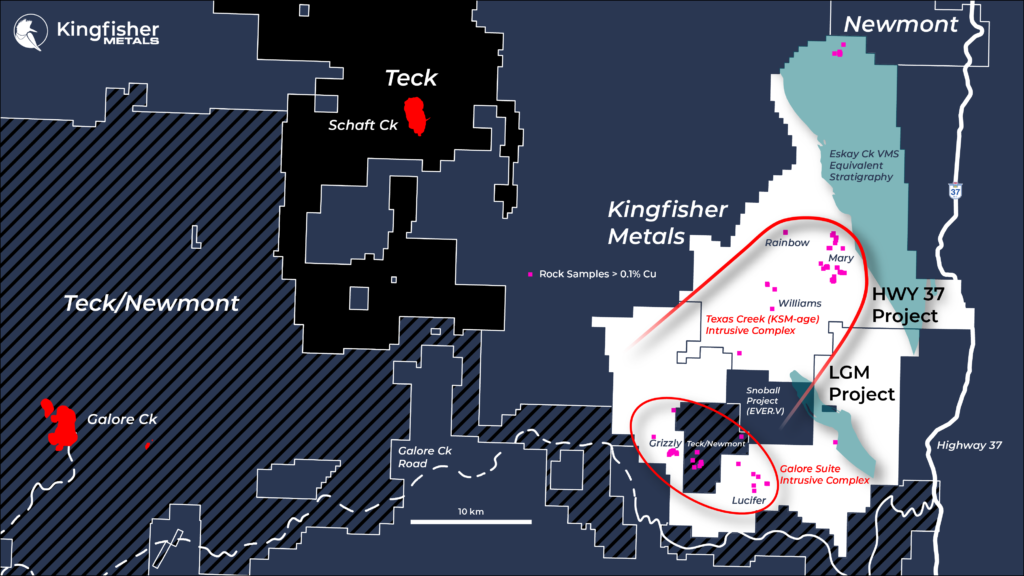

Kingfisher Metals Corp. (TSX-V: KFR) (FSE: 970) (OTCQB: KGFMF) (“Kingfisher” or the “Company”) is pleased to announce that it has entered into a definitive agreement (the “Agreement”) to acquire the LGM Project from Origen Resources Inc. (“Origen”). The 26,771 HaLGM Project is located immediately south and contiguous with Kingfisher’s HWY 37 Project, in Northwest British Columbia within the Golden Triangle.

Highlights

- Expansion of contiguous holdings in the Golden Triangle from 362 km2 to 630 km2 including KSM-type targets in west, alkalic Galore Creek-type targets in central region (Grizzly and Lucifer) and unexplored Eskay Creek-type stratigraphy to the east.

- Grizzly Target trench sampling from 2006 returned 0.74% Cu and 1.09 g/t Au over 38 m.

- The LGM Project represents one of only three silica-undersaturated magmatic-volcanic complexes in the Golden Triangle with discovery potential for Galore Creek-type porphyry systems and has only seen 3,988 m of drilling.

- Historical stream sampling at Lucifer outlined a 4 km-long trend of highly anomalous stream sediment samples grading up to 7.8 g/t Au – similar in strength and scale to the Hank epithermal deposit signature at HWY 37.

- LGM Project is fully permitted for diamond drilling.

Dustin Perry, CEO states “Acquiring the LGM Project fits into Kingfisher’s strategy to explore large district-scale opportunities and further increases our land holdings adjacent to Highway 37 in the prolific Golden Triangle. Historical results at LGM show very encouraging early-stage indications of porphyry Cu-Au mineralization with the Galore Creek potential.”

Gayle Febbo, VP Exploration states “The Grizzly and Voigtberg showings represent the only known showings in the region with mineralization hosted in pseudoleucite bearing volcanic rocks without a significant discovery. My work at Galore Creek focused on the structural patterns of ore shoots, and I believe comparable unrecognized patterns and potential exist for the LGM Project.”

The LGM Project Overview

The LGM Project lies directly south of the HWY 37 Project (Figure 1). It parallels Highway 37 and is bound to the south by the Galore Creek access road. The project comprises 26,771 Ha with underlying NSR royalties ranging from 1% to 2%.

LGM offers exposure to three district-scale exploration targets: 1) KSM-type porphyry showings (Texas Creek suite intrusions) in the western half of project, 2) Galore Creek-type showings in the southwest region of project (Galore Creek suite intrusions), and 3) Eskay-type prospective stratigraphy in the eastern project (Iskut River Formation). Despite the highly favourable location within the Golden Triangle and proximity to both the highway and the Galore Creek access road, the project has only seen 3,988 m of shallow reconnaissance diamond drilling. Historical exploration at the project has focused on the Grizzly and Lucifer targets with exploration dating back to the 1970s.

The LGM/Voigtberg, Galore Creek, and Newmont Lake projects represent the only three areas in the Golden Triangle where ~210-208 Ma silica-undersaturated, alkalic magmatic-volcanic complexes are identified. These rare and Cu-Au-rich systems are marked by the presence of pseudoleucite in both the intrusions and in the overlying volcanic rocks. Although many Galore Creek suite intrusions are identified in the region, only three reflect full vertical preservation that includes the pseudoleucite-bearing volcanic carapace. Galore Creek is the most advanced of these projects with a measured and indicated resource of 1,197 Mt at 0.46% Cu and 0.25 g/t Au, and the Newmont Lake Project is host to the Burgundy Ridge drill delineated Cu-Au porphyry deposit. The LGM/Voigtberg region represents rare exposure to a Galore Creek-type system, and the only magmatic-volcanic complex where a deposit has not yet been delineated. The Company notes that mineralization on nearby projects is not indicative of mineralization on the LGM Project.

Figure 1: Regional Overview Map

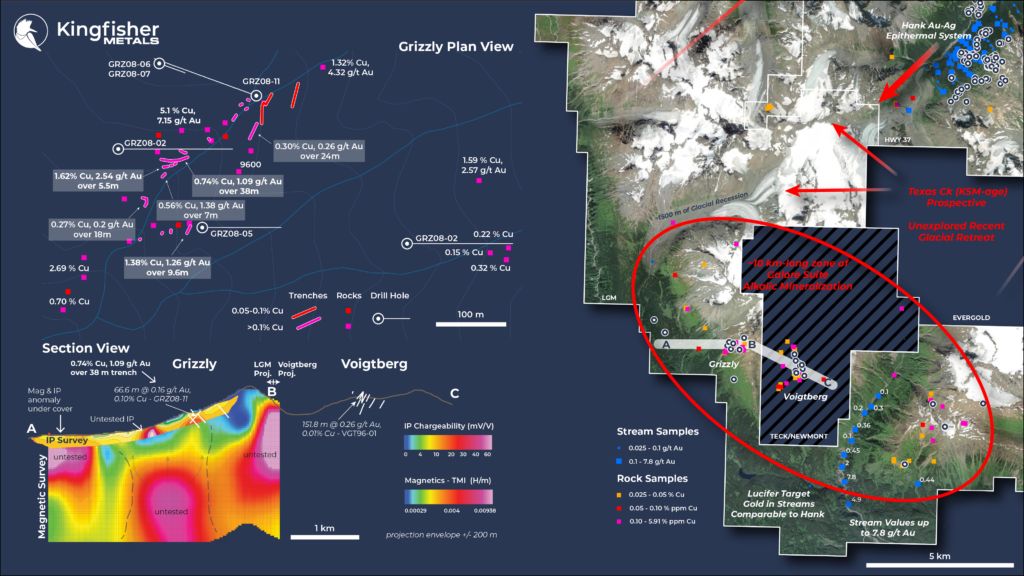

Figure 2: LGM Project – Grizzly-Voigtberg-Lucifer Trend

Grizzly Porphyry Target Area

The Grizzly target (Figure 2) is a silica-undersaturated alkalic Cu-Au porphyry with a comparable setting to Galore Creek. The target is centered on a surface trench of 0.74% Cu and 1.09 g/t Au over 38 m and lies within a 1 km by 1 km Cu-Au-Ag-Mo soil geochemical anomaly that grades up to 2916 ppm Cu, 1100 ppb Au, 5.4 ppm Ag, and 160 ppm Mo. Excellent rock sampling results up to 5.91% Cu and 13 g/t Au at Grizzly were the focus of a small drill program in 2008, with 1442.9 m of diamond drilling.

The small program failed to identify the geometry of the porphyry intrusion and drilled exclusively along an east-west azimuth into pseudoleucite-bearing rocks. The NNE axis of mineralization in moderately S-dipping gully defined by rocks was not crossed by the 2008 drill holes. Anomalous intercepts from 2008 include 0.16 g/t Au and 0.10% Cu over 66.6 m (hole GRZ08-11).

Follow-up geophysical surveys identified a moderate chargeability and magnetic anomaly directly below the Grizzly trench showing. The strongest chargeability anomaly remains untested and lies downslope from the Grizzly showing in a region where monzonite to syenite porphyry is mapped on surface. Three large untested magnetic anomalies were identified at depth below the Grizzly showing, the most westerly coincides with a moderate shallow chargeability anomaly.

The Grizzly showing appears to be a high-level, Galore Creek-type setting with several untested geophysical anomalies and excellent trench results that have not been crossed by drilling. The first-ever 3D modelling was completed by Kingfisher during the due diligence process, and it highlighted porphyry mineralization outlined by historical trenching occurs as a ~150 m wide panel that dips moderately to the south on the shoulder of a large magnetic anomaly. The region represents an opportunity to test higher-level, structurally controlled porphyry emplacement bodies from surface as well as deeper, bulk tonnage porphyry targets.

Lucifer Porphyry and Epithermal Target Area

Lucifer is an early-stage 4 by 5 km region defined by a Cu-Au-Ag-Mo soil geochemical anomaly grading up to 3383 ppb Au, 787 ppm Cu, 5.6 ppm Ag, and 216 ppm Mo; the strongest ASTER anomaly across the Grizzly-Voigtberg-Lucifer Trend; and a 2.5 km by 1 km area of silica-sericite-carbonate-pyrite alteration outlined by Noranda in 1991. The region is also defined by a large gossan continuous with the Grizzly and Voigtberg targets and is prospective for both porphyry and epithermal mineralization.

Widely spaced drilling at Lucifer amounts to 1,821.96 m. Airborne geophysical surveys were completed at Lucifer including magnetic susceptibility and VTEM.

The source of Cu-Au mineralization at Lucifer is not yet drill delineated and several gossans on surface to the east are unsampled.

Potential Continuation of Hank-Williams Trend

The northern LGM project lies to the southwest from the Hank-Williams Trend on the HWY 37 Project. Within this area are Texas Creek Suite intrusions mapped by the BC Geological Survey. Much of the prospective region lies in areas of extensive glaciation that have undergone significant recession since the last work was completed in the area by Skeena Resources in 1990.

Historical rock sampling of intrusive boulders at the toe of one glacier returned grades up to 0.90% Cu, 0.27 g/t Au, and 6.8 g/t Ag. That glacier has since receded by ~1,500 m and not been subsequently explored. Sampling of lateral moraines in the area returned up to 4.5 g/t Au and 74.6 g/t Ag from breccias.

Terms of the Agreement

Under the terms of the Agreement, the Company will issue 3,000,000 common shares in the capital of Kingfisher, to Origen and pay C$75,000 in cash to Origen in exchange for the transfer of the LGM Project claims on closing. In addition, the LGM Property is subject to underlying royalty agreements over different parts of the project that range from 1 to 2% with Triple Flag Precious Metals (1%), Ryan Kalt (2%), and Carl von Einsiedel (2%).

The transaction remains subject to various terms and conditions, including, but not limited to, the approval of the TSX-V and CSE.

Dustin Perry, P.Geo., Kingfisher’s CEO, is the Company’s Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has prepared the technical information presented in this release.

Options Issuance

Kingfisher also announces the grant of 1,700,000 stock options that are exercisable for a period of five years at a price of C$0.25 per share to its directors, officers, various staff members, and an investor relations consultant (Adelaide Capital Markets Inc.).

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on underexplored district-scale projects in British Columbia, including the Golden Triangle region. Kingfisher has two 100% owned district-scale projects and an option to earn 100% of the HWY 37 Project, that offer potential exposure to gold, copper, silver, and zinc. The Company currently has 40,219,553 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 236 358 0054

E-Mail: info@kingfishermetals.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property. This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the transaction, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.