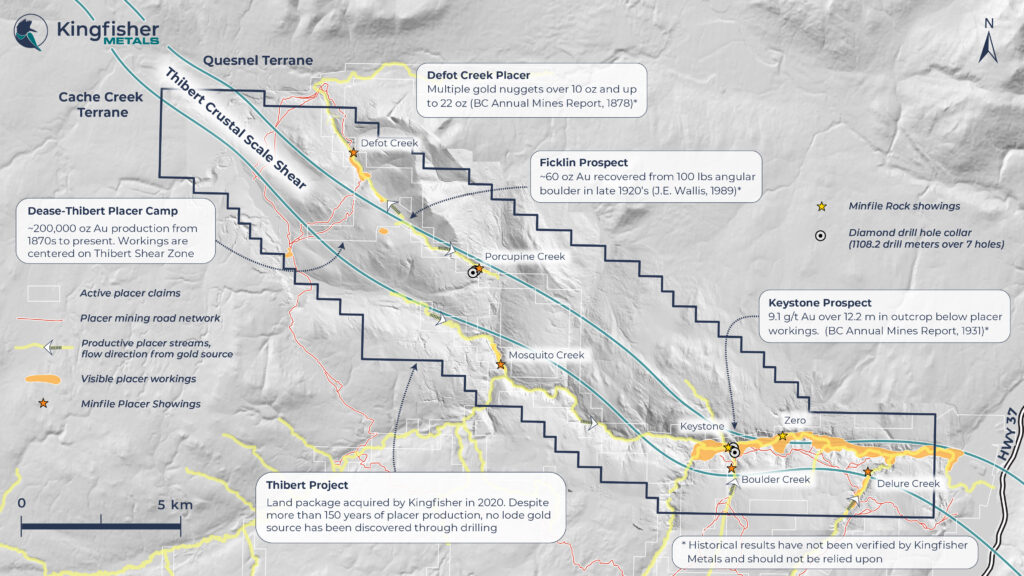

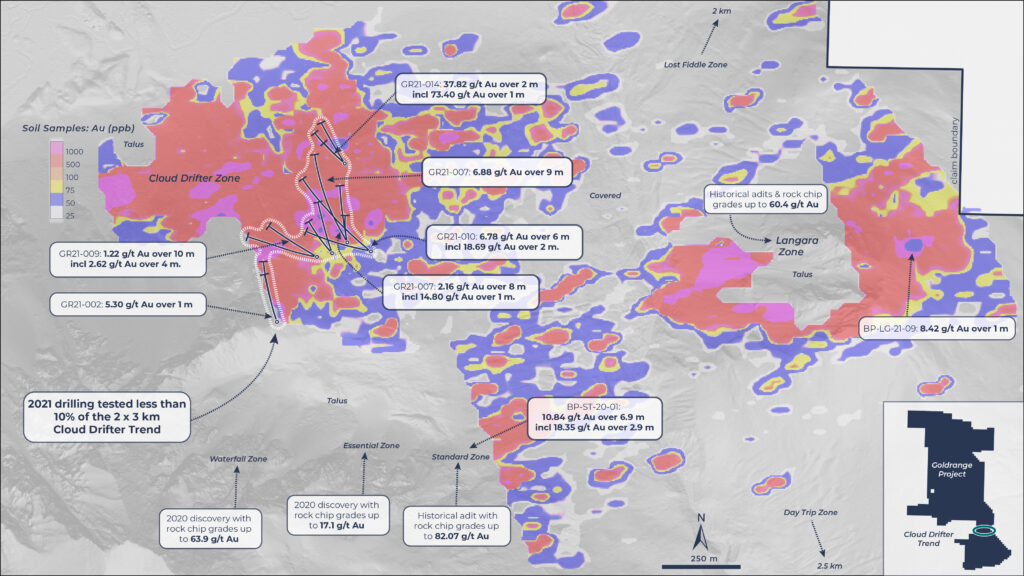

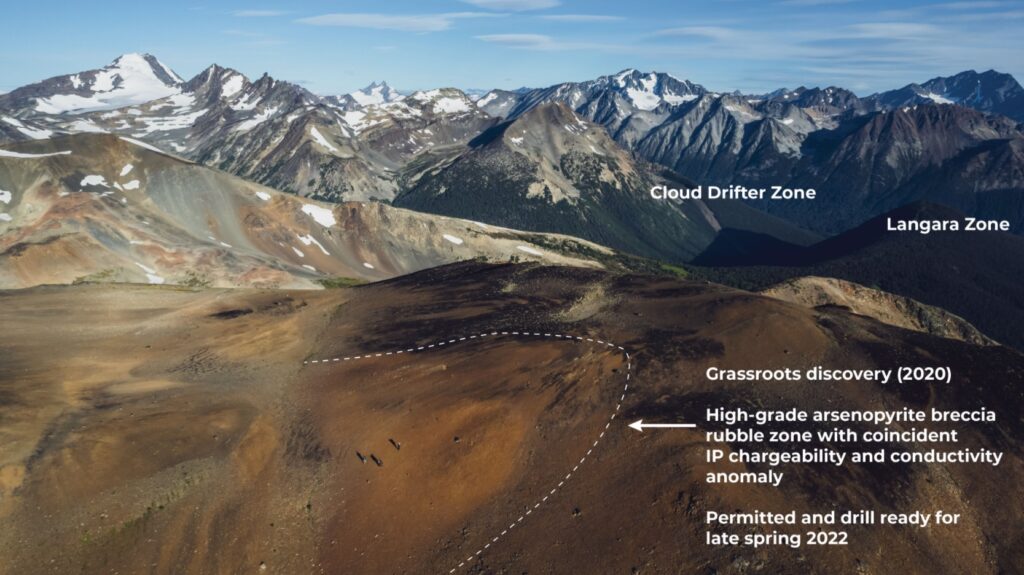

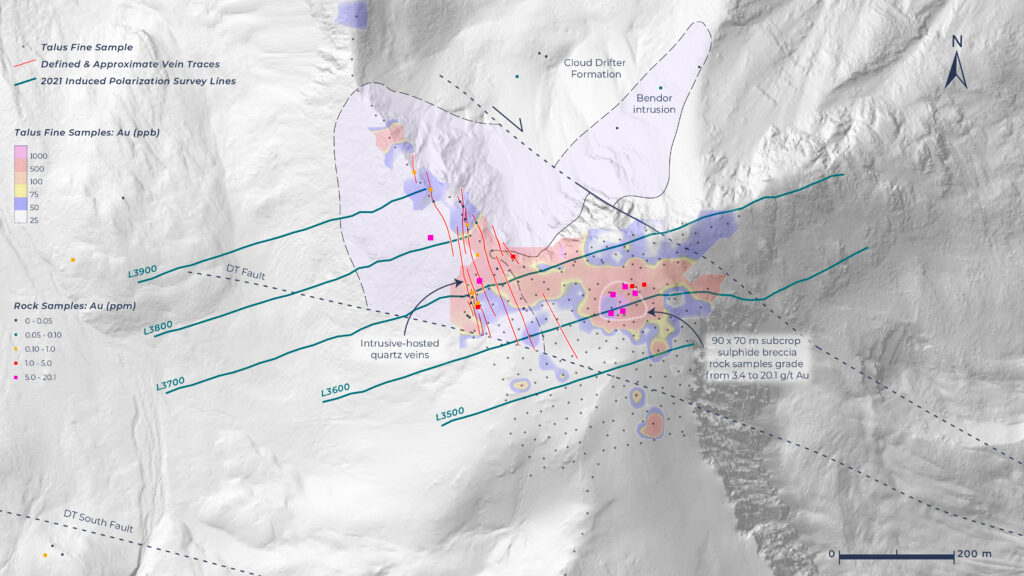

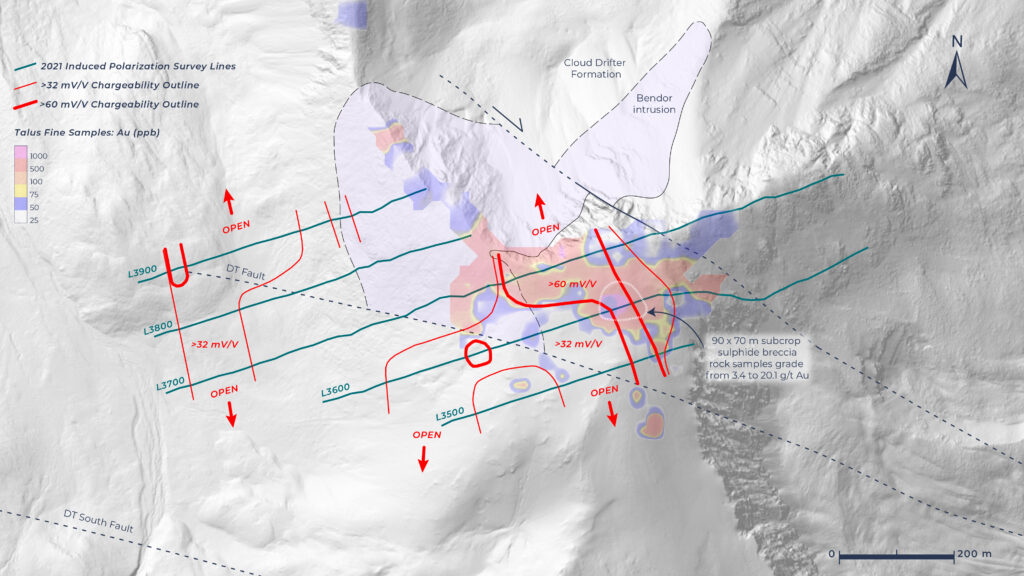

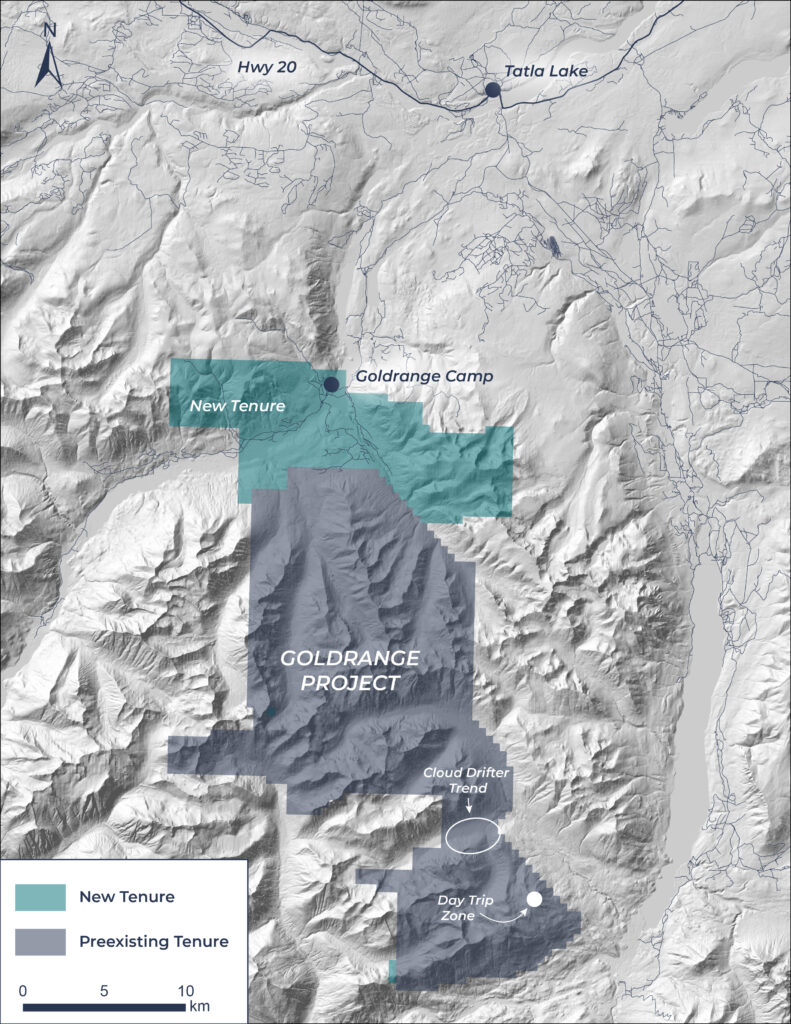

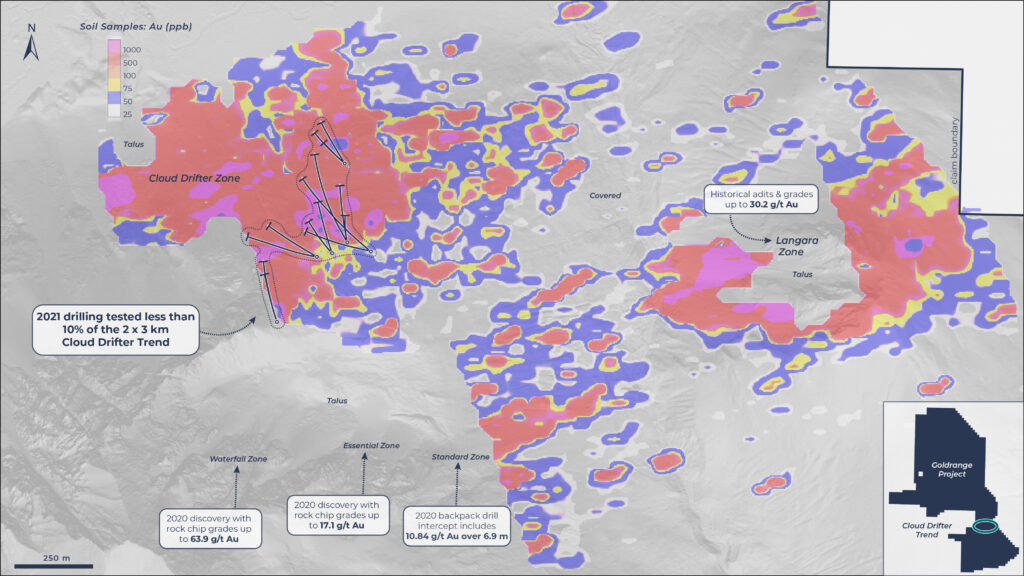

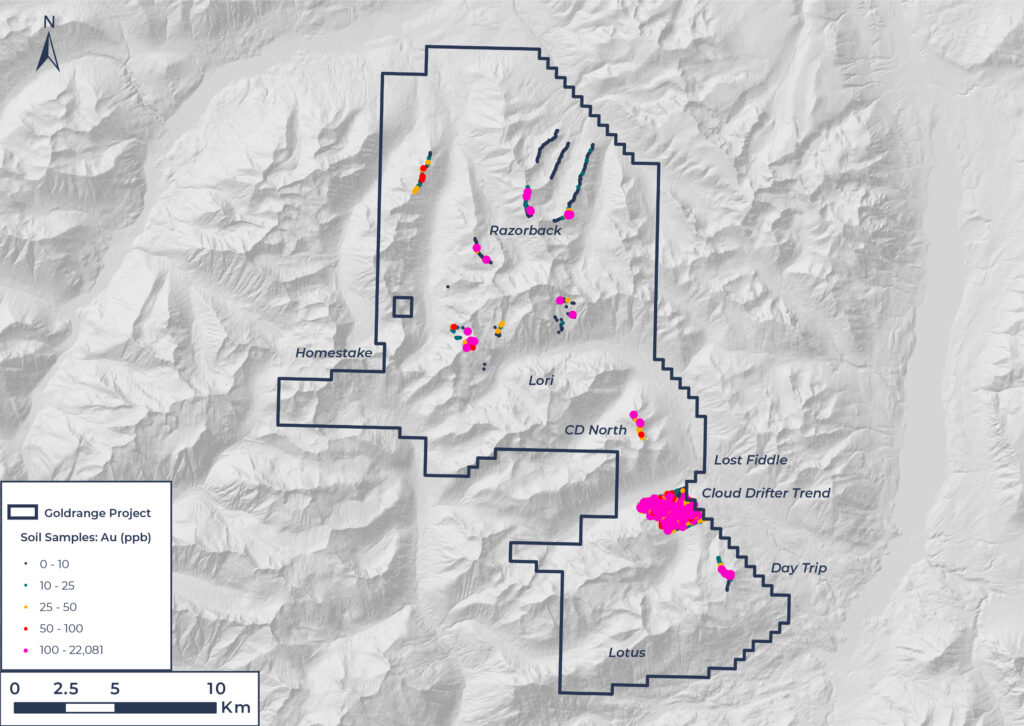

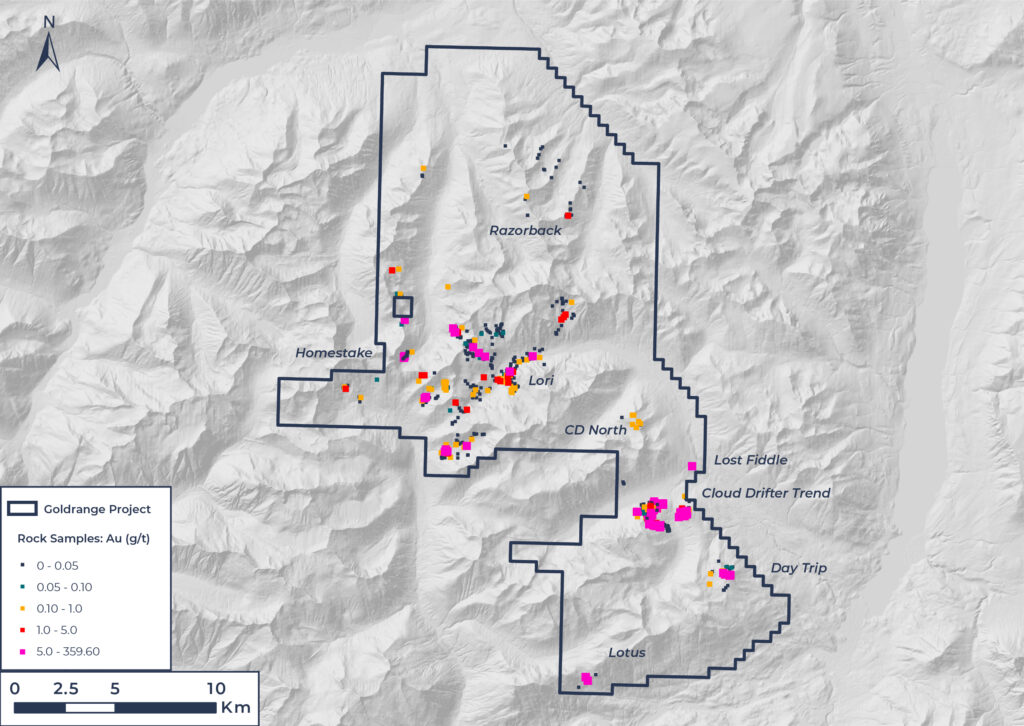

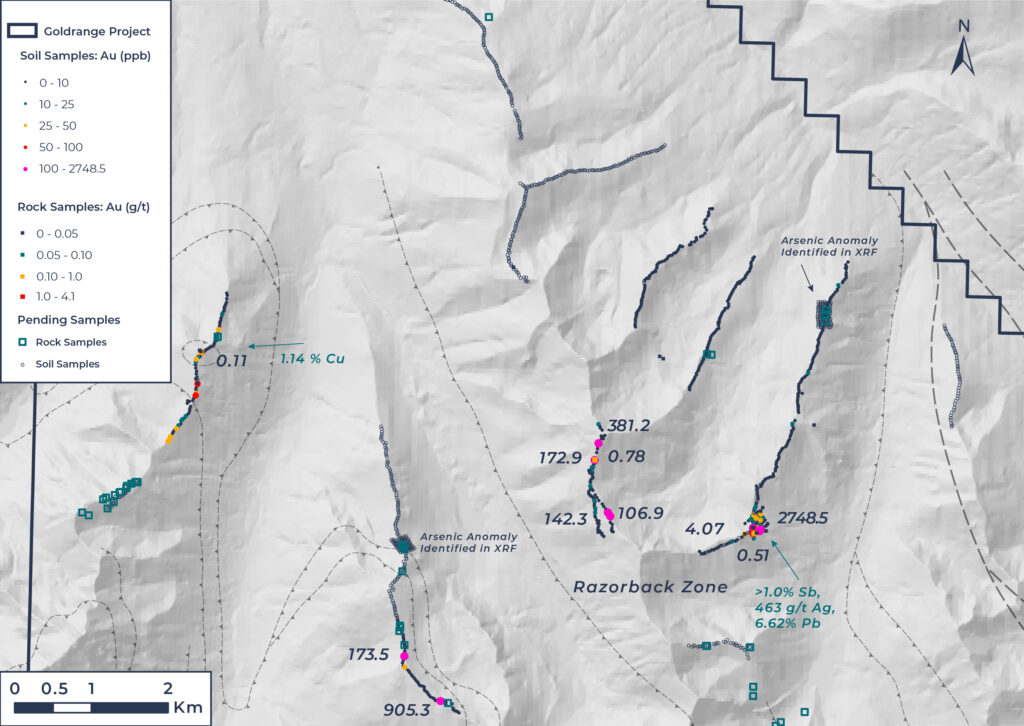

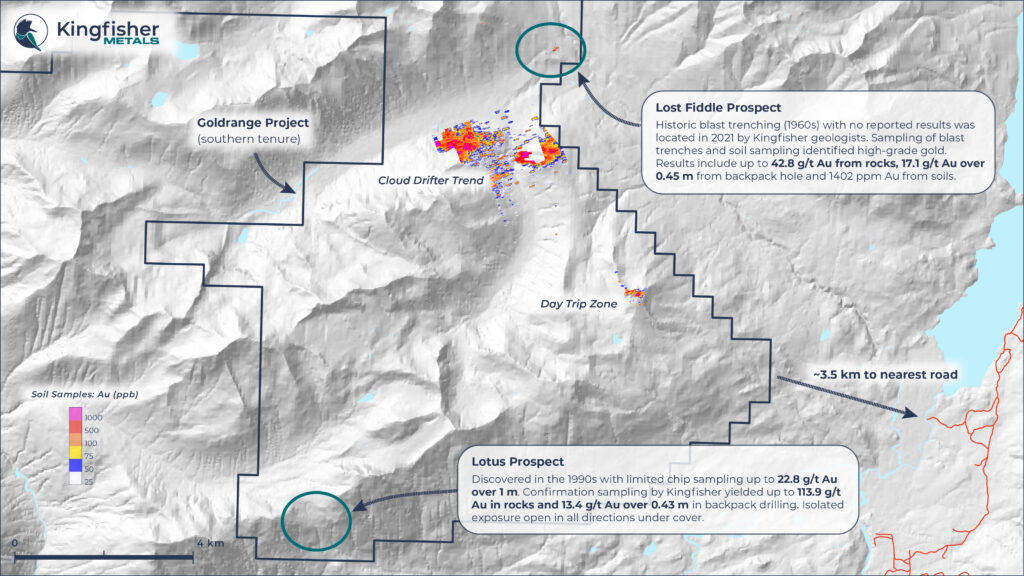

VANCOUVER, British Columbia, April 19, 2022 – Kingfisher Metals Corp. (TSX-V: KFR) (FSE: 970) (OTCQB: KGFMF) (“Kingfisher” or the “Company”) announces results from its 100% owned GoldrangeProject. Goldrange is located approximately 25 km south of the town of Tatla Lake in the Chilcotin region of Southwest British Columbia.

Highlights

- Fieldwork outlined two areas (Lotus and Lost Fiddle) with bonanza gold grades in outcrop.Mineralization at both projects under forest and till cover and is open laterally and at depth.

- Rock chip sampling at Lotus returned four samples greater than one ounce per ton gold with up to 113.9 g/t Au and backpack drill resultsinclude up to 13.4 g/t Au over 0.43 m.

- At the Lost Fiddle Prospect, which is only 2 km north of the Cloud Drifter Trend, backpack drilling of historical blast trenches returned up to 17.1 g/t Au, 431 g/t Ag, and 4.12% Cu over 0.45 m.

Dustin Perry, CEO states “Regional sampling in 2021 highlights the high-grade discovery potential at the district-scale Goldrange Project. The Lotus and Lost Fiddle prospects are particularly attractive as there are no limitations on dimensions. Outcrop exposures at both locations contain bonanza grades that disappear under forest or till cover leaving excellent upside for future discoveries.”

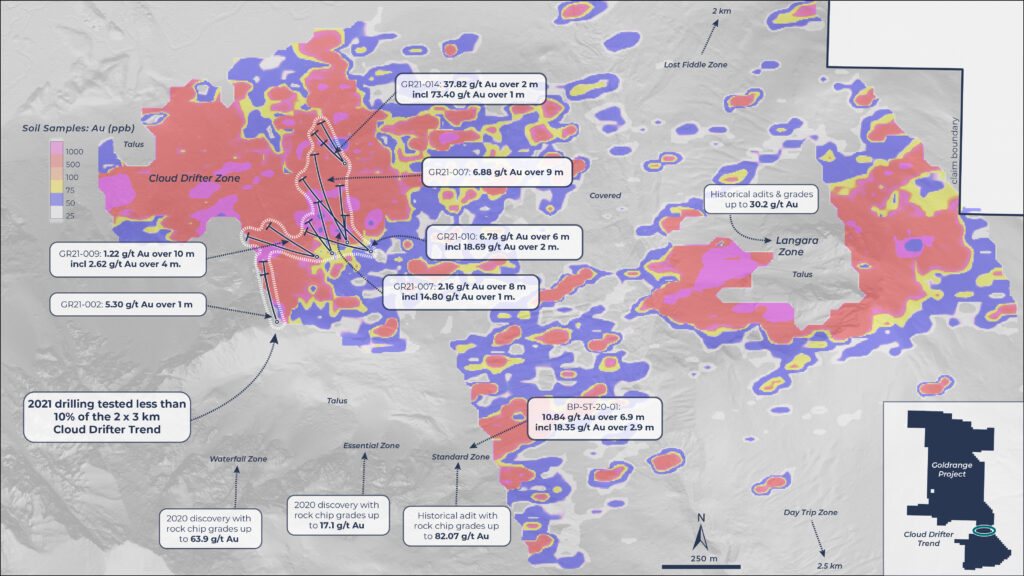

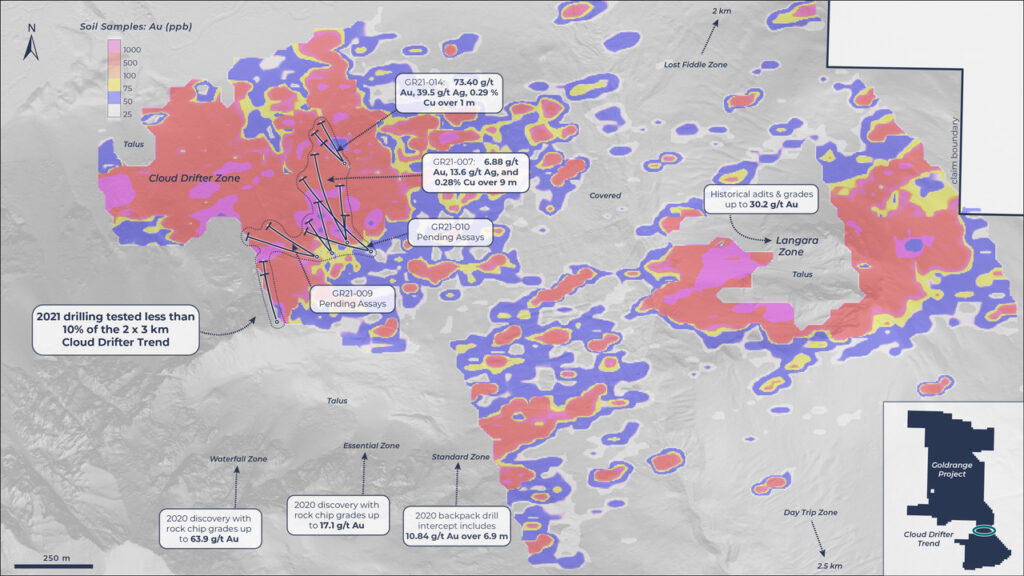

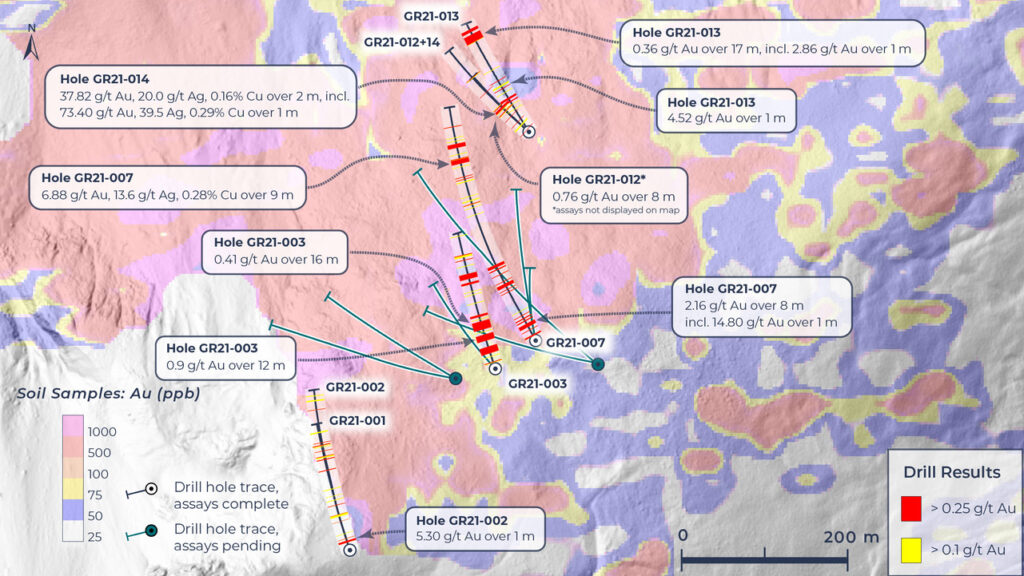

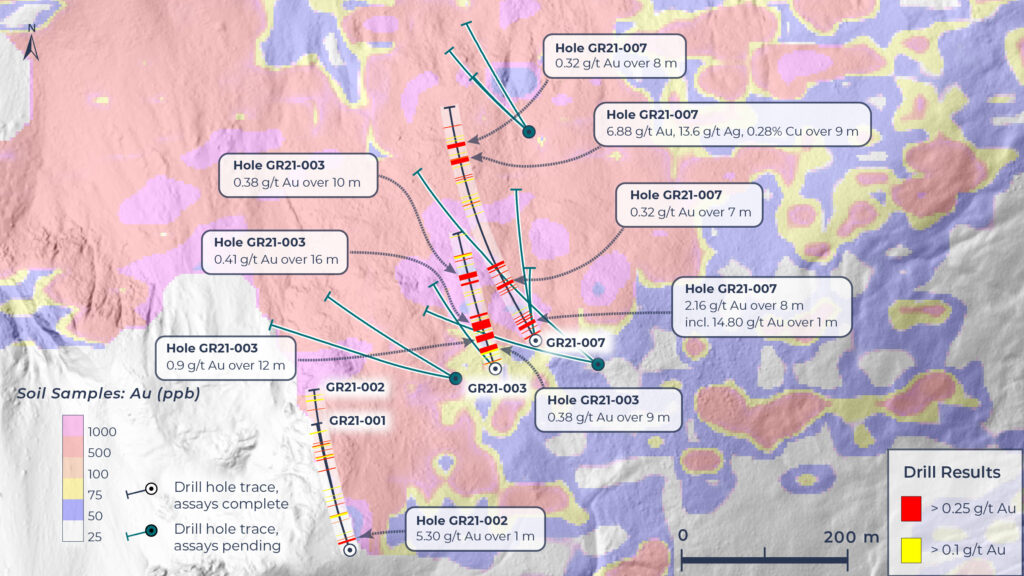

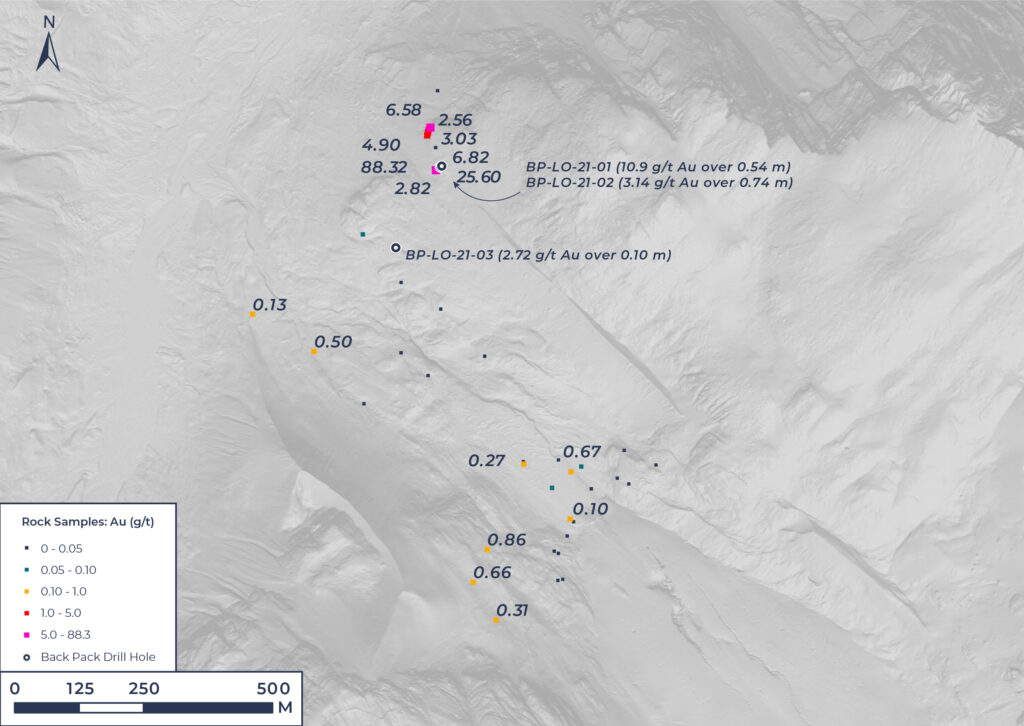

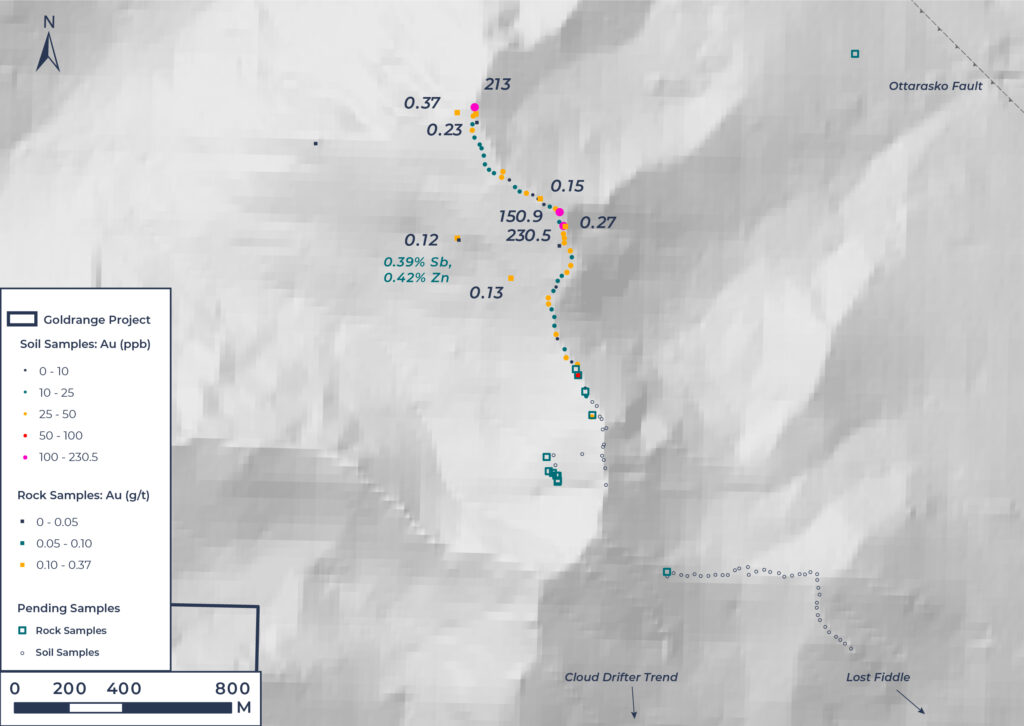

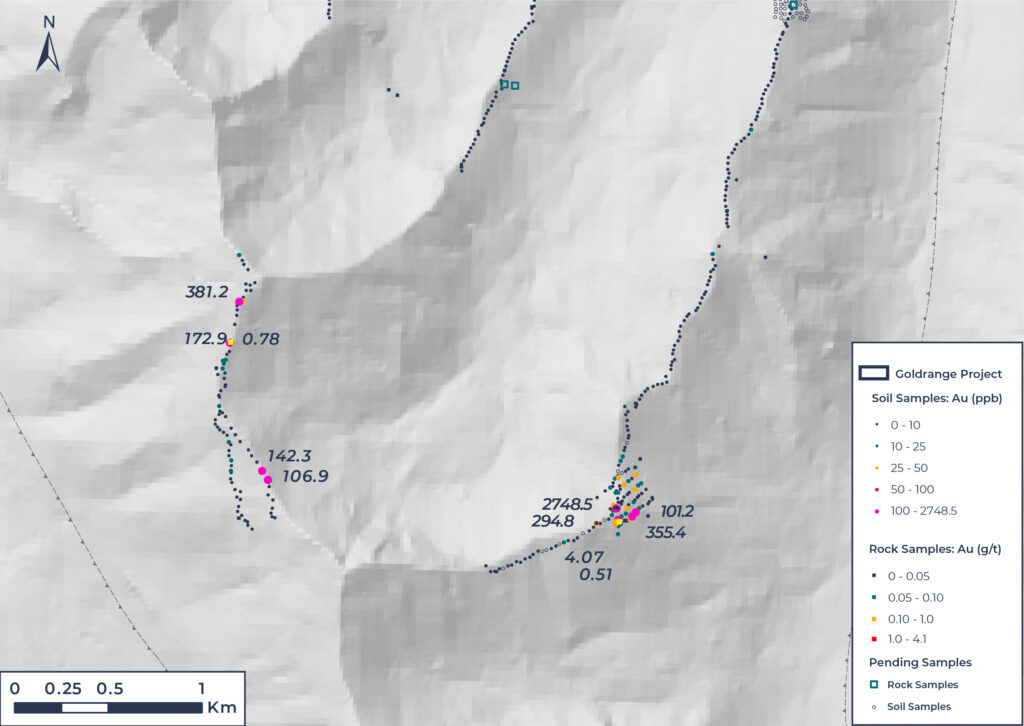

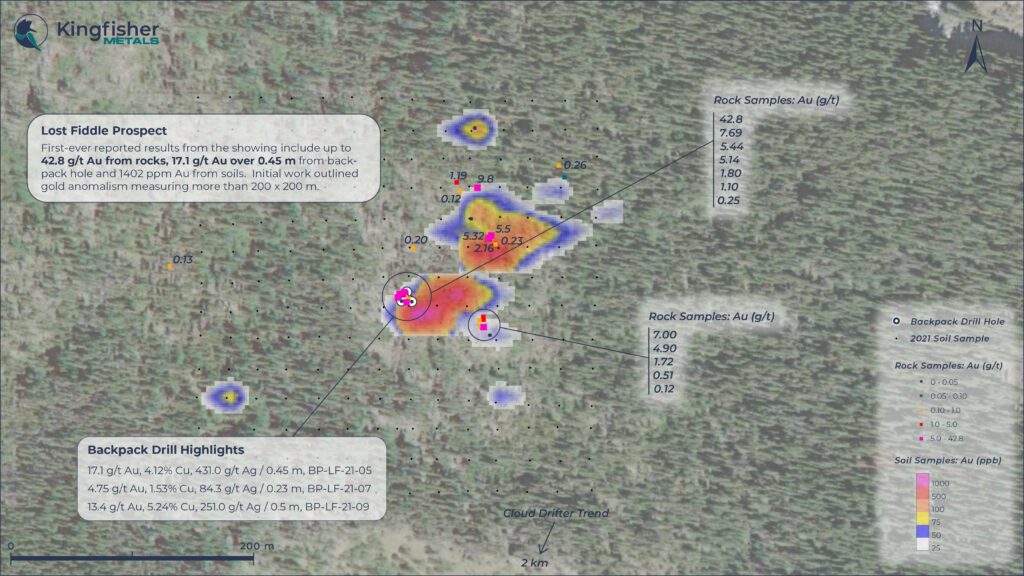

The Lost Fiddle Prospect is located 2 km north of the Cloud Drifter Trend, the most advanced target within the district (Figure 1). Kingfisher geologists located historical blast trenches for the first time since the 1960s. The only available information on the Lost Fiddle Prospect was from government records, which provided an approximate location but no assay results. The blast trenches were located by Kingfisher some 325 m northwest of where records indicated.

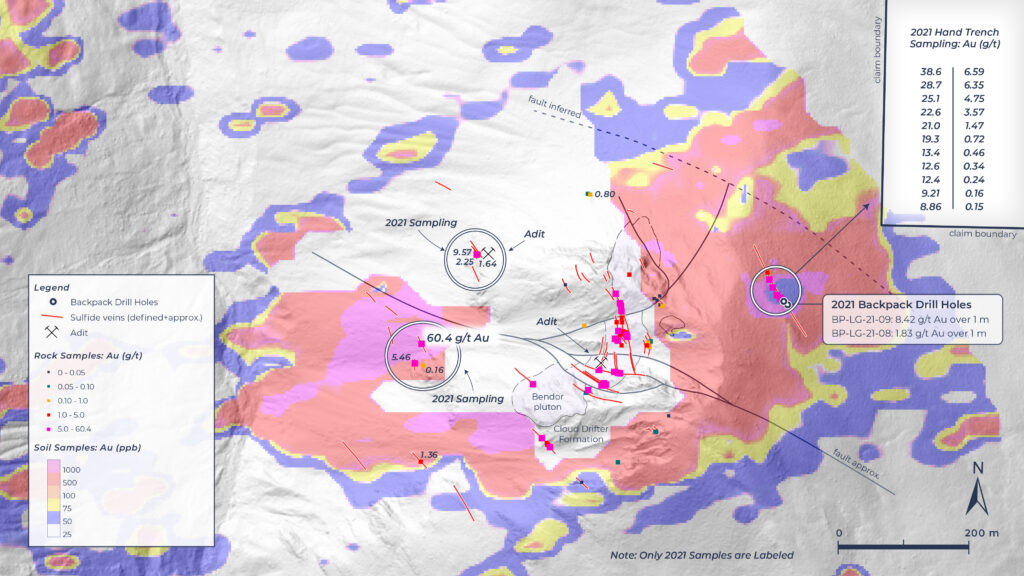

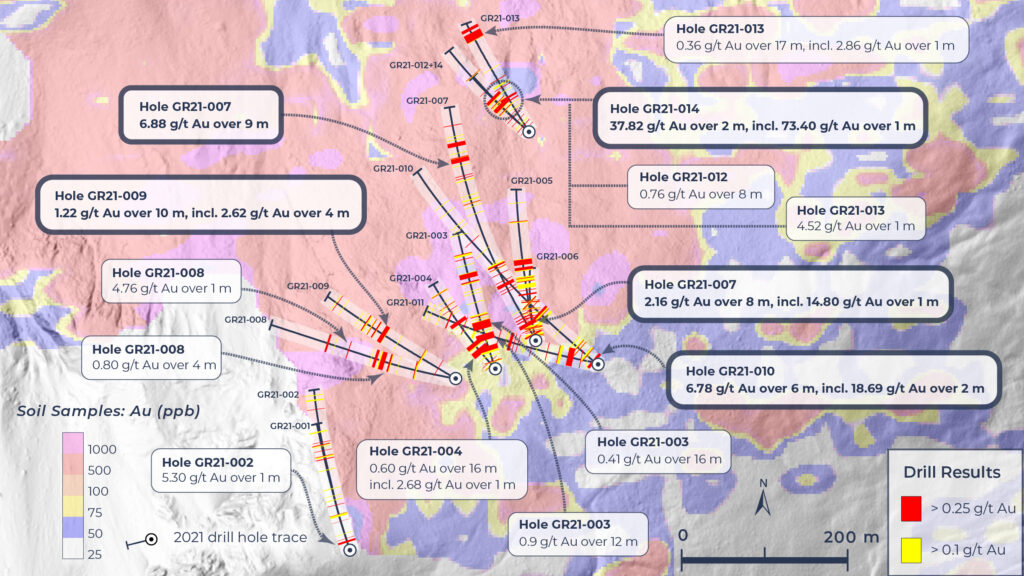

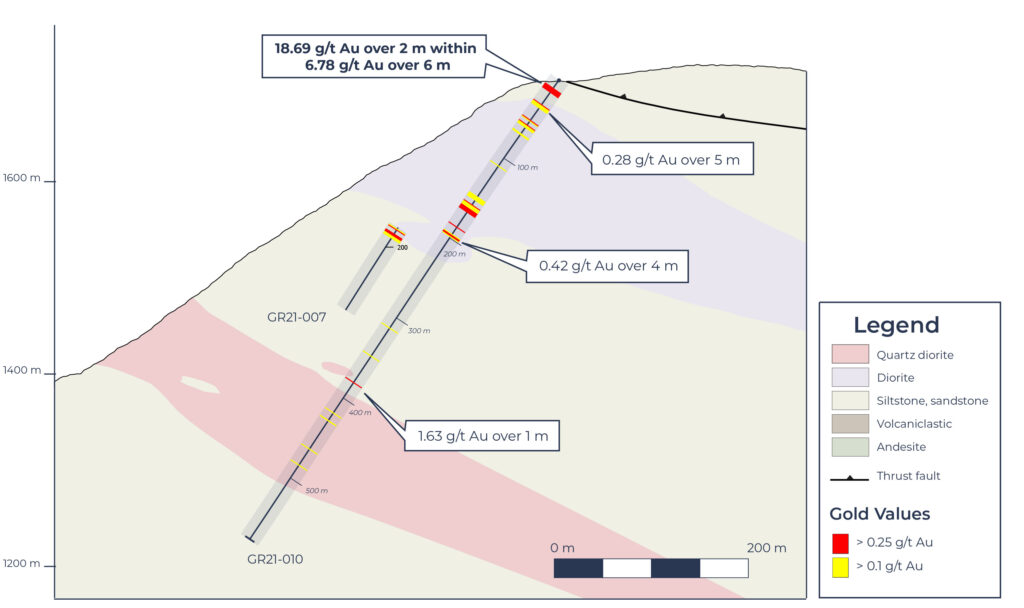

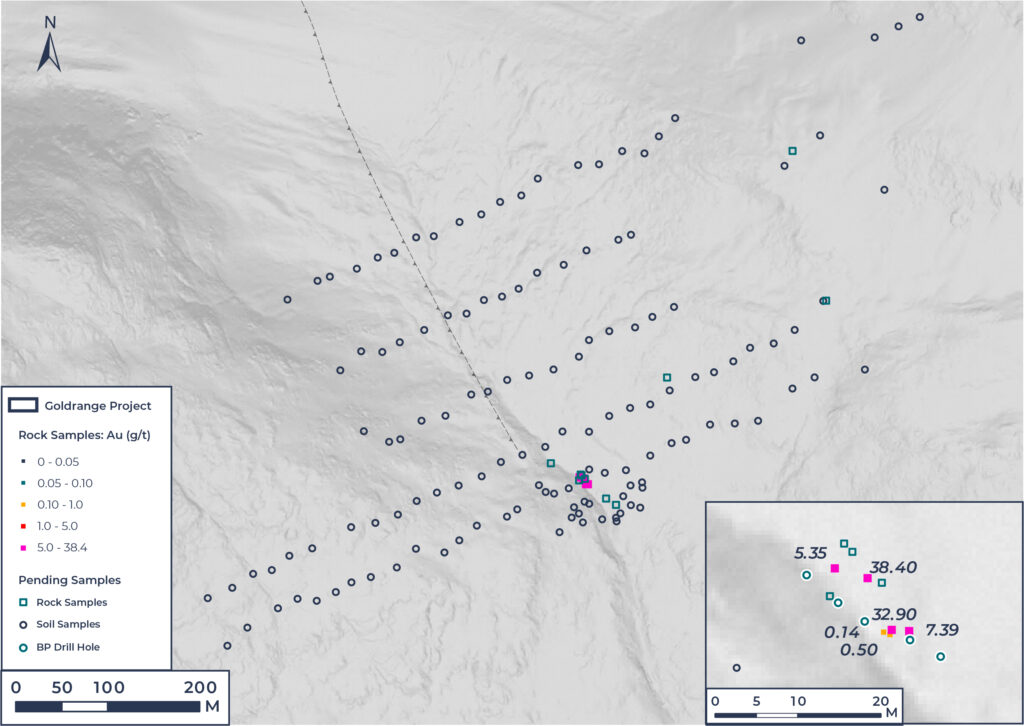

During the 2021 field program, nine short backpack drill holes totalling 16.07 m, 198 soil samples and 27 grab and rock chip samples were collected at Lost Fiddle (Figure 2; Tables 1 and 2). The backpack drill and rock chip samples were focused around three historical blast trenches and mineralized exposures. Soils were collected on a 25 m grid. Rock samples returned several high-grade gold results including the previously reported (Sept 28, 2021) 42.80 g/t Au, 1097.0 g/t Ag, and 1.27% Cu (Figure 2; Table 1). Anomalous soils were located proximal to the historical blast trenches with grades up to 1402 ppb Au (1.4 g/t), 49,718 ppb Ag (49.7 g/t) and 2062.8 ppm Cu (0.21%; Figure 2, Table 2). The soil grid was covered in a thick layer of till, which may account for a lower soil response outboard of the outcrop area. Backpack drilling was focused around the western blast trench. Hole BP-LF-21-05 graded 17.1 g/t Au, 431 g/t Ag, and 4.12% Cu over 0.45 m hosted in a strongly oxidized quartz vein with vuggy boxwork. Hole BP-LF-21-09 intersected 50 cm of massive pyrite-pyrrhotite-chalcopyrite-arsenopyrite sulfide (true thickness unknown) from 2.4 to 2.9 m grading 13.4 g/t Au, 251 g/t Ag, and 5.24% Cu hosted in volcaniclastic conglomerate. Kingfisher’s sampling at Lost Fiddle delineated a mineralized footprint measuring at least 200 x 200 m.

| Au (g/t) | Ag (g/t) | Cu (%) | |

| Min. Value | 0.01 | 0.1 | 0.01 |

| Max. Value | 42.80 | 1097.0 | 1.27 |

| Ave. Value | 3.83 | 131.4 | 0.39 |

| Median Value | 1.10 | 37.2 | 0.23 |

| 90th Percentile | 8.11 | 429.2 | 1.16 |

Table 1: 2021 Lost Fiddle rock sample statistics (n = 27)

| Au (ppb) | Ag (ppb) | Cu (ppm) | |

| Min. Value | 0.1 | 24 | 6.1 |

| Max. Value | 1402.0 | 49718 | 2062.8 |

| Ave. Value | 18.7 | 582 | 54.9 |

| Median Value | 2.3 | 113 | 23.6 |

| 90th Percentile | 16.7 | 688 | 88.1 |

Table 2: 2021 Lost Fiddle soil sample statistics (n = 198)

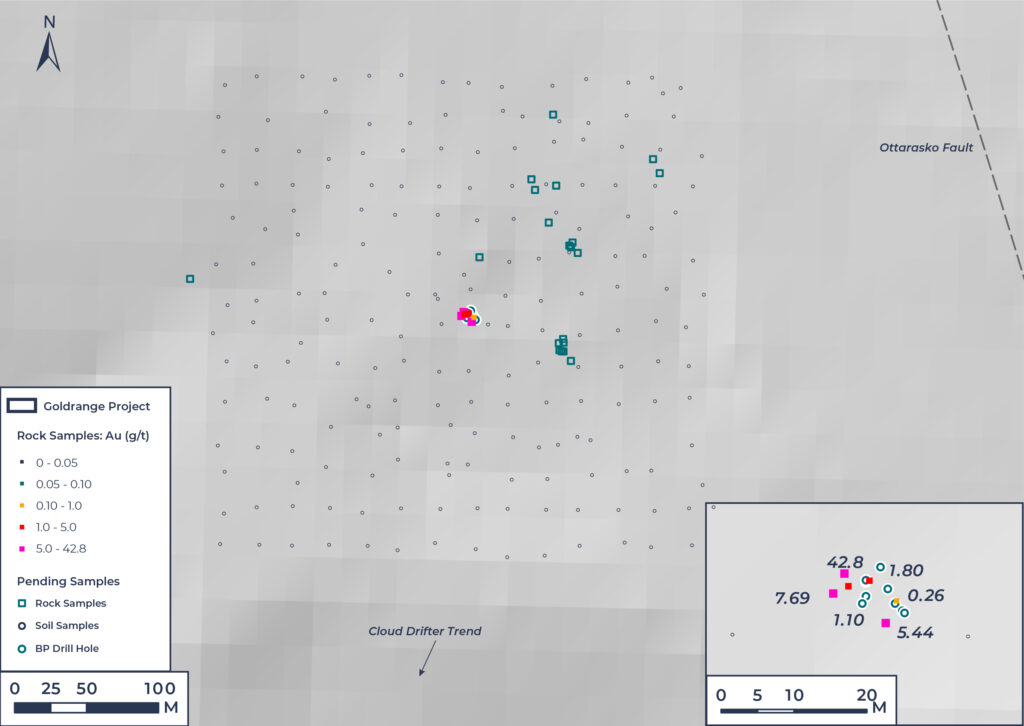

The Lotus Prospect was discovered in the 1990s in a gully exposure within broad forest and till cover. Lotus hosts a northwesterly-striking, moderately west-dipping shear banded quartz vein and reverse brittle fault zone with a minimum 3 m width. The true thickness of the zone is unknown due to forest cover on both west and east continuations. Veins of quartz, carbonate, pyrite and arsenopyrite cut volcanic and sedimentary rocks. The target lies on trend with a district-scale thrust fault and is proximal to a regional-scale contact with Bendor plutonic rocks, known as an important focus for mineralization at the Goldrange Project.

In 2021, Kingfisher geologists completed a program of hand trenching, backpack drilling and rock chip sampling. Five shallow backpack holes totalling 11.85 m and an additional 10 rock chip samples were collected (Figure 3, Table 3). Rock chips collected from the vein exposure returned four samples more than one ounce per ton gold with grades up to 113.9 g/t Au (Table 3). Backpack drill highlights include hole BP-LT-21-01, which graded 13.4 g/t Au over 0.43 m. Backpack drilling was plagued with poor recovery with a considerable amount of sulfide material washed out of the drill hole in a slurry. Mineralization within the gully projects laterally uphill beneath till cover, laterally and downhill beneath forest cover and has never been tested with a diamond drill. The width extent of the vein is masked by the presence of a post-mineral, tabular felsic dike following the western margin of the gully exposure

| Au (g/t) | Ag (g/t) | Cu (%) | Te (ppm) | |

| Min. Value | 0.00 | 0.1 | 0.00 | 0.3 |

| Max. Value | 113.90 | 205.0 | 0.44 | 217.7 |

| Ave. Value | 15.88 | 25.1 | 0.04 | 31.4 |

| Median Value | 0.71 | 2.5 | 0.01 | 3.6 |

| 90th Percentile | 69.17 | 104.5 | 0.20 | 133.6 |

Table 3: 2020 and 2021 Lotus rock sample statistics (n = 16)

Future Plans

The Company intends to file an amendment to its current 5-year area-based permit to incorporate the Lost Fiddle and Lotus prospects so that permitted work including IP geophysics and drilling can be completed.

Sampling Protocol

Backpack drillholes at the Goldrange Project are BQ sized (36.4 mm diameter). A continuous series of one half to one-metre-long full core samples was taken down the entire length of each backpack drill hole. Unlabeled certified reference materials (CRM) were inserted systematically throughout the backpack drillhole sample sequence along with blanks. The total number of blanks, and CRM samples equals approximately 5% of the total samples taken.

Grab and chip rock samples are selective by nature and values reported may not be representative of mineralized zones. Rock and backpack drill core samples were submitted to Acme Analytical Laboratories Inc., a division of Bureau Veritas Commodities Canada Ltd., located in Vancouver, British Columbia, an ISO9001:2008 accredited laboratory. The samples were prepared using the PRP70-250 method by crushing 1.0 kg of rock to =>70% passing through a 2 mm sieve. A sample of 250 grams was then pulverized so that greater than or equal to 85% passes through a less than 75 μmsieve. A 0.25 g split was then subjected to a 4 acid near total digest where the split is heated in a HNO3, HClO4 and HF solution to fuming, dried and then dissolved in HCL. The resulting solution was then analyzed for 45 major and trace elements using ICP-ES/MS (method code MA200). A 30 g split was analyzed for gold using a lead collection fire assay fusion that was then digested and analyzed using AAS (method code FA430).

A 30 g split of samples that assayed >10 ppm gold and/or >200 ppm Ag were analyzed using a lead collection fire assay fusion with a gravimetric finish (method code FA530). Samples that assayed for >200 ppm W; > 4000 ppm Bi, Mo, or Sb; >10000 ppm Cu, Pb or Zn were digested using a HNO3, HClO4 and HF solution to fuming, dried and then dissolved in HCL. The resulting solution was then analyzed using ICP-ES (method code MA370). Samples that assayed > 10000 ppm As were digested using a modified aqua regia digestion (1:1:1 HNO3:HCl:H2O) and analyzed using ICP-ES (method code MA370).

Soil samples weighing approximately 250 grams per sample were delivered by company personnel to Acme Laboratories Inc.. The soil samples were prepared using the SS80 method by drying them at 60˚C and sieving to less than 180 μm (80 mesh). A 30 gram split of the sieved soil sample was then subjected to a modified aqua regia digestion (1:1:1 HNO3:HCl:H2O) and analyzed for 37 major and trace elements using ICP-ES/MS (method code AQ252). Field duplicates were collected and submitted every 40 samples.

Dustin Perry, P.Geo., Kingfisher’s CEO, is the Company’s Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has prepared the technical information presented in this release.

Kingfisher Metals Corp.(https://kingfishermetals.com/) is a Canadian based exploration company focused on underexplored district-scale projects in British Columbia. Kingfisher has three 100% owned district-scale projects that offer potential exposure to high-grade gold, copper, silver, and zinc. The Company currently has 85,173,300 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone:+1 236 358 0054

E-Mail: info@kingfishermetals.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property. This news release contains forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. All statements, other than statements of historical fact, are forward-looking statements or information. Forward-looking statements or information in this news release relate to, among other things: formulation of plans for drill testing; and the success related to any future exploration or development programs.

These forward-looking statements and information reflect the Company’s current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include; success of the Company’s projects; prices for gold remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company’s projects; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour- related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: risks related to the COVID-19 pandemic; fluctuations in gold prices; fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation); fluctuations in currency markets (such as the Canadian dollar versus the U.S. dollar); operational risks and hazards inherent with the business of mineral exploration; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards; our ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; changes in laws, regulations and government practices, including environmental, export and import laws and regulations; legal restrictions relating to mineral exploration; increased competition in the mining industry for equipment and qualified personnel; the availability of additional capital; title matters and the additional risks identified in our filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described, or intended. Investors are cautioned against undue reliance on forward-looking statements or information. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances.