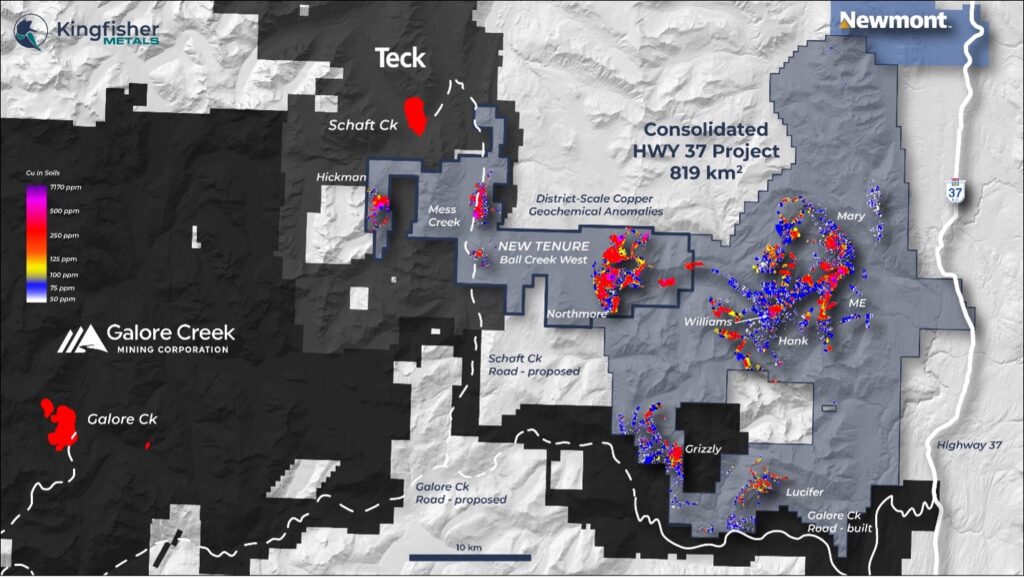

Creates Largest Contiguous Project (HWY 37) Held by a Non-Producing Company in the Golden Triangle, BC

Kingfisher Metals Corp. (TSX-V: KFR) (FSE: 970) (OTCQB: KGFMF) (“Kingfisher” or the “Company”) is pleased to announce that it has entered into a definitive agreement dated December 4, 2024 (the “Agreement”) to acquire the Ball Creek West project (the “BAM Project”) from P2 Gold Inc. (“P2 Gold”) (the “Transaction”). The BAM Project comprises 54 claims totalling 18,893 hectares and is located immediately west and contiguous with Kingfisher’s HWY 37 Project, in Northwest British Columbia within the Golden Triangle.

The Transaction will bring the consolidated HWY 37 Project to 819 km2 making it the largest contiguous project held by a non-producing company in the Golden Triangle. The BAM Project is highly prospective for Cu-Au porphyry systems with three grassroots, large-scale target areas: Northmore, Mess Creek, and Hickman.

Consolidation of the Golden Triangle

- The Golden Triangle is the most endowed region in Canada for large Cu-Au porphyry systems where neighbouring major miners Teck and Newmont hold Red Chris, Galore Creek, and Schaft Creek

- Kingfisher entered the Golden Triangle in 2023 and has rapidly consolidated the largest contiguous non-producer held project in the region with 819 km2

- The addition of three large-scale porphyry Cu-Au targets furthers the strategy of positioning Kingfisher as the premier Cu-Au explorer in the region

- New tenure addition of 189 km2 is fully assessed with no holding costs until 2032

Dustin Perry, CEO states “Since we shifted our exploration focus to the Golden Triangle, we have taken a two-pronged approach of regional consolidation and systematic exploration. This acquisition marks a significant step in elevating the Company to having the largest contiguous project held by a non-producing company in the Golden Triangle. We see the Northmore, Mess Creek, and Hickman targets as having the hallmarks of large Cu-Au±Mo porphyry systems similar in scale to the targets we have identified to date. This acquisition further increases our pipeline of highly prospective targets in the most prospective porphyry region in Canada. This acquisition provides optionality to the Company as the tenures are in good standing until 2032 and require no immediate work. This allows us to prioritize drilling on our more advanced and recently generated targets while taking a systematic approach to de-risking these large porphyry anomalies.

Once ingested into our rapidly evolving machine learning VRIFY AI model, these targets will not only benefit from our existing database, but they will further refine the existing target areas through pattern recognition. We believe our methodical approach combined with cutting edge geoscience and AI is positioning the Company and our shareholders for long term success in an environment of rising metal prices.”

Transaction Details

Under the terms of the Agreement, the Company will (a) issue common shares to P2 Gold with an aggregate value of C$250,000 priced at C$0.165 per share, and (b) pay C$1,000,000 in cash to P2 Gold, with C$50,000 due on signing the Agreement and C$950,000 due on the closing of the Transaction, in exchange for the BAM Project. The BAM Project is subject to underlying royalty agreements over the project that includes a 1% net smelter return to be retained by Evrim Exploration Canada Corp., a subsidiary of Orogen Royalties Inc. (“Orogen”), and a 2% net smelter return to be retained by Sandstorm Gold Ltd. (“Sandstorm”), as well as a provision for Orogen to buy down 1% of the Sandstorm net smelter return for C$1,000,000 and the right to up to C$4,100,000 in milestone payments.

The Transaction remains subject to various terms and conditions, including, but not limited to, the approval of the Exchange and Kingfisher completing a private placement of at least C$1,000,000. The closing of the Transaction is anticipated on or about February 28, 2025.

BAM Project Overview

The BAM Project fits into Kingfishers’ strategy of consolidating highly prospective projects in the Golden Triangle and systematically exploring them. The addition of Northmore, Mess Creek, and Hickman fit into the Company’s strategy as they have the hallmarks of large porphyry Cu-Au systems. Given the BAM Project tenures are in good standing until 2032, the Company has no financial obligations to assess the tenures for approximately 8 years. The new tenures are contiguous with the rest of the Company’s Golden Triangle landholdings and any work credits done across the 819 km2 can be spread across the project. This optionality enables Kingfisher to prioritize the more advanced targets at the Williams, Hank, Mary, and ME drill ready for near term drilling while completing systematic and lower cost exploration at these new target areas. The Company believes this process of large-scale consolidation, screening, target development, and drill testing is the most efficient and responsible way to deploy shareholder capital.

The overarching themes of the opportunities at the Northmore, Mess Creek, and Hickman targets include:

- Located within a prolific mineral region

- Large km-scale geochemical anomalies and alteration systems

- Limited shallow historical drilling

- Limited modern geophysical coverage

- No follow up yet on 2019 sampling that discovered the Hickman target, greatly expanded the Northmore geochemical anomaly, and extended the Mess Creek geochemical anomaly

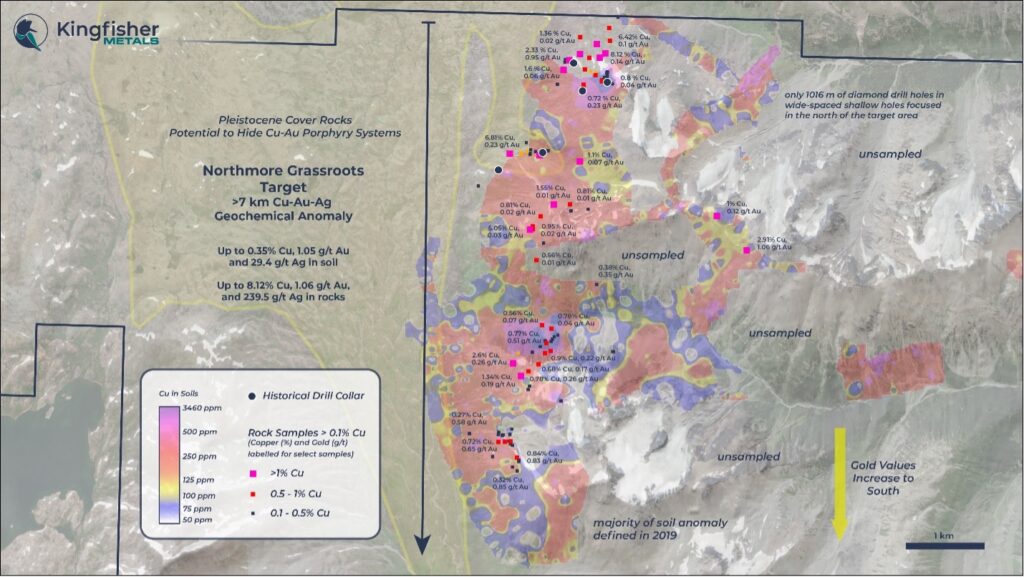

Northmore Grassroots Target*

The Northmore grassroots target area (Figure 2) includes a soil anomaly that extends 7 km N-S and has a width of 1.5-2.5 km E-W with several sampling gaps in steep gossan slopes. The broad Cu-Au-Ag-Mo multi-element anomaly reflects a region with a mix of outcrop and vegetative cover. Rock samples from the anomaly include up to 8.12% Cu and 1.06 g/t Au. Five shallow widely spaced drill holes totalling 1016 m tested the anomaly focused at the north. Drilling returned anomalous copper grades (~400-800 ppm Cu) over widths of 25 to 100 m.

A historical 11 line-km induced polarization-resistivity survey at the northern anomaly, completed in 1991, showed chargeability increasing in the eastern portion of the grid. The Company intends to digitize and invert this paper format data for visualization and targeting work in 3D space. A 352 line-km high resolution aeromagnetic survey from 2006 will also be inverted for use in 3D space and structural interpretation.

The broad grassroots Northmore target area is host to Texas Creek, or KSM-type, intrusions as well as syenite interpreted by previous workers to be Galore Creek intrusions. The Company plans to undertake further work to determine whether a KSM or Galore-style exploration model will apply here.

Initial work to further refine targets at Northmore will include expanding soil coverage to capture the full extent of anomalism and new geophysical studies. This new data coupled with 3D inversions of historical geophysical datasets will provide insight into the plumbing system and porphyry target areas for additional IP surveys and drill target generation within the large soil anomaly.

*Sources: Geochem: P. Jamet, 1991. (Assessment Report 22045), Henry Marsden, 2005. (Assessment Report 28076), John Bradford, 2006. (Assessment Report 28833), Stewart Harris, 2018. (Assessment Report 37223), Stewart Harris, 2019. (Assessment Report 37953), Oliver Friesen, 2020. (Assessment Report 38858), Mohan R. Vulimiri, 1990. (Assessment Report 20785), John Bradford, 2008. (Assessment Report 29568), Thomas K. Branson, 2012 (Assessment Report 33614), John Bradford, 2009. (Assessment Report 30743), and Mark E. Baknes, 2021. (Ball Creek NI-43-101). IP-Resistivity: David E. Blann, 1991. (Assessment Report 22001). Magnetics: John Bradford, 2006. (Assessment Report 28833).

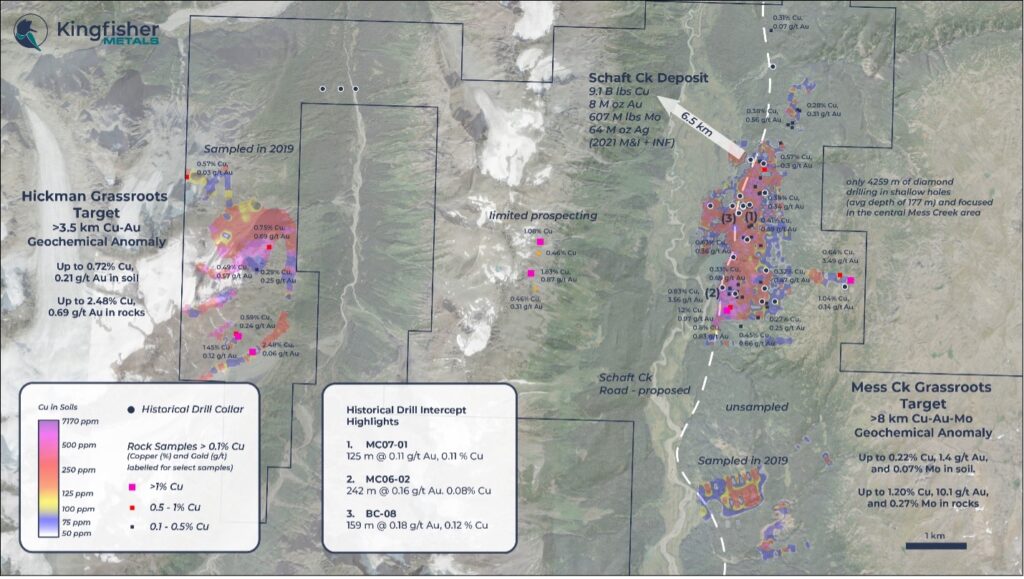

Mess Creek Grassroots Target*

The Mess Creek soil and rock anomaly extends a minimum of 8 km along the length of the Mess Creek with elevated Au-Cu-Mo (Figure 3). In areas, the width of the anomaly measures a minimum of 2 km but sampling along the trend is not sufficient to characterize either the full strike length or width of the anomaly. A total of 24 holes to average depth of 177 m are focused in a 2.3 km N-S by 1 km E-W drill footprint (Figure 3). The drill area intersected anomalous Cu-Au including: 125 m of 0.11 g/t Au and 0.11% Cu (MC07-01), 242 m of 0.16 g/t Au and 0.08% Cu (MC06-02), and 159 m of 0.18 g/t Au and 0.12% Cu (BC-08).

Geophysical coverage at Mess Creek includes 447 line- km of a modern high resolution aeromagnetic survey that encompasses the Mess Creek soil anomaly. The principal Mess Creek soil anomaly is covered by 1970’s era induced-polarization-resistivity data currently in paper format with limited depth penetration. The Company intends to digitize paper format data and to generate inversion products for both IP and magnetic data for 3D visualization and structural interpretation.

The Mess Creek area coincides with a trend of Galore Creek intrusions (the Loon Lake stock) and historical work areas document Galore-like alkalic Cu-Au-bearing syenite porphyry intrusions. The Mess Creek target area is also highly prospective for intrusion-related gold systems (e.g., Brucejack or Snip) based on the presence of the regional scale Mess Creek fault system.

The Company intends to completely capture the anomaly through expanded soil sample surveys and follow-up with geophysical surveys. These results coupled with 3D visualization techniques to historical geophysical and drill results will inform drill targeting work.

*Sources: Geochem: Mark E. Baknes, 2021. (Ball Creek NI-43-101), Wayne Hewgill and Godfrey Walton, 1986. (Assessment Report 15603), John Bradford, 2006. (Assessment Report 28833), John Bradford, 2008. (Assessment Report 29568), Thomas K. Branson, 2012 (Assessment Report 33614), Oliver Friesen, 2020. (Assessment Report 38858), S. J. Tennant, 1991. (Assessment Report 21360), John Bradford, 2008. (Assessment Report 29568), John Bradford, 2009. (Assessment Report 30743), G. A. Clouthier, 1977. (Assessment Report 06391), G. A. Clouthier, 1976. (Assessment Report 06162), K. Buchanan, G. Gutrath, 1972. (Assessment Report 04100), and G. C. Gutrath, 1971. (Assessment Report 03093). Magnetics: John Bradford, 2006. (Assessment Report 28833). IP-Resistivity: J. Vysselaar, G. A. Clouthier, 1978. (Assessment Report 06875), David K. Fountain, 1973. (Assessment Report 04755), Ashton W. Mullan, Peter K. Smith, 1972. (Assessment Report 03989), and G. A. Clouthier, 1977 (Assessment Report 06162).

Hickman Grassroots Target Area*

The Hickman grassroots target area is an open and relatively new 3.5 km-long Cu-Au-Mo soil anomaly that was delineated in 2019 without follow-up (Figure 3). Surface work identified the presence of potassic-altered porphyry stockwork on surface and rock sampled up to 0.69 g/t Au and 2.5% Cu. The sampled region reflects a comparable geological setting to the Schaft Creek deposit, located ~7 km north of the target. Both the Schaft Creek deposit and Hickman target lie at the margin of the Late Triassic Hickman batholith (225 to 222 Ma) associated with monzodiorite porphyry phases.

No geophysical surveys have been completed at Hickman.

*Sources: Geochem: Oliver Friesen, 2020. (Assessment Report 38858), and Mark E. Baknes, 2021. (Ball Creek NI-43-101).

Qualified Person

Dustin Perry, P.Geo., Kingfisher’s CEO, is the Company’s Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has prepared the technical information presented in this release. Kingfisher believes the work completed by historical operators was performed to a professional standard but has not independently confirmed the results. The Company notes that mineralization on other projects within the Golden Triangle is not indicative of mineralization on the BAM Project.

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on underexplored district-scale projects in British Columbia, including the Golden Triangle region. Kingfisher has two 100% owned district-scale projects and an option to earn 100% of the HWY 37 Project, that offer potential exposure to gold, copper, silver, and zinc. The Company currently has 43,201,553 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 778 606 2507

E-Mail: info@kingfishermetals.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property. This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the transaction, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.