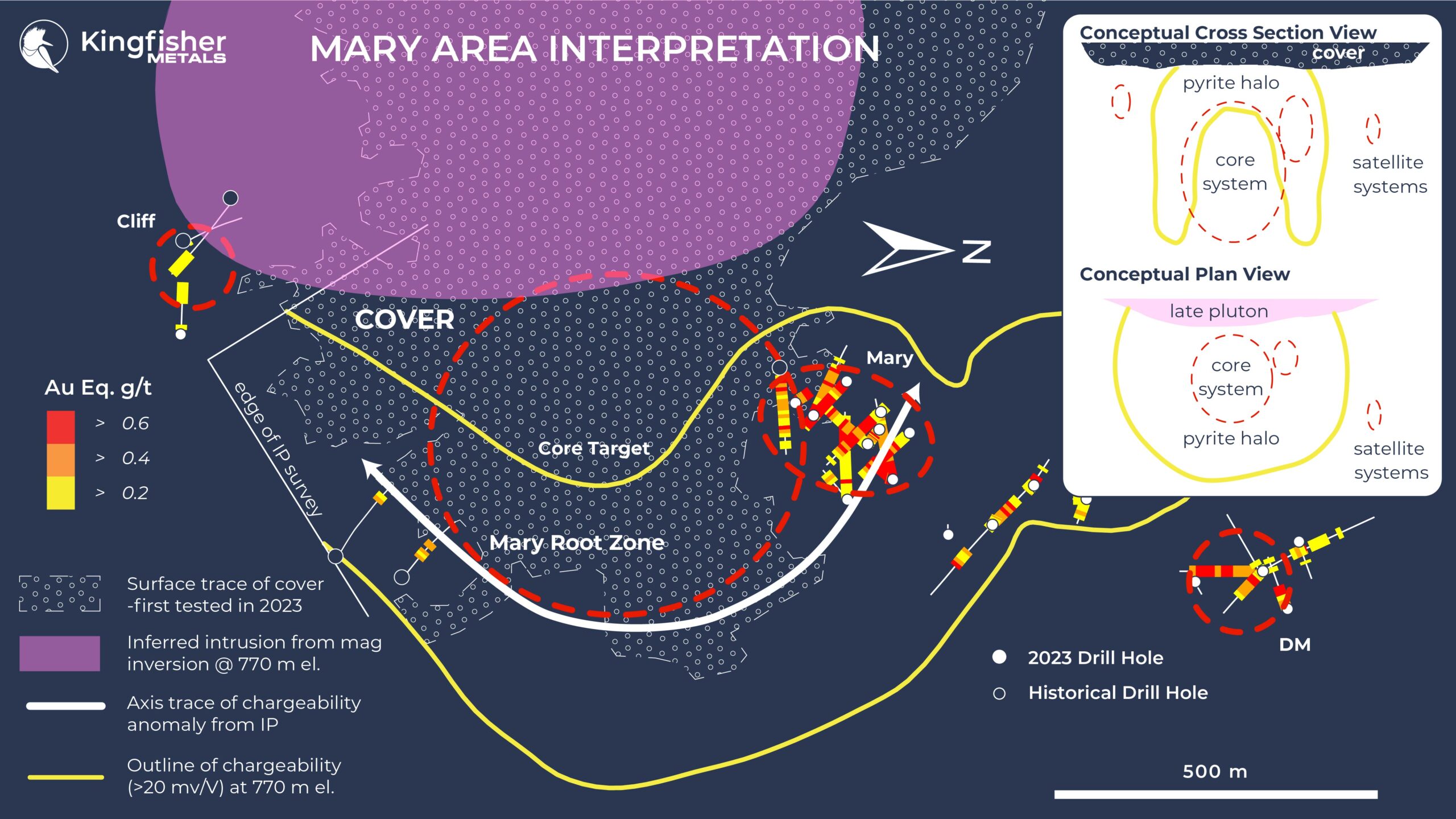

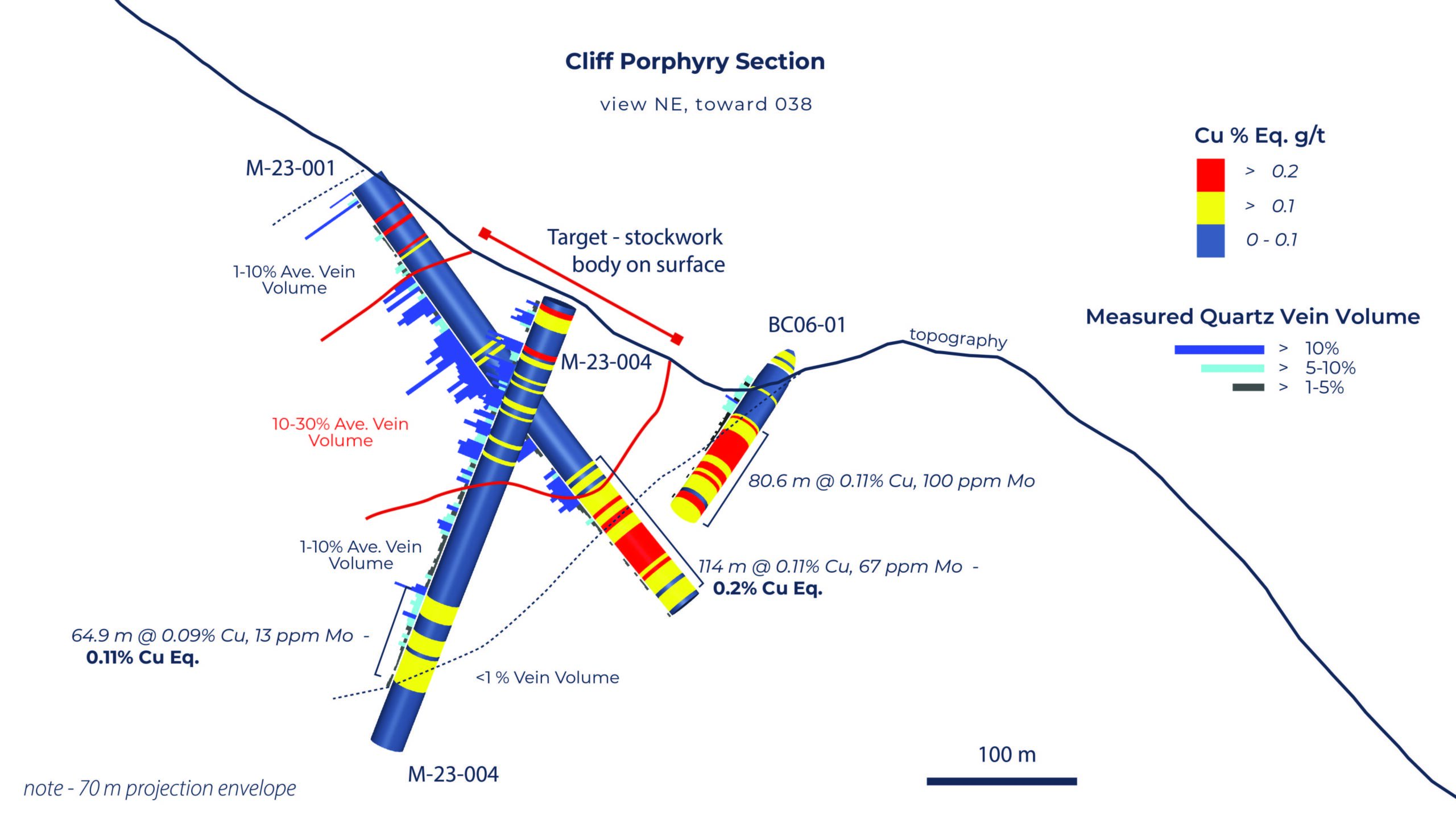

Mary Cu-Au

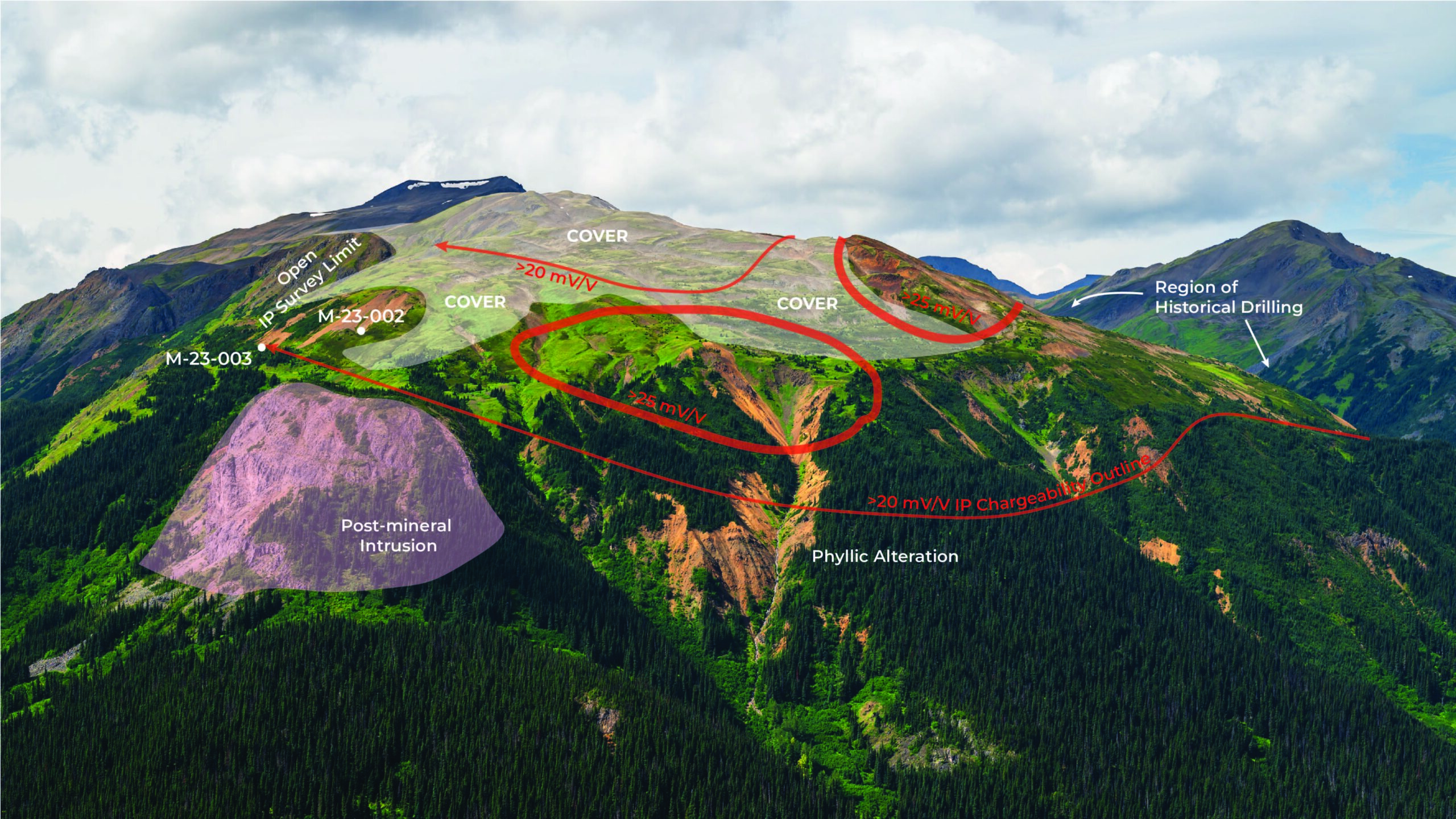

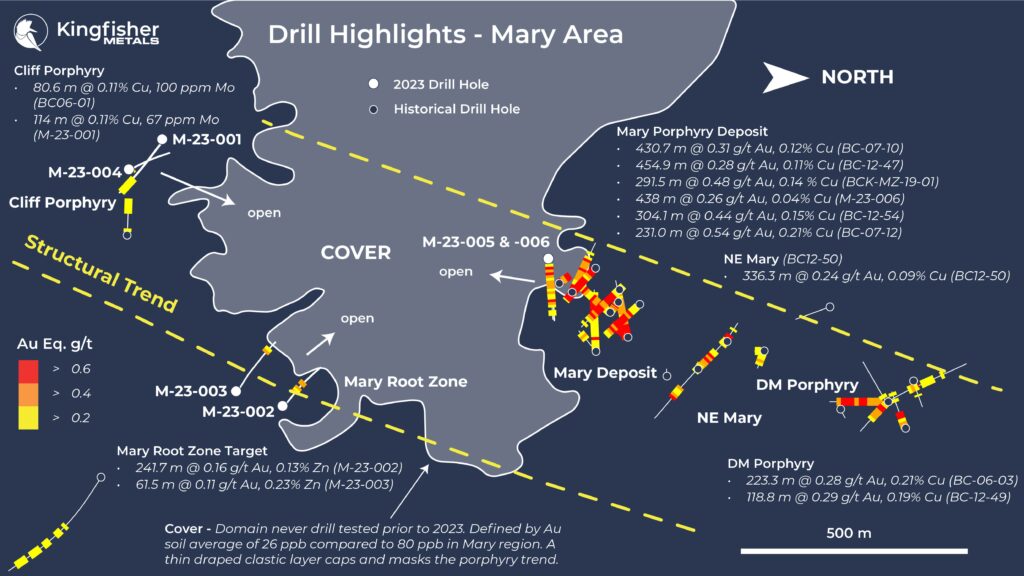

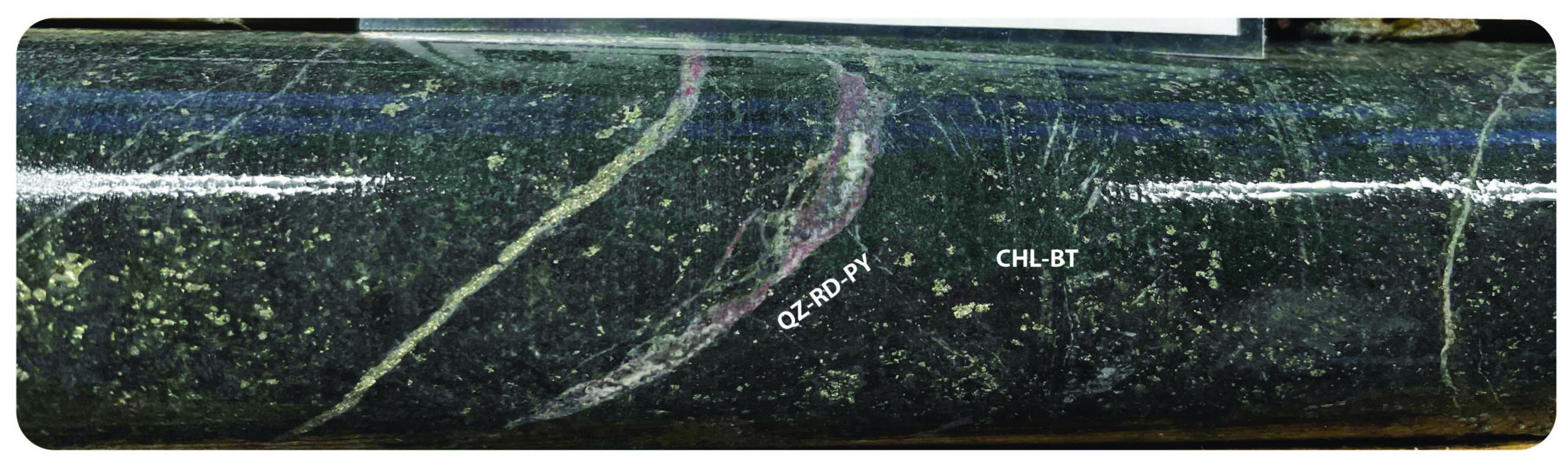

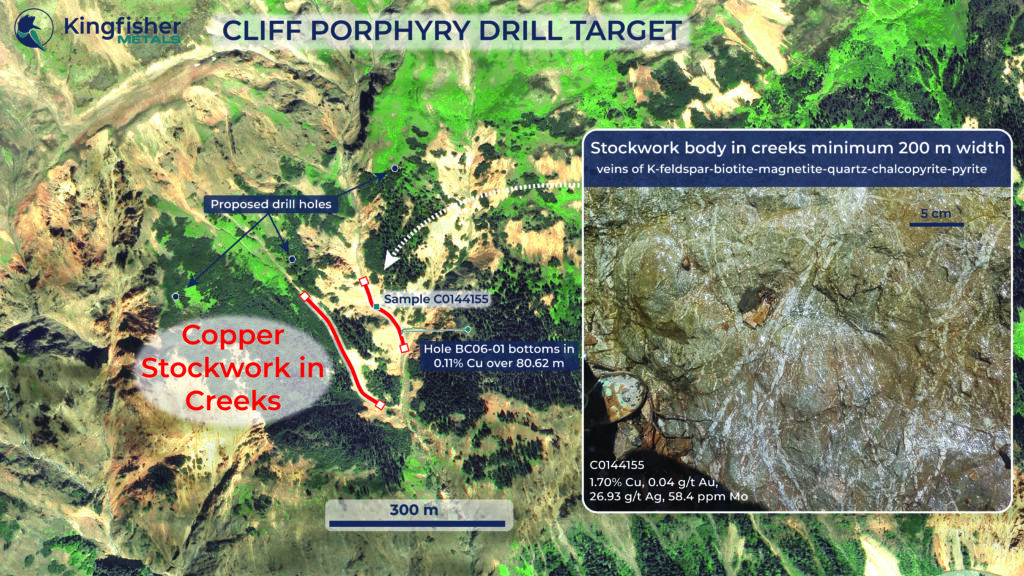

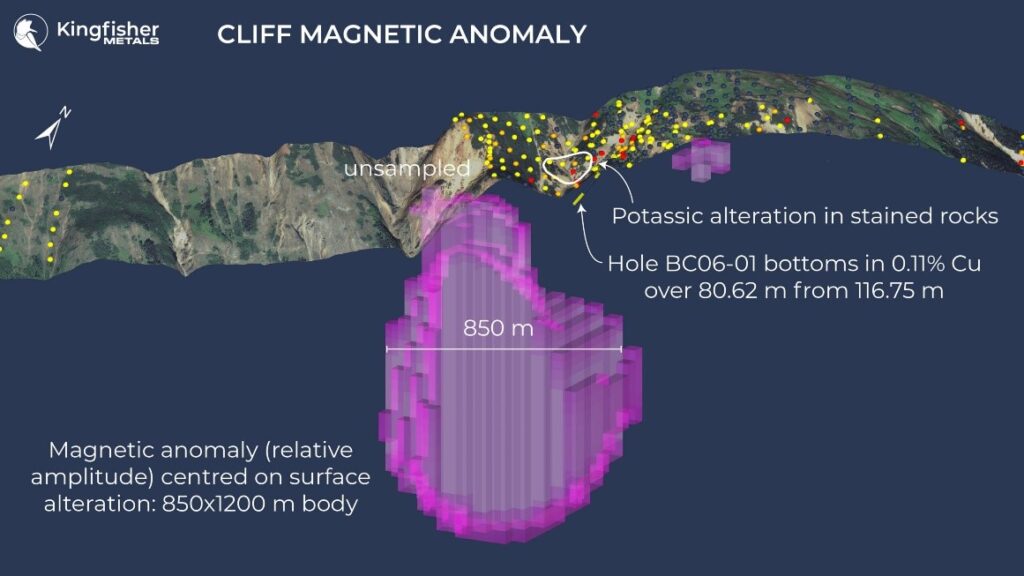

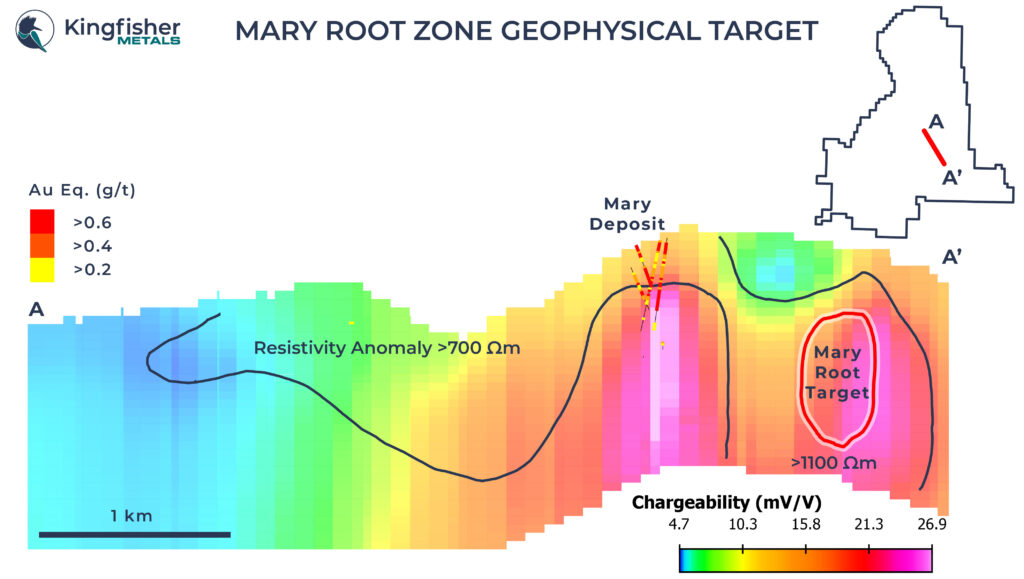

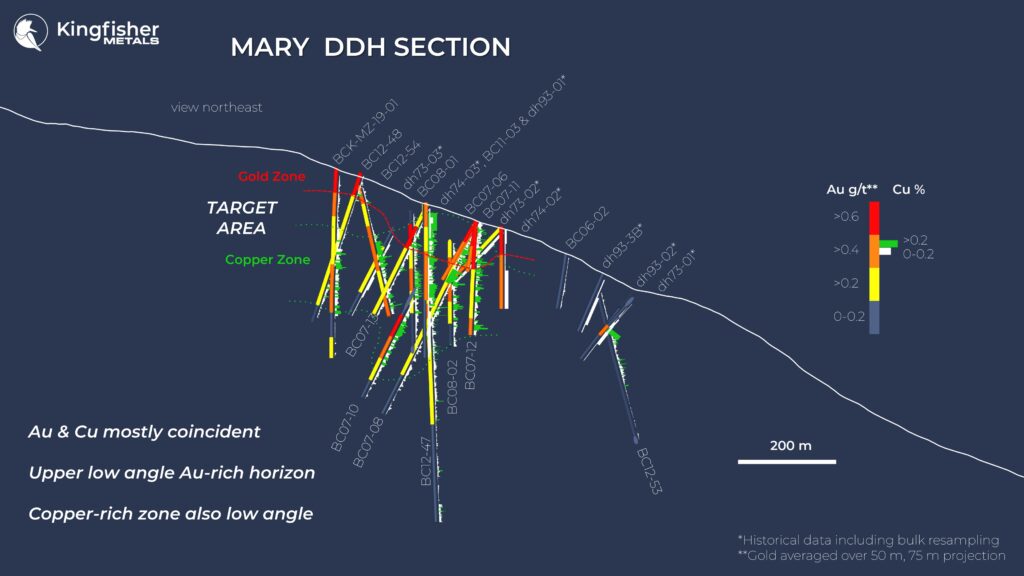

The Mary porphyry deposit is highlighted by intercepts such as 0.48 g/t Au and 0.14% Cu over 291.5 m and 0.54 g/t Au and 0.12% Cu over 430.7 m. Drilling has outlined a mineralized trend measuring ~1300 m by 400 m and is interpreted as the upper levels of a large porphyry Cu-Au system where Au to Cu ratios are high. Mary sits within a 3 km-long IP chargeability anomaly greater than 20 mV/V and is also located within an 8 km-long geochemical anomaly.

Rainbow Cu-Au

The Rainbow Cu-Au system outcrops in an area of widespread glacial till cover draped over outcrop. Historical drilling returned 0.76 g/t Au and 0.05 % Cu over 91 m from surface. Limited work has been done to identify the source of this mineralization or the lateral extent of the system beneath till with only 3 drill holes completed in the area.

Hank Au-Ag

The Hank epithermal Au-Ag deposit occurs as a 6 km-long trend of epithermal alteration, mineralization, and geochemical anomalies. Historical drilling has outlined several zones of intermediate to high sulfidation epithermal mineralization ranging from lithocap alteration at the highest elevations to intermediate sulfidation mineralization closer to the valley bottom. Historical intercepts include high-grade intercepts such as 11.63 g/t Au and 13.8 g/t Ag over 20 m, 13.4 g/t Au and 132.4 g/t Ag over 9.1 m, and 133 g/t Au and 263 g/t Ag over 0.8 m. The Company believes there is significant potential to discover high-grade feeder mineralization at Hank given the majority of historical drilling was within 150 m of surface and limited to only one azimuth. Additionally, the Company believes there is potential for discovering a porphyry Cu-Au system at depth below epithermal mineralization.

ZTEM Survey

Geotech Ltd has been contracted to complete at 1253 line-km ZTEM survey over the HWY 37 Project. The airborne survey collects deep penetrating electromagnetic and magnetic data which will be used to fingerprint the known areas of mineralization and unlock buried targets across the project. ZTEM surveys have proven to be highly successful in global exploration for porphyry Cu-Au systems and epithermal Au-Ag systems, with examples including at Pebble, Cobre Panama, and Ana Paula.

VRIFY AI

Kingfisher has engaged VRIFY AI to leverage the power of advanced machine learning models to analyze and identify potential mineral targets at the HWY 37 and LGM projects in northwestern British Columbia’s prolific Golden Triangle. Through the use of public and proprietary data sets, VRIFY AI utilizes sophisticated machine learning classifiers to create 3D models of potential mineral targets, incorporating probabilistic values to assess the accuracy of these models. This innovative approach enhances the precision of geological targeting, enabling exploration teams to instantly access and apply machine learning as needed. This allows for more intentional and accurate drilling of known mineral targets while prioritizing exploration targets and discovering previously unidentified mineral prospects. The AI tool ensures unbiased geological targeting and subjective data interpretation, accelerating exploration processes and improving the accuracy of mineral system identification.

Data collected during the Phase 1 exploration program will be continuously fed into the machine learning models leading to improved drill targeting.

IP Surveys and Geological Mapping

Focused exploration work including deep penetrating IP geophysics by Peter E. Wallcot and Associates and geological mapping by Dr. Stephanie Sykora will be completed on targets generated from both the ZTEM survey and VRIFY AI. The goal of these surveys will be to derisk targets prior to drilling.

Thibert Project Summary

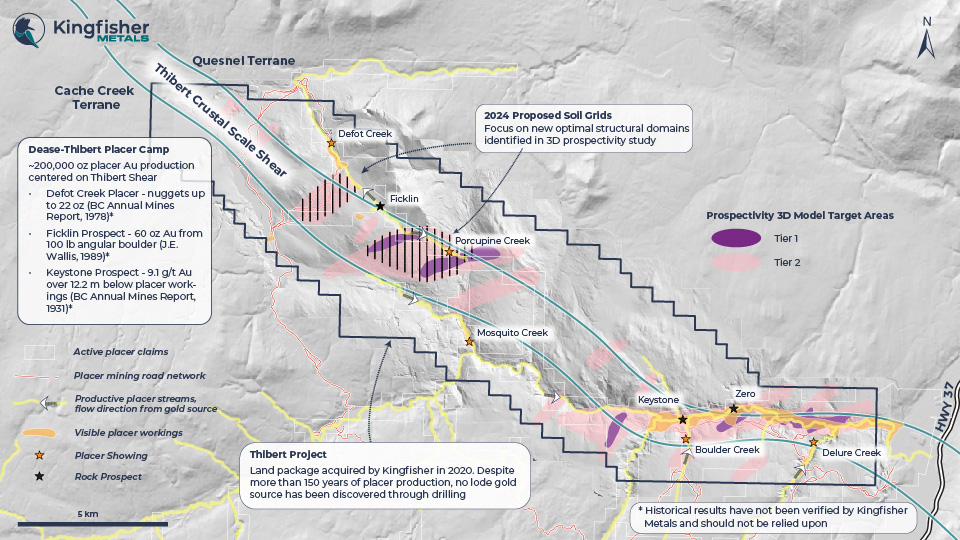

The 130 km2 Thibert Project is located approximately 65 km north of Dease Lake, northwest British Columbia and covers an area of significant historical and contemporary placer gold production from Thibert Creek and several tributaries for which the bedrock source has not yet been discovered. The Thibert Project spans 27 km of strike length along the Thibert Shear Zone – a major crustal scale terrane bounding fault system. The project is prospective for Cretaceous orogenic gold mineralization similar to that found in the Juneau Gold Belt in Alaska, the Motherlode District in California, and the Bralorne and Cassiar Districts in British Columbia. The Company notes that mineralization on nearby projects or metal districts is not indicative of mineralization on the Thibert Project.

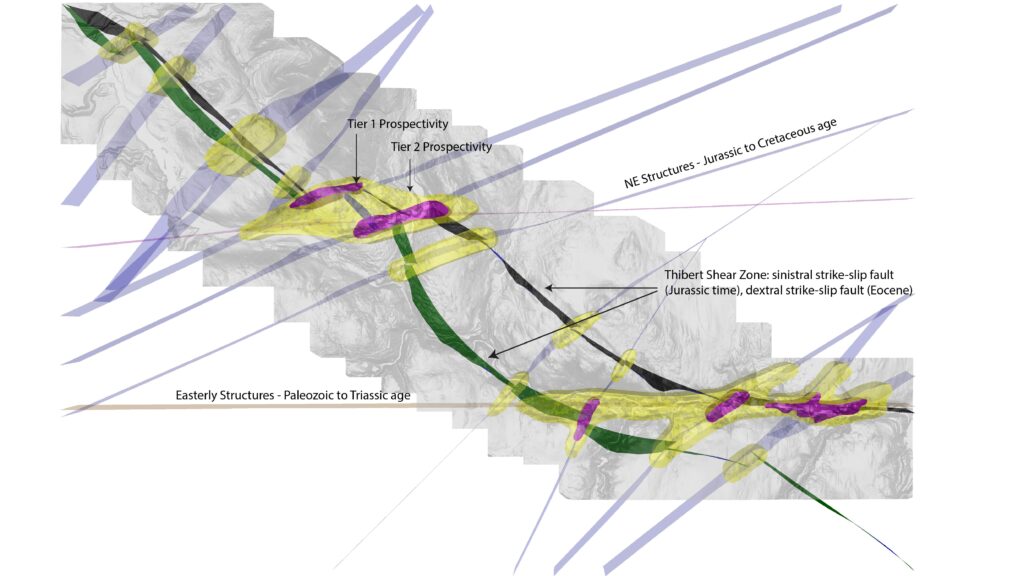

Prospectivity Modelling

Using the Cassiar Gold District as an analogue, a 3-dimensional gold prospectivity assessment was completed at the Thibert Project. The model generated new prospective domains for bedrock gold discovery – Tier 1 and Tier 2 (Figure 2). Shear zones at Thibert were modelled in 3D based on airborne magnetic data and structural interpretation products from Fathom Geophysics (Figure 3). Structural prospectivity assessment was weighted based on ideal structural geometry (ENE) of sheeted vein arrays at Cassiar. Prospectivity is interpreted to broadly follow the trend of the Thibert shear zone, and geometry of the vein swarms and prospectivity domains are inferred to be ENE in orientation similar to at Cassiar. The most prospective domains (Tier 1) coincide with domains of multiple structural intersections, and Tier 1 coincide with at least one structural intersection.

Soil Sampling Program

The planned soil sampling program in 2024 consists of ~1000 soil samples with samples spaced 25 m apart on lines spaced 250 m apart over two areas of interest that coincide with Tier 1 and Tier 2 prospectivity areas with limited glacial till.

The exploration goal for the soil campaign is to outline significant areas of gold anomalism that will lead to a reconnaissance RAB drill program in the future.

Qualified Person

Dustin Perry, P.Geo., Kingfisher’s CEO, is the Company’s Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has prepared the technical information presented in this release.

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on underexplored district-scale projects in British Columbia, including the Golden Triangle region. Kingfisher has two 100% owned district-scale projects and an option to earn 100% of the HWY 37 project, that offer potential exposure to gold, copper, silver, and zinc. The Company currently has 40,219,553 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 236 358 0054

E-Mail: info@kingfishermetals.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property. This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the projects, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.