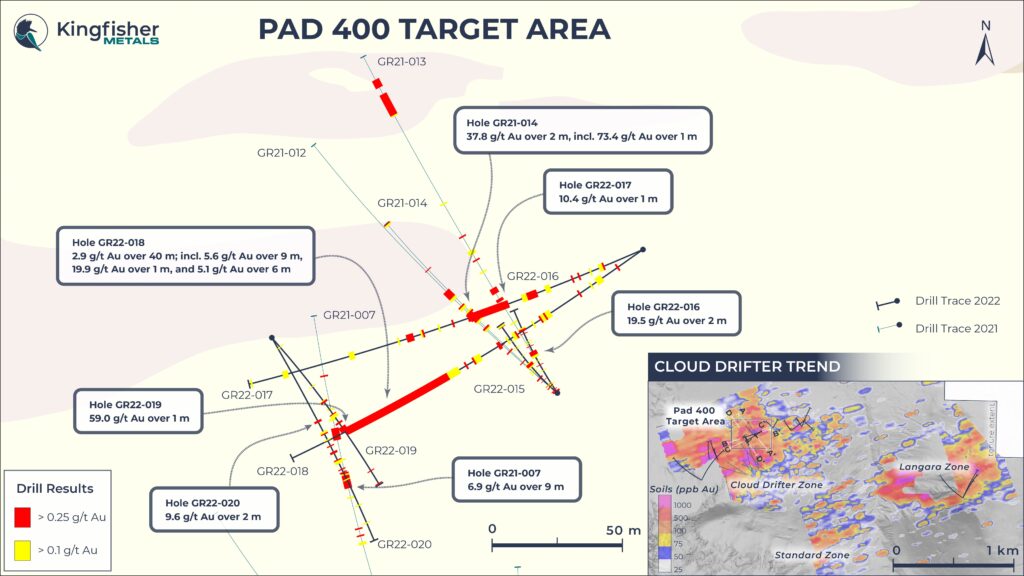

VANCOUVER, British Columbia, November 9, 2022 – Kingfisher Metals Corp. (TSX-V: KFR) (FSE: 970) (OTCQB: KGFMF) (“Kingfisher” or the “Company”) is pleased to announce the results of rotary air blast (“RAB”) drilling, and surface geochemical and ground geophysical surveys at the 100% owned 511 km2 Goldrange Project. Goldrange is located approximately 25 km south of the town of Tatla Lake in the Chilcotin region of Southwest British Columbia.

Highlights

- The Day Trip Zone is 5 km from the Cloud Drifter Zone and these results represent the first modern exploration efforts at this zone.

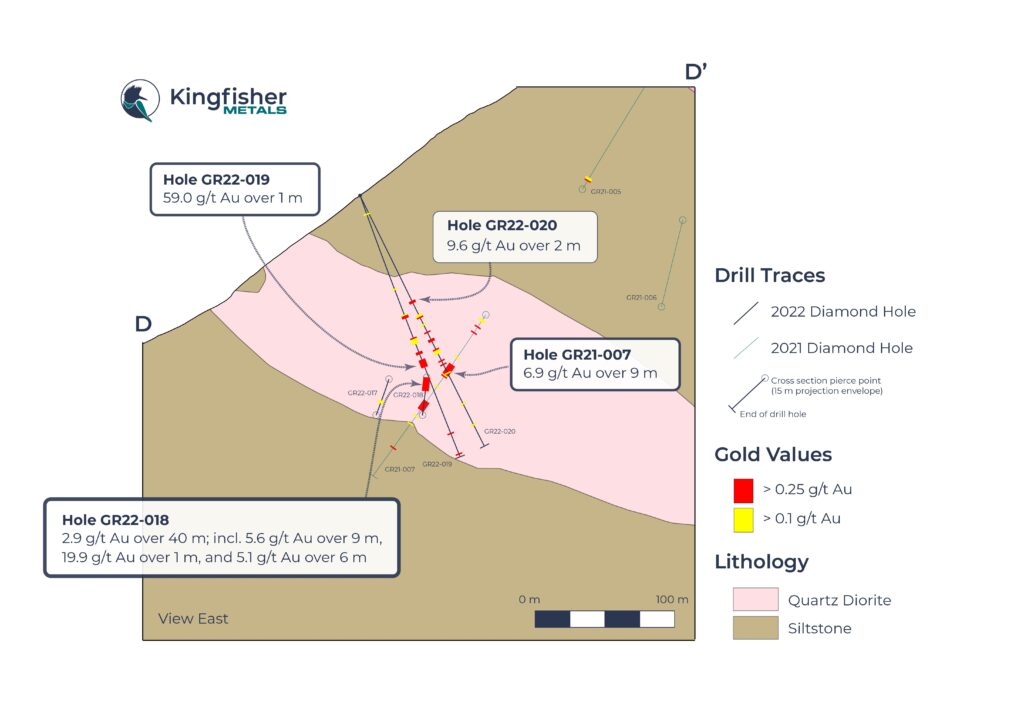

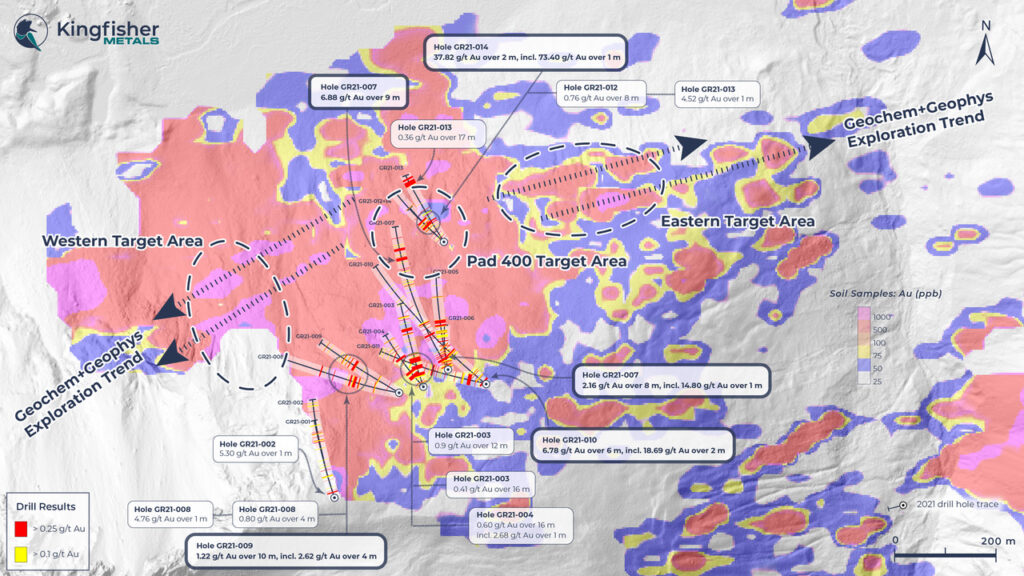

- Gold anomalism is analogous to horizontal gold trends in 2021 drill results from the upper Cloud Drifter Zone, which lie spatially above high-grade feeders identified in 2022 (NR link).

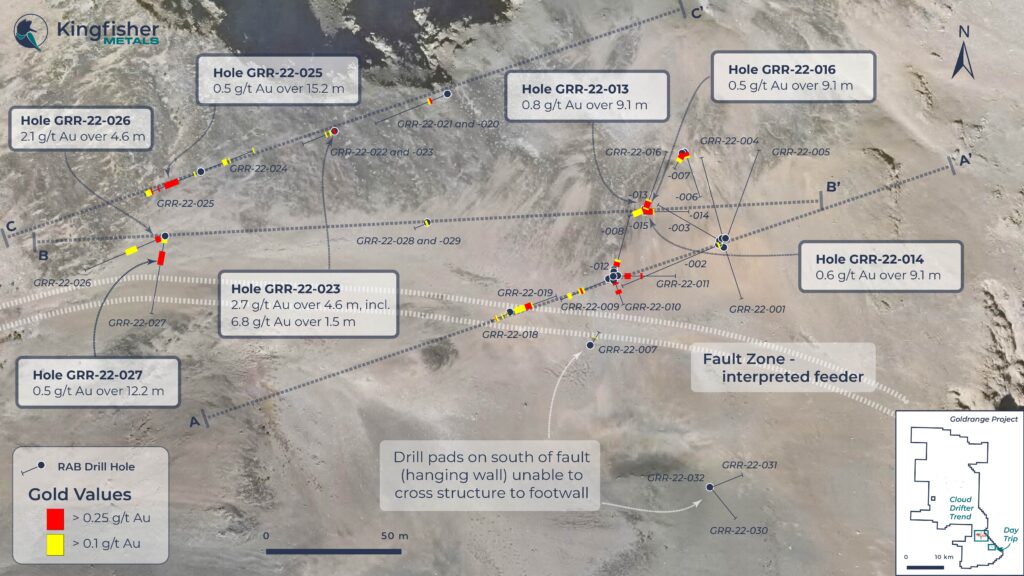

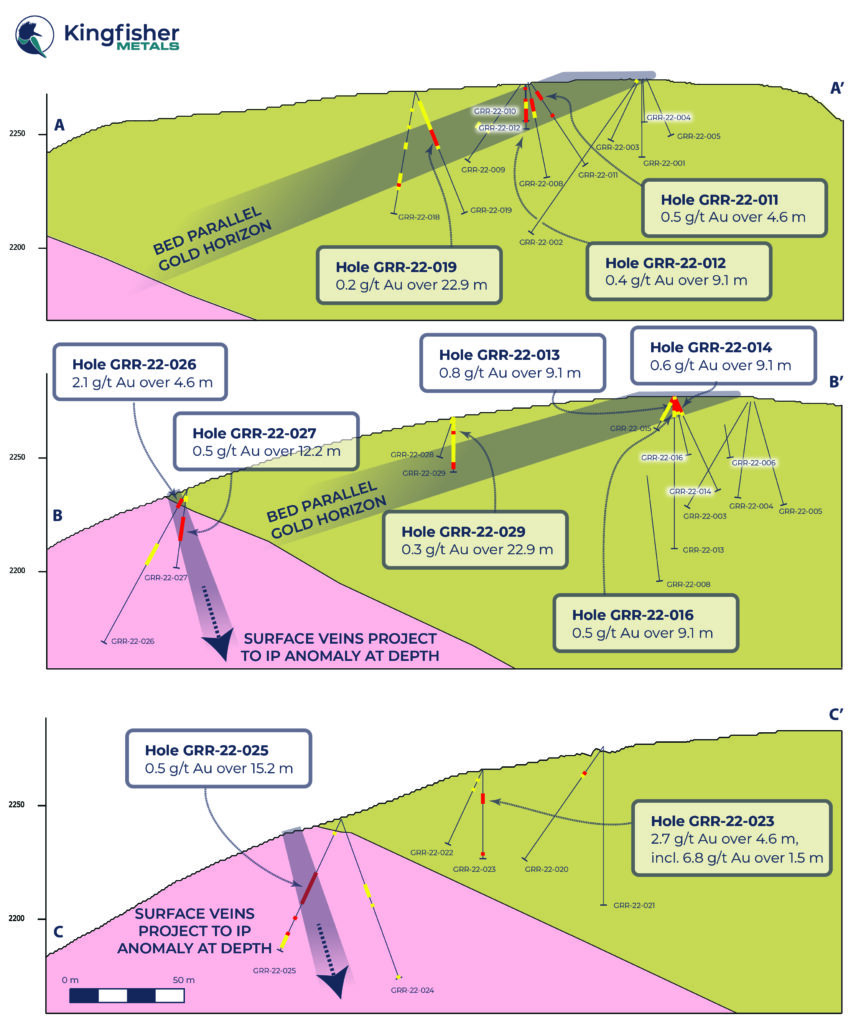

- Highlight intercepts include 2.7 g/t Au over 4.6 m in GRR-22-023, 0.5 g/t Au over 12.2 m in GRR-22-27, 2.1 g/t Au over 4.6 m in GRR-22-026, and 0.8 g/t Au over 9.1 m in GRR-22-013.

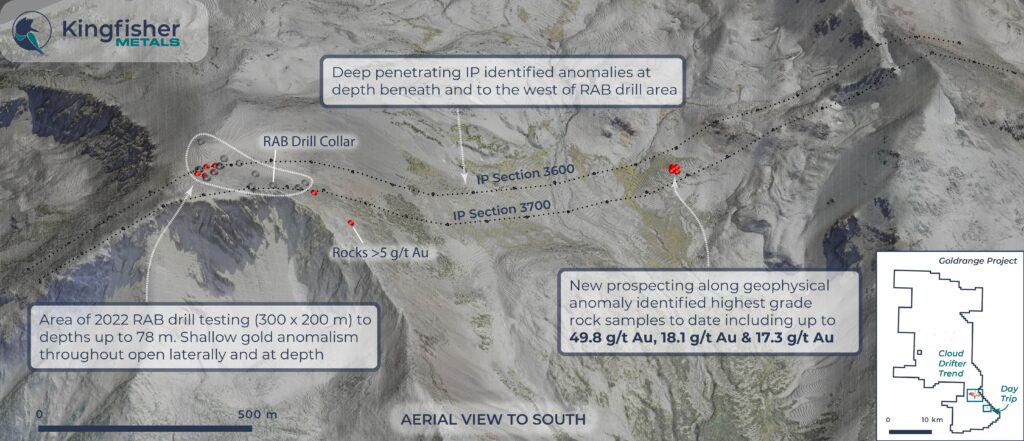

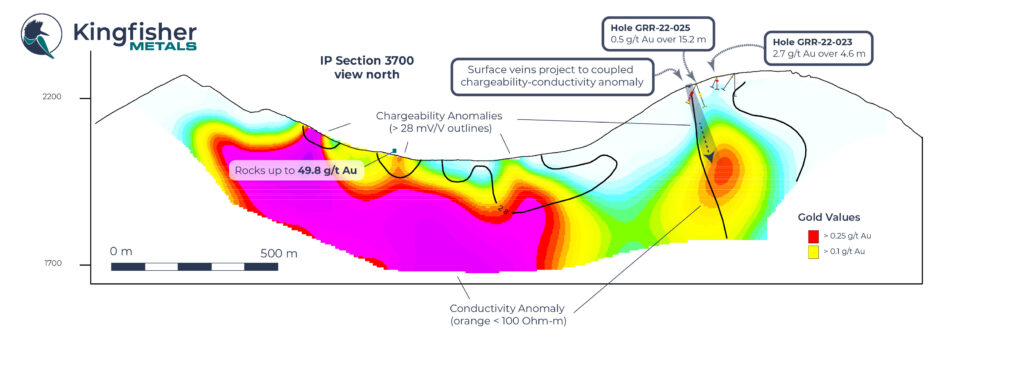

- Shallow gold intercepts are open laterally and at depth, with an overall dip in geometry toward the west where 2022 rock sampling returned grades up to 49.8 g/t Au and extended the geochemical footprint 1 km to the west.

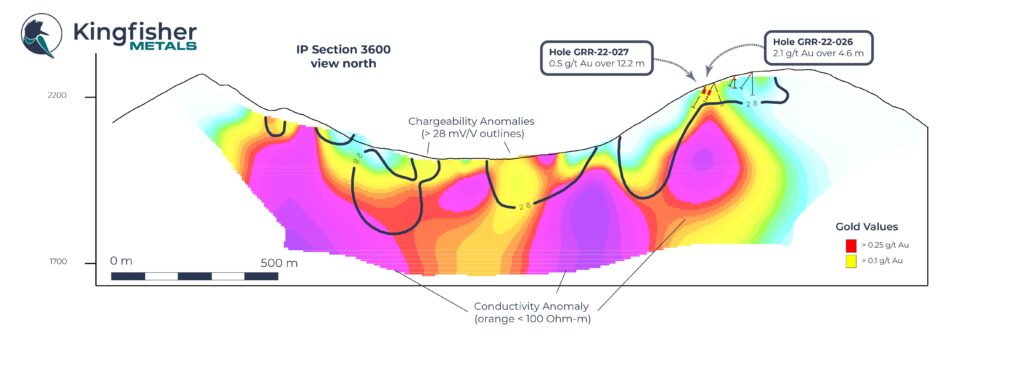

- Induced Polarization (IP) geophysical survey identified several strong chargeability and conductivity anomalies over 2 km; two sizeable diamond drill targets were identified from coincident chargeability-conductivity anomalies at depths below RAB drill capabilities.

Dustin Perry, CEO states “Initial shallow RAB drilling at Day Trip shows a broad zone of open-ended gold anomalism over 1 km associated with strong chargeability and conductivity anomalies that stretch nearly 2 km. Early indications point to there potentially being a significant gold system that will need subsequent drilling to the west and at depth.” Day Trip Zone Overview

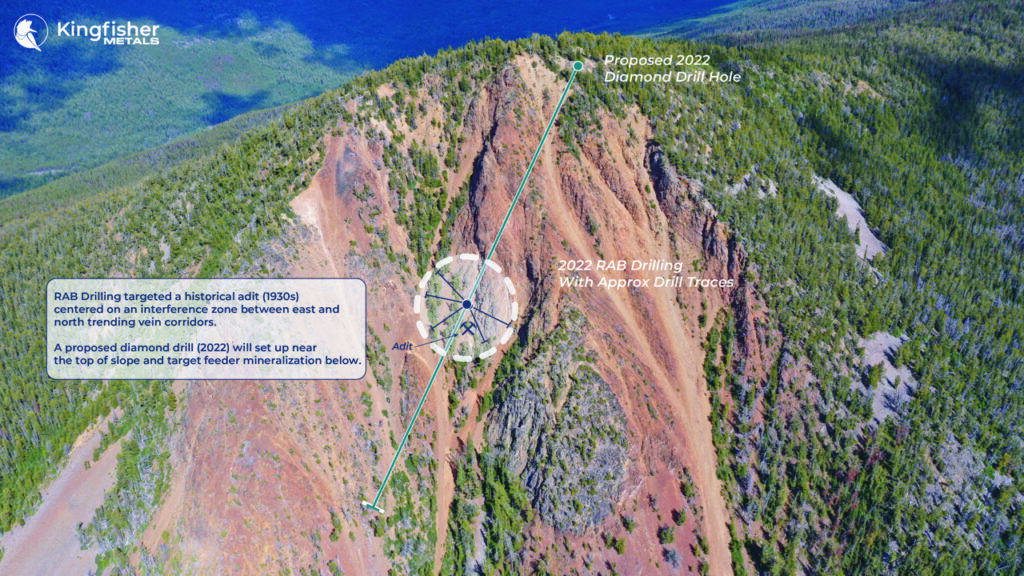

Kingfisher commenced the first-ever drill program at the Day Trip Zone with a RAB drill rig in May 2022. The initial 27 holes (Table 1) focused on a ~300 m by 200 m area at shallow depths of less than 78 m.

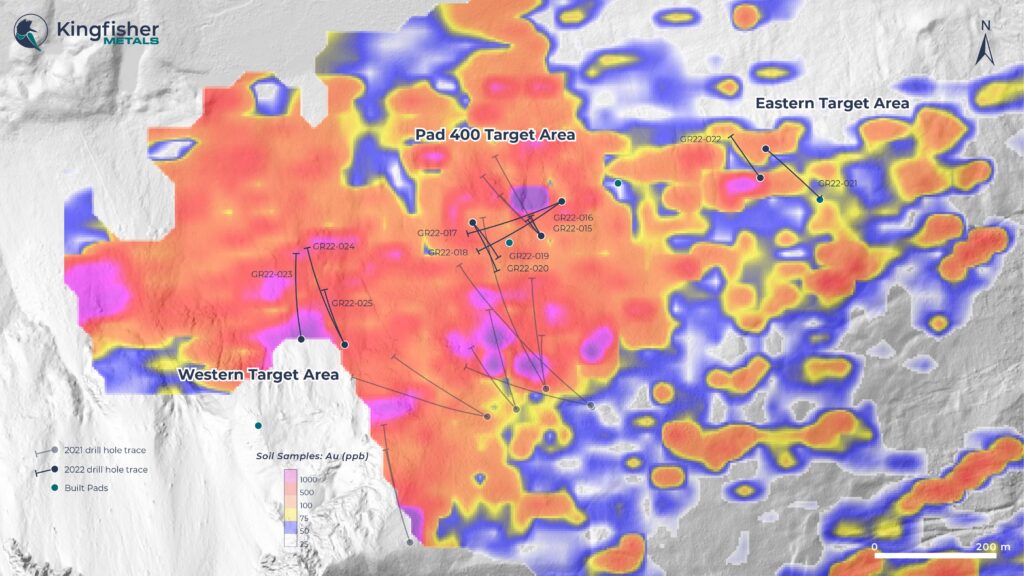

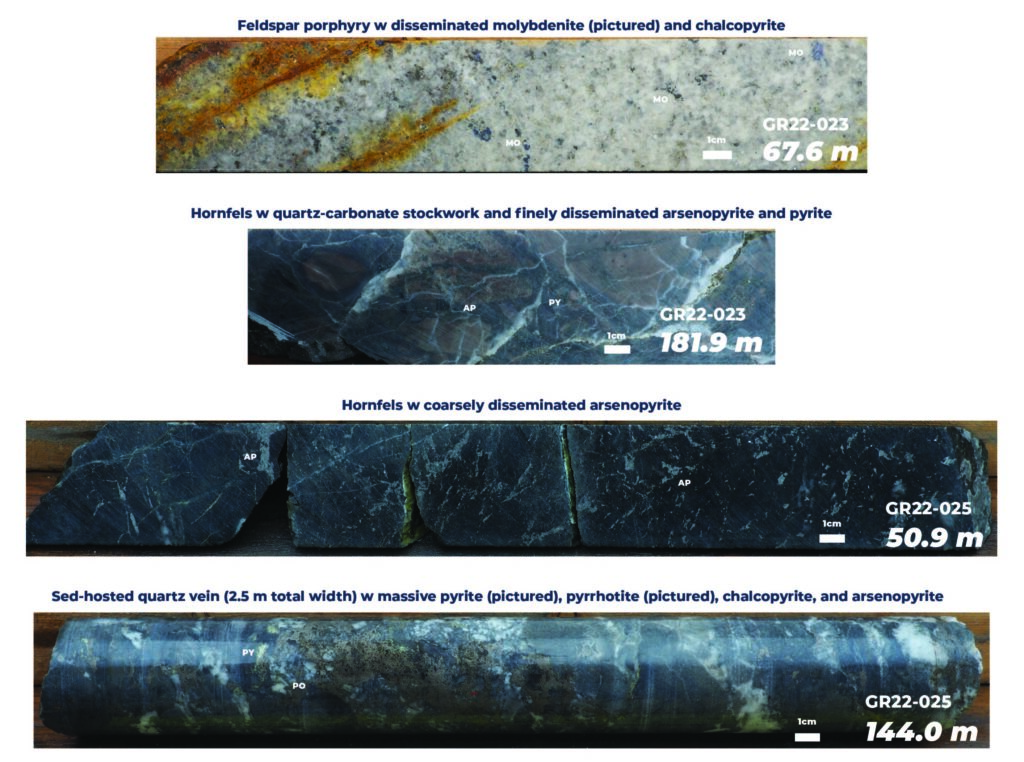

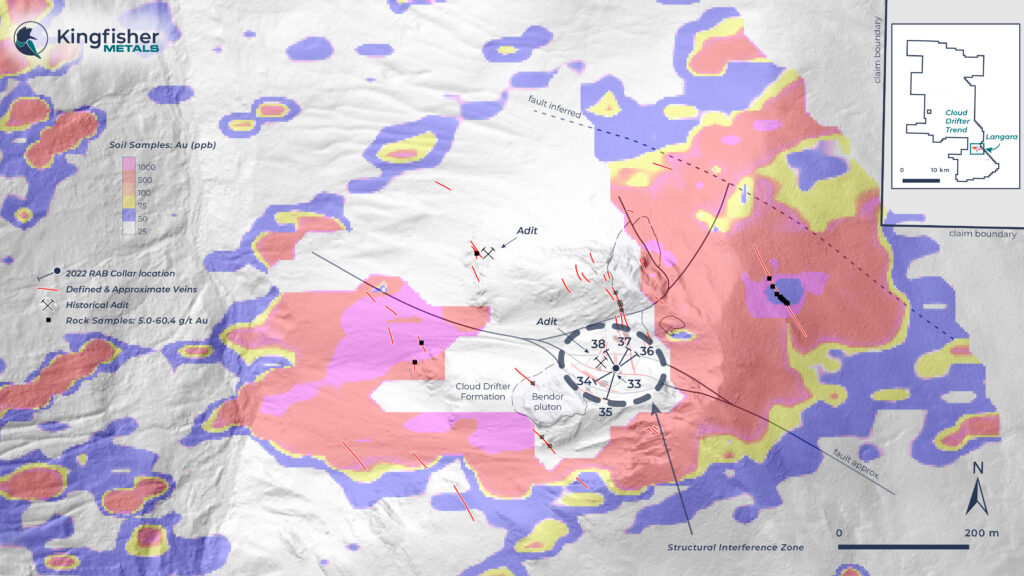

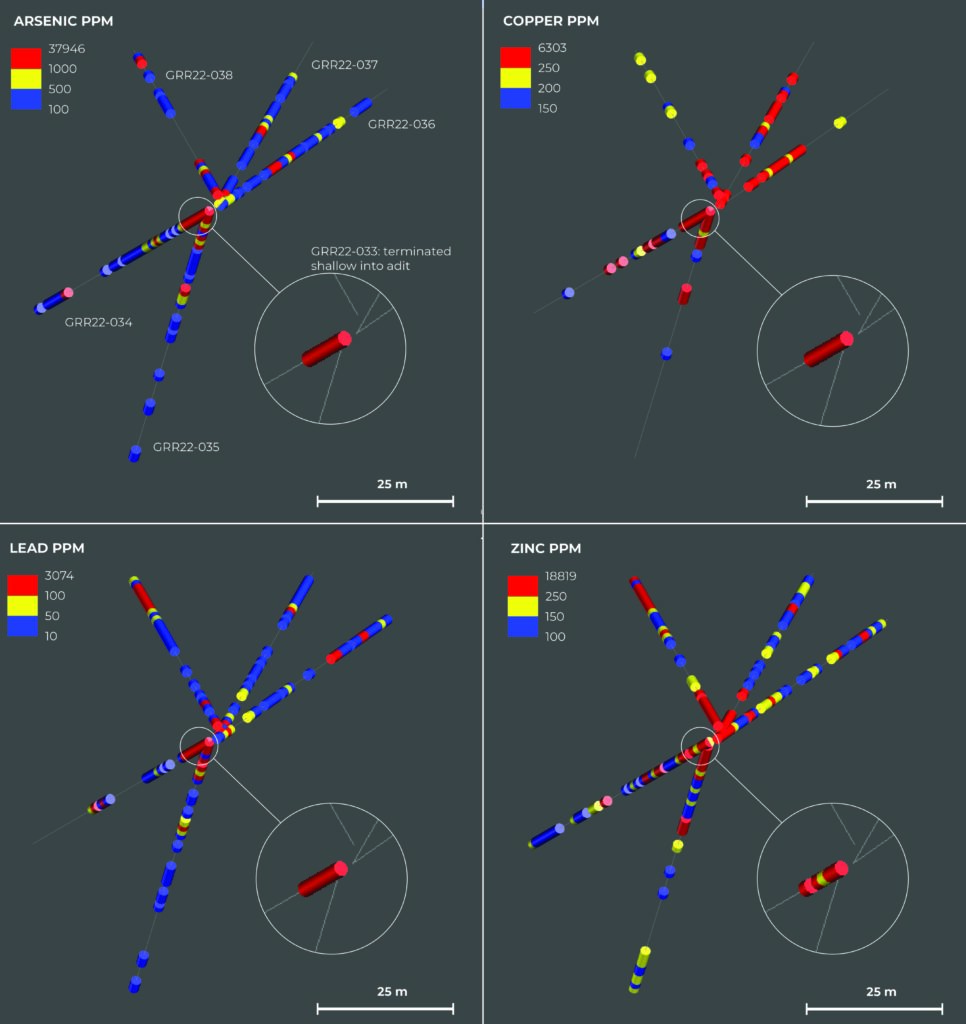

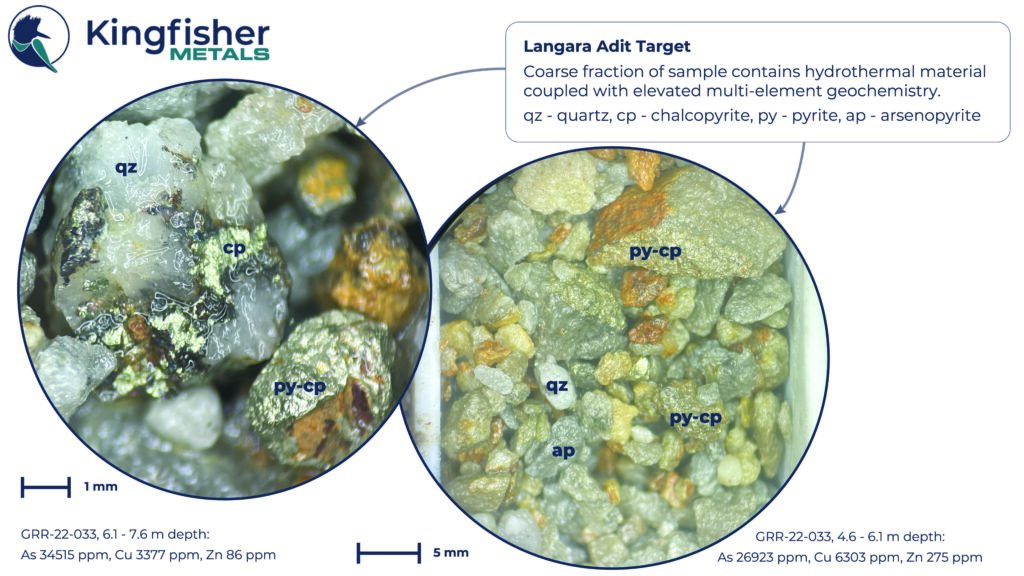

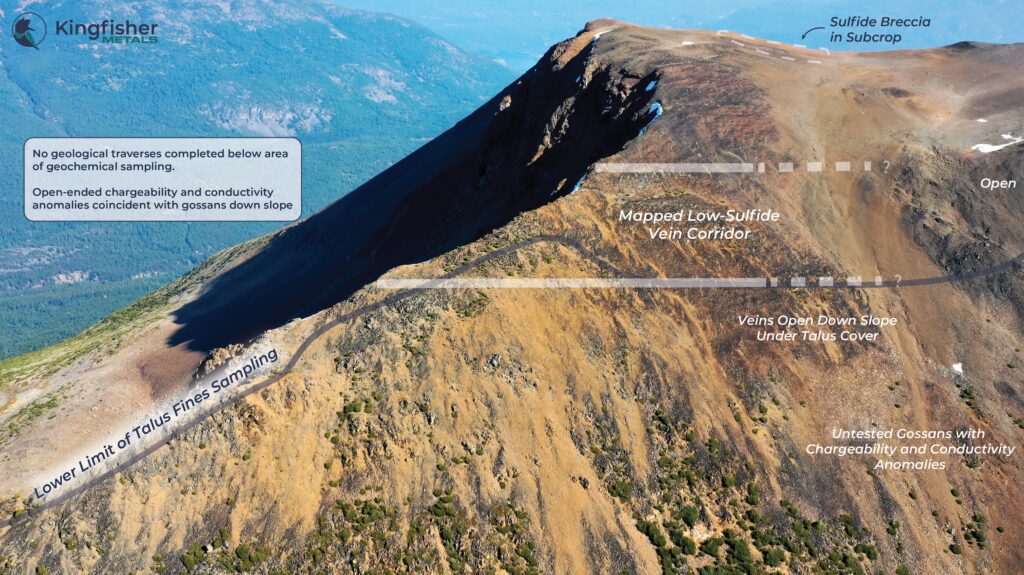

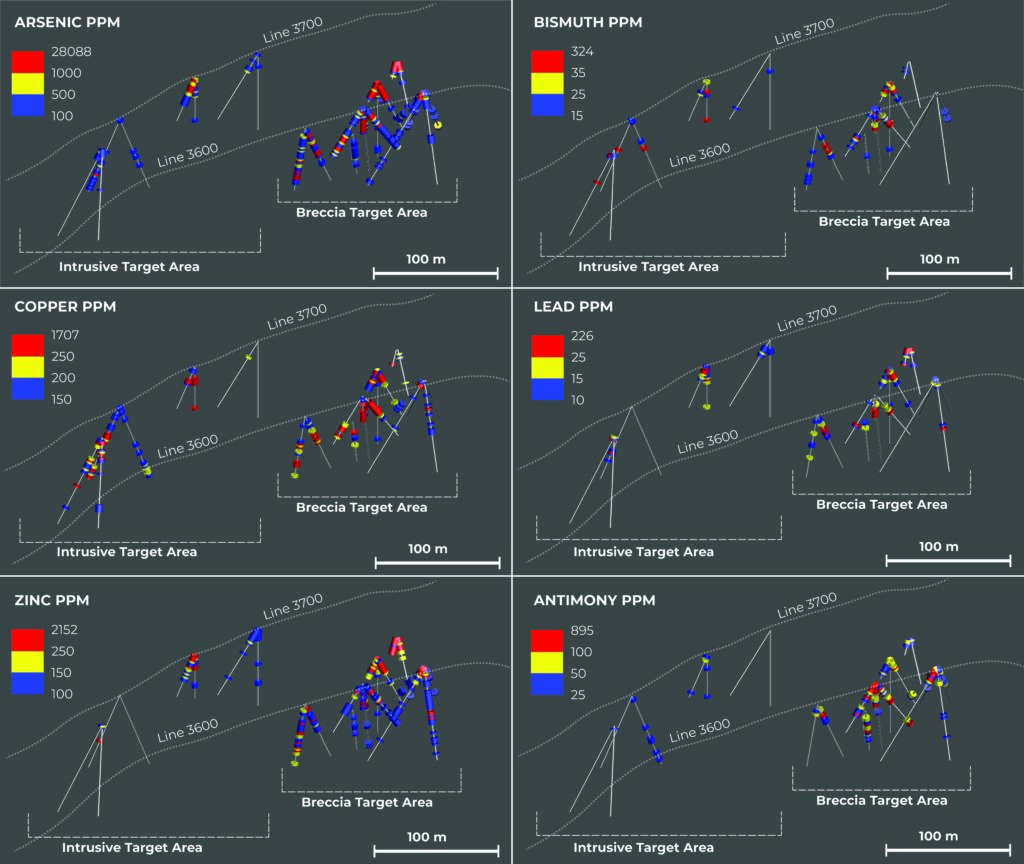

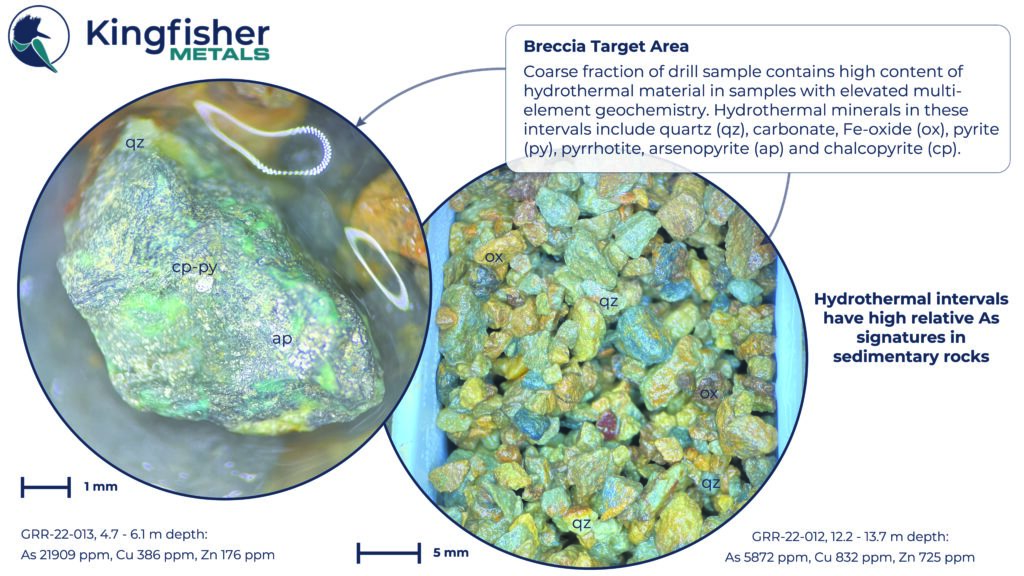

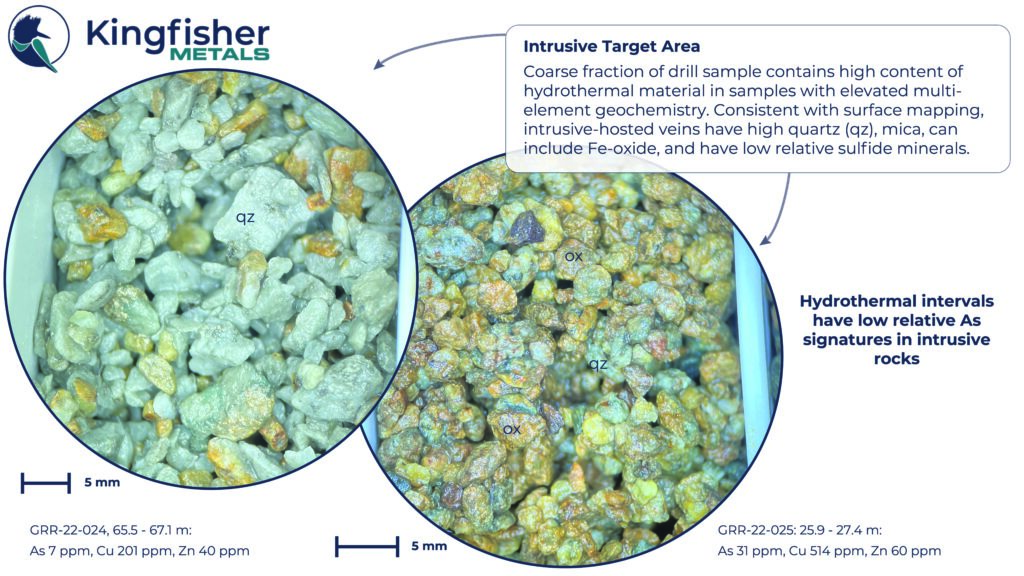

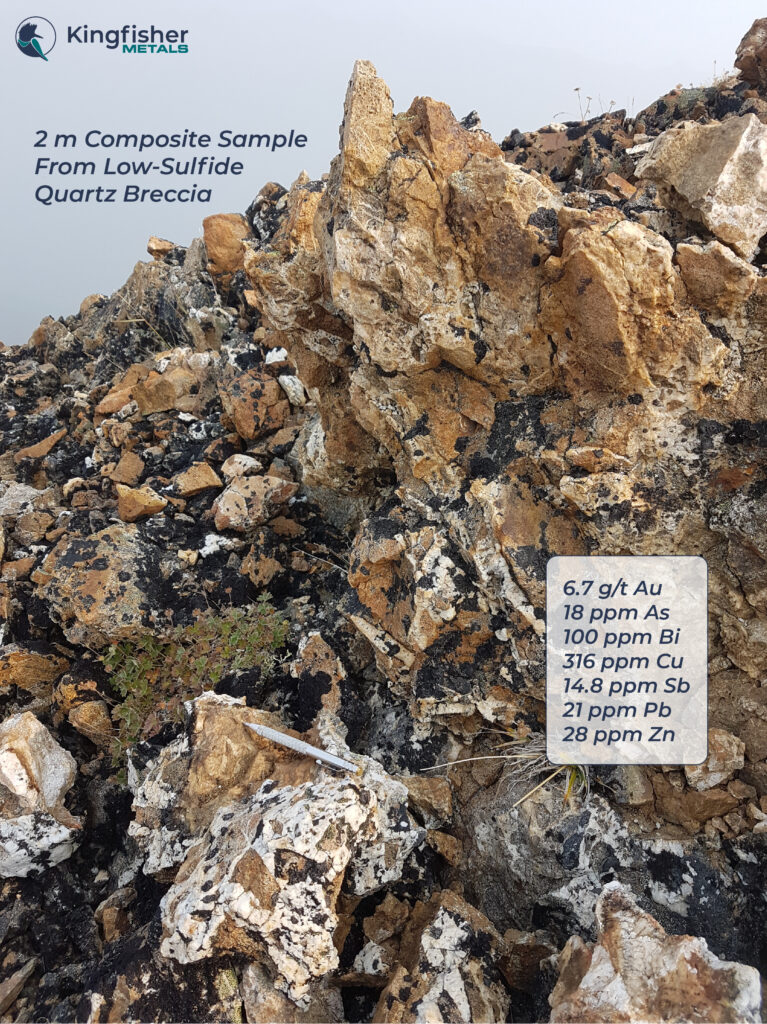

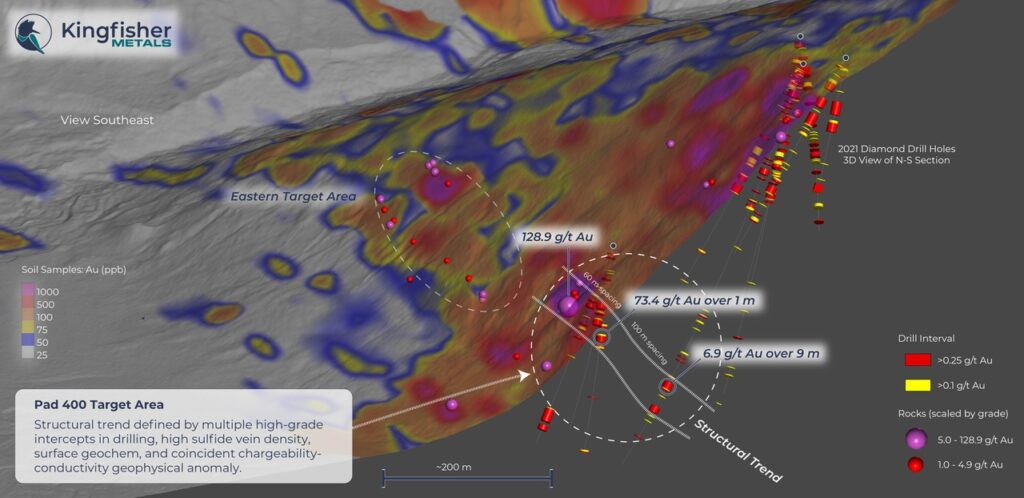

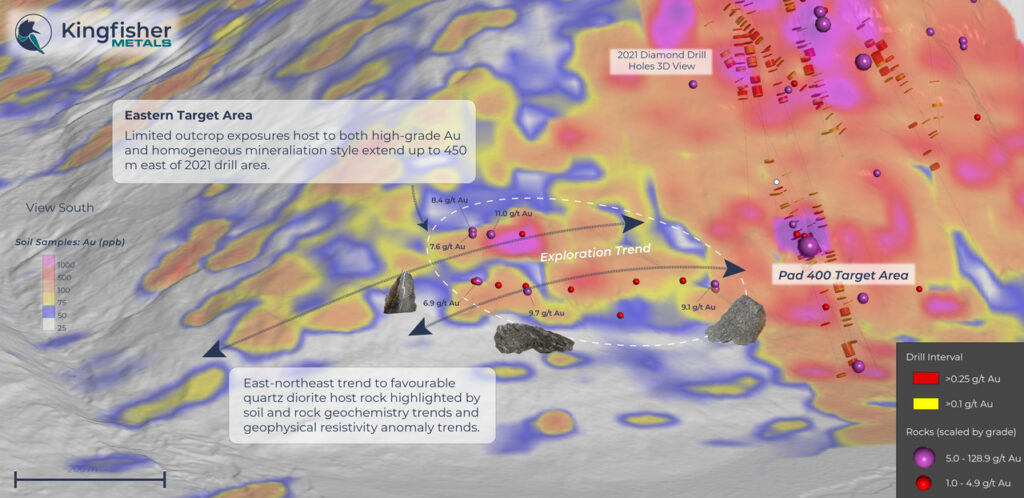

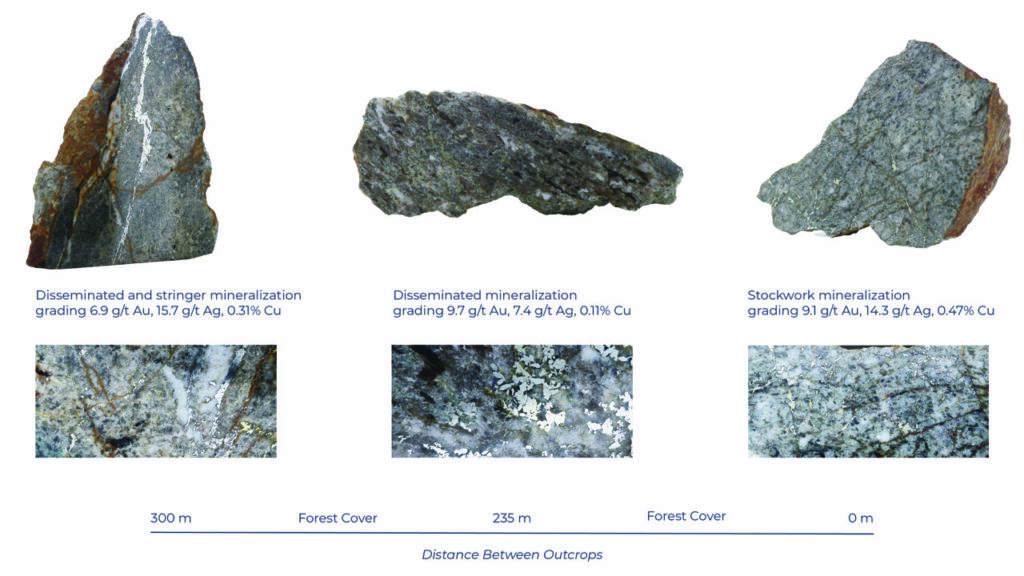

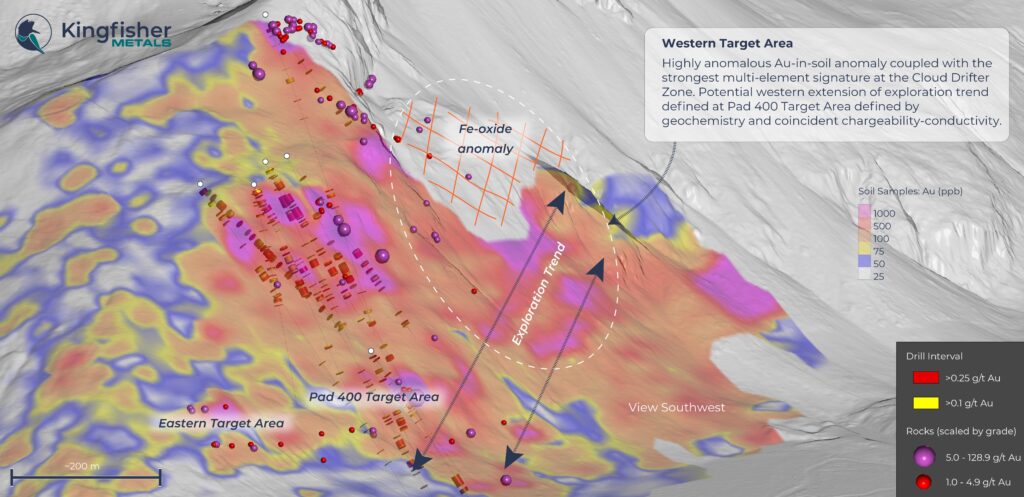

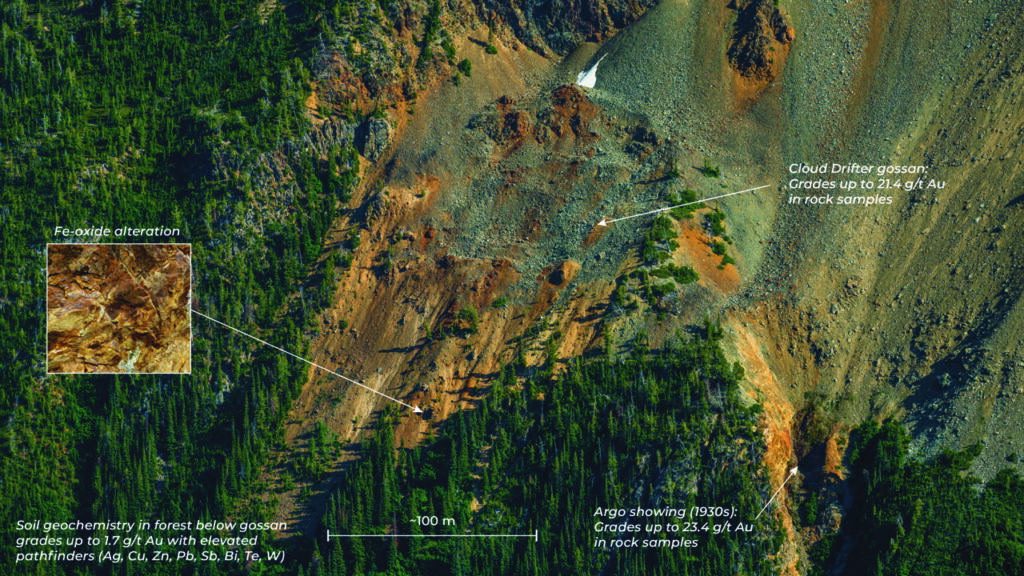

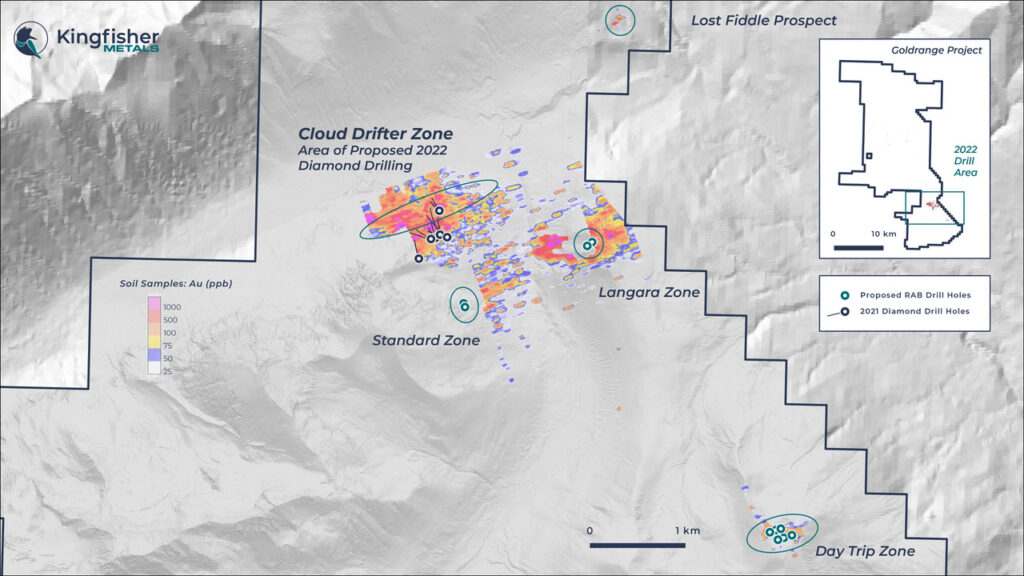

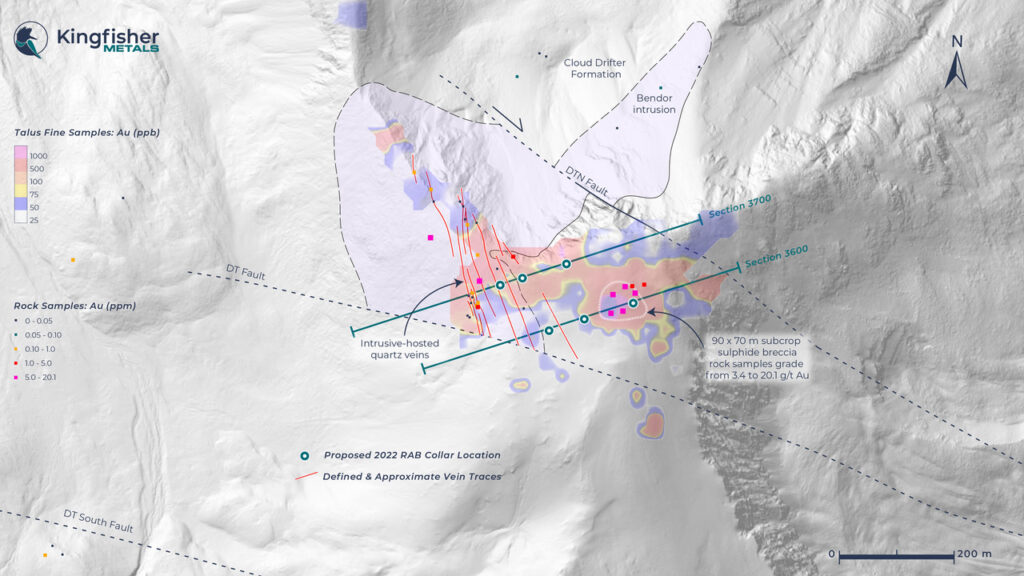

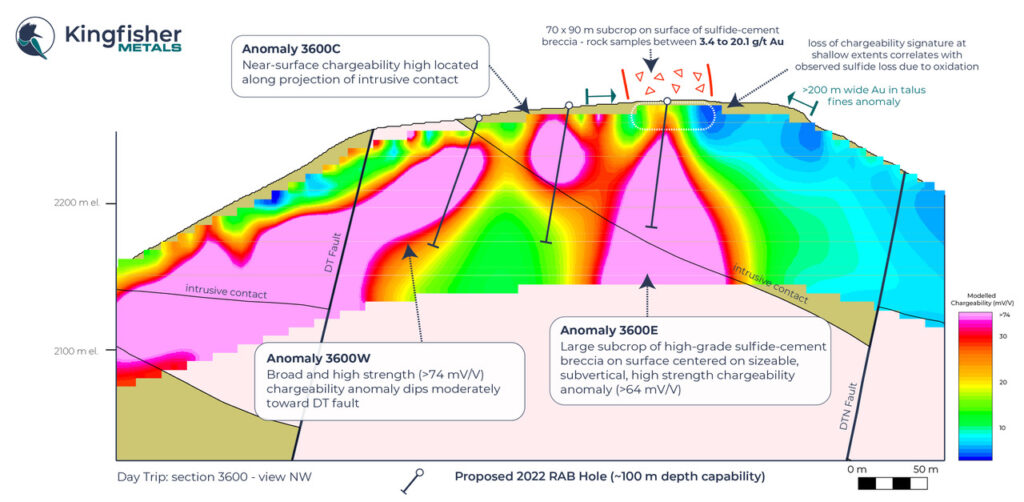

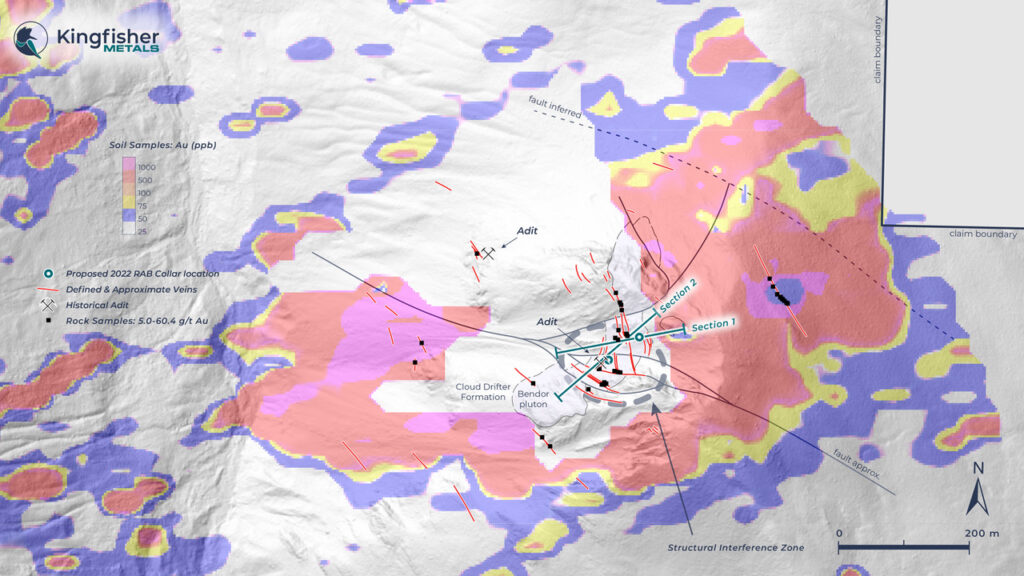

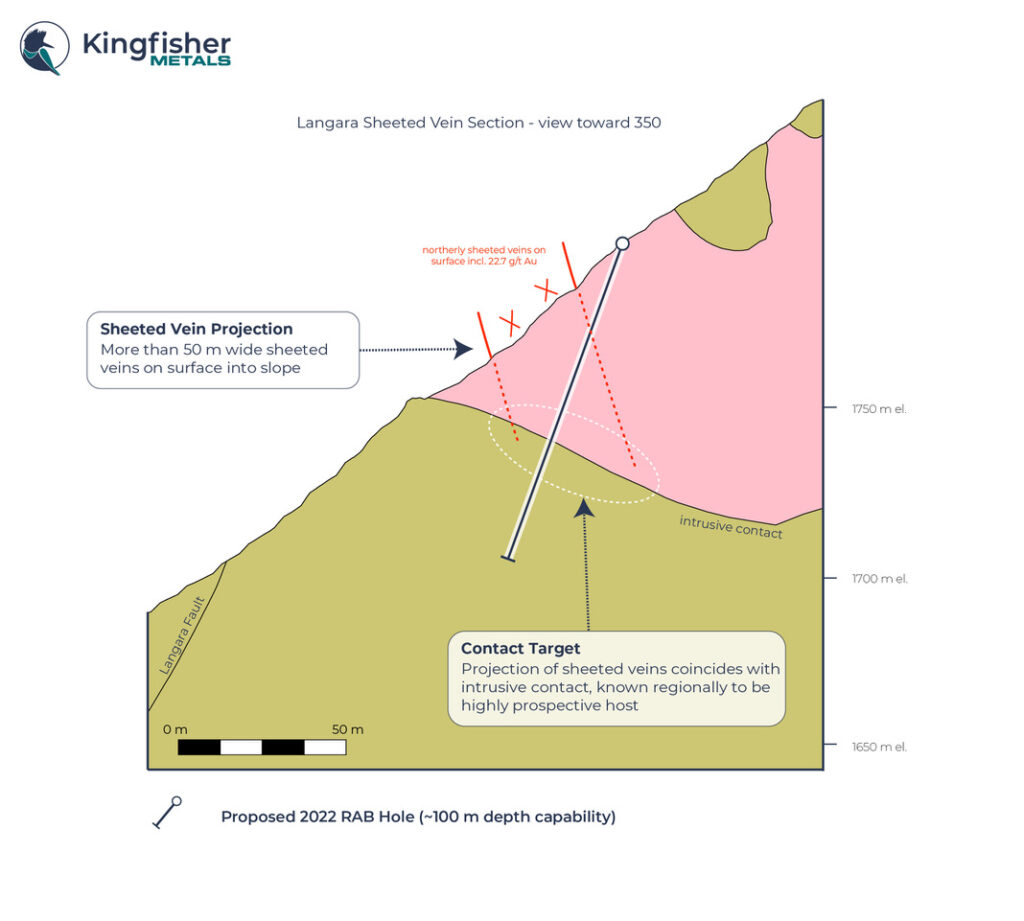

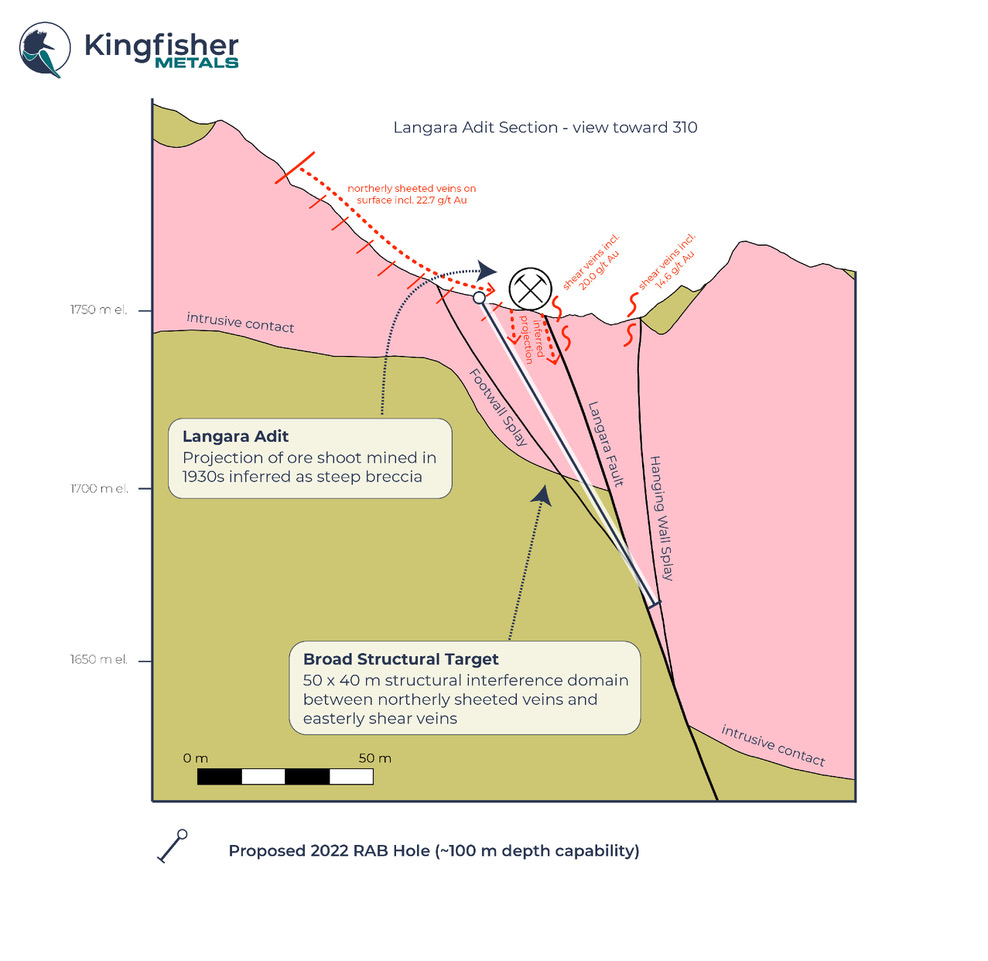

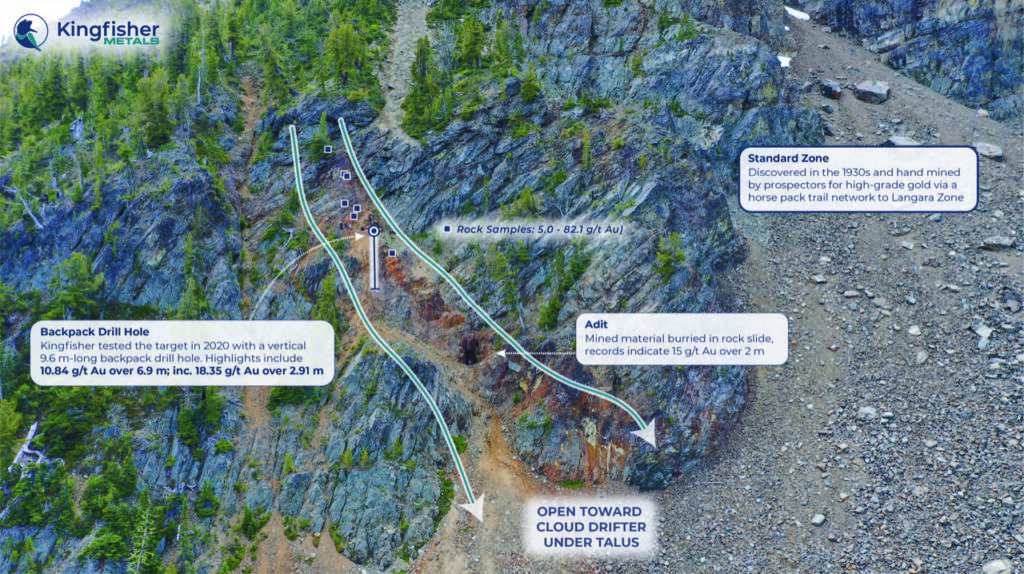

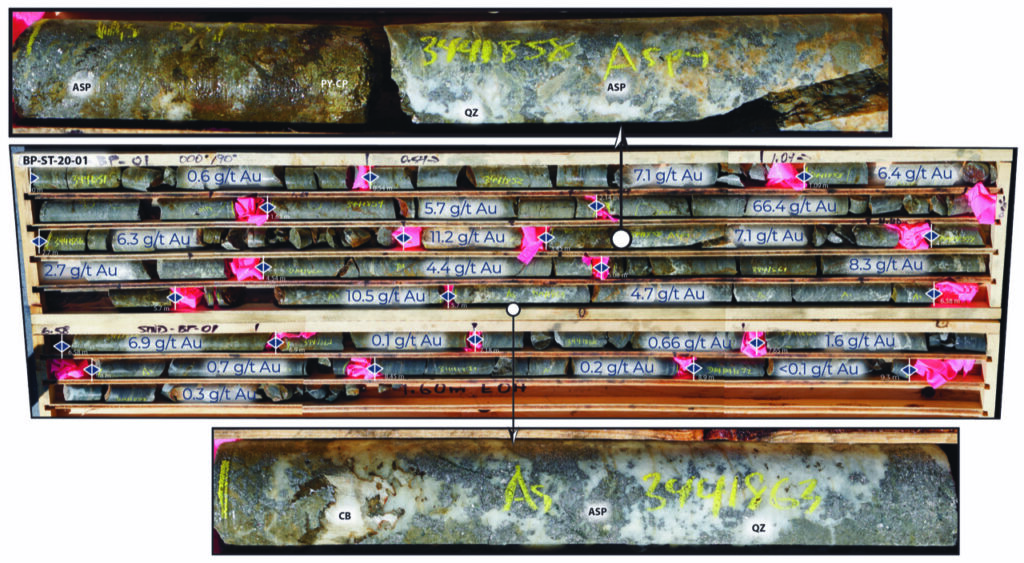

The Day Trip Zone covers a rounded mountain top approximately 5 km southeast of the Cloud Drifter Trend (Figures 1 and 2). The target is situated between two interpreted fault splays off the regional Ottarasko Fault. High-density intrusive-hosted veins, up to 2 m in width, occur over an area ~100 m by 400 m. Quartz veins from this area returned grades from below detection limit to 6.7 g/t Au over 2 m. Adjacent to the intrusion is a ~70 m x 90 m area of arsenopyrite-cement breccia in subcrop (Figure 1). Approximately 20% of the subcrop material in this area consists of arsenopyrite-cement breccia and rocks grade from 3.4 to 20.1 g/t Au. Talus fines sampling in 2020 and 2021 outlined a broad area of gold anomalism coincident with areas of gold in outcrop and subcrop that grades up to 8.4 g/t Au. Rock and talus fines geochemistry both yield a strong multi-element signature of As, Ag, Cu, Bi, Te, Sb, Zn and Pb associated with Au.

RAB Drill Results

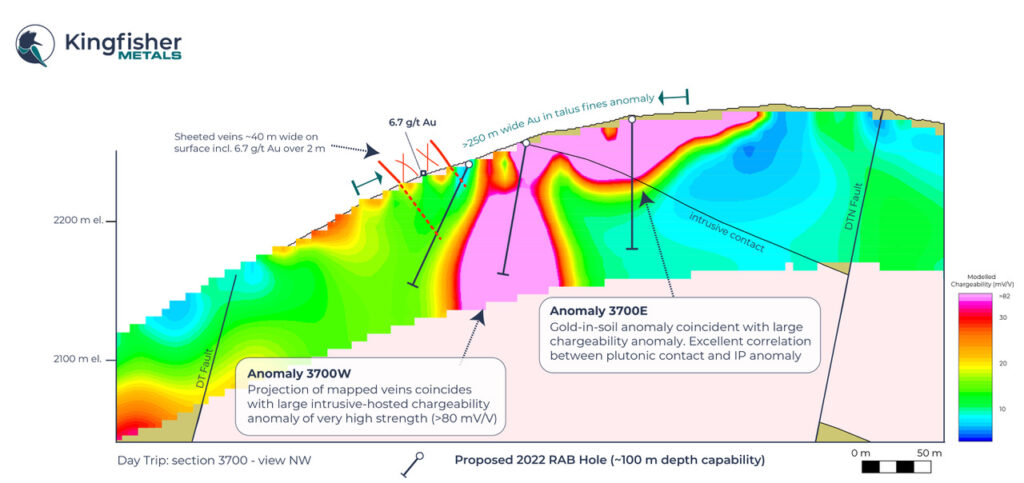

The purpose of the Day Trip RAB drill program was to identify location and geometry of anomalous gold sampled on surface. The RAB holes tested shallow extents of the target over a 250×200 m area. Broad anomalous gold is shallow or at surface and was intercepted in all but the most southerly pad, which failed to reach target depth. Gold anomalism in the sedimentary-hosted, western holes defines a 20 degree west-dipping layer that parallels bedding. Gold intercepts in the intrusive-hosted western holes are interpreted to dip steeply east, similar to the veins on surface. The overall vein geometry from surface coupled with the gold intercepts, projects toward a large conductive and chargeability anomaly (Figure 5).

The feeder to the sulfide breccia rubble identified on surface and the subhorizontal gold pattern near surface is interpreted to be rooted in an easterly fault zone to the south of the RAB drill area. One pad attempted to drill through this structure into the interpreted feeder (GRR-22-30, -31, 32), but was unable to cross the structure due to difficult conditions.

| Hole* | From (m) | To (m) | Interval (m) | Au (g/t) |

| GRR-22-011 | 4.57 | 9.14 | 4.57 | 0.52 |

| GRR-22-012 | 7.62 | 16.76 | 9.14 | 0.43 |

| GRR-22-013 | 0.00 | 9.14 | 9.14 | 0.79 |

| GRR-22-014 | 0.00 | 9.14 | 9.14 | 0.56 |

| GRR-22-016 | 0.00 | 9.14 | 9.14 | 0.54 |

| GRR-22-019 | 4.57 | 27.43 | 22.86 | 0.22 |

| GRR-22-023 | 10.67 | 15.24 | 4.57 | 2.70 |

| Incl. | 10.67 | 12.19 | 1.52 | 6.81 |

| GRR-22-025 | 25.91 | 41.15 | 15.24 | 0.50 |

| GRR-22-026 | 4.57 | 9.14 | 4.57 | 2.06 |

| GRR-22-027 | 13.72 | 25.91 | 12.19 | 0.48 |

| GRR-22-029 | 0.00 | 22.86 | 22.86 | 0.27 |

*True widths are not known at this time. All widths reported are drilled widths. Drill holes not listed between GRR-22-001 to GR-22-032 report no significant intercepts

Table 1. RAB Drill Hole Results

| Hole | Easting (m) | Northing (m) | Elevation (m) | Depth (m) | Azimuth | Dip |

| GRR-22-001 | 392313 | 5702390 | 2274 | 70.10 | 162 | 70 |

| GRR-22-002 | 392311 | 5702391 | 2274 | 82.30 | 247 | 55 |

| GRR-22-003 | 392311 | 5702393 | 2275 | 56.39 | 300 | 55 |

| GRR-22-004 | 392313 | 5702394 | 2275 | 65.53 | 345 | 55 |

| GRR-22-005 | 392314 | 5702394 | 2275 | 71.63 | 20 | 55 |

| GRR-22-006 | 392296 | 5702432 | 2280 | 36.58 | 162 | 55 |

| GRR-22-007 | 392295 | 5702432 | 2280 | 13.72 | 210 | 55 |

| GRR-22-008 | 392264 | 5702379 | 2273 | 82.30 | 15 | 70 |

| GRR-22-009 | 392262 | 5702376 | 2272 | 41.15 | 247 | 55 |

| GRR-22-010 | 392264 | 5702375 | 2272 | 19.81 | 160 | 55 |

| GRR-22-011 | 392266 | 5702377 | 2273 | 44.20 | 90 | 55 |

| GRR-22-012 | 392264 | 5702377 | 2272 | 19.81 | 0 | 90 |

| GRR-22-013 | 392278 | 5702407 | 2279 | 67.06 | 0 | 90 |

| GRR-22-014 | 392278 | 5702406 | 2278 | 45.72 | 90 | 65 |

| GRR-22-015 | 392278 | 5702407 | 2278 | 16.76 | 247 | 60 |

| GRR-22-016 | 392278 | 5702407 | 2279 | 54.86 | 20 | 60 |

| GRR-22-017 | 392254 | 5702346 | 2271 | 41.15 | 30 | 80 |

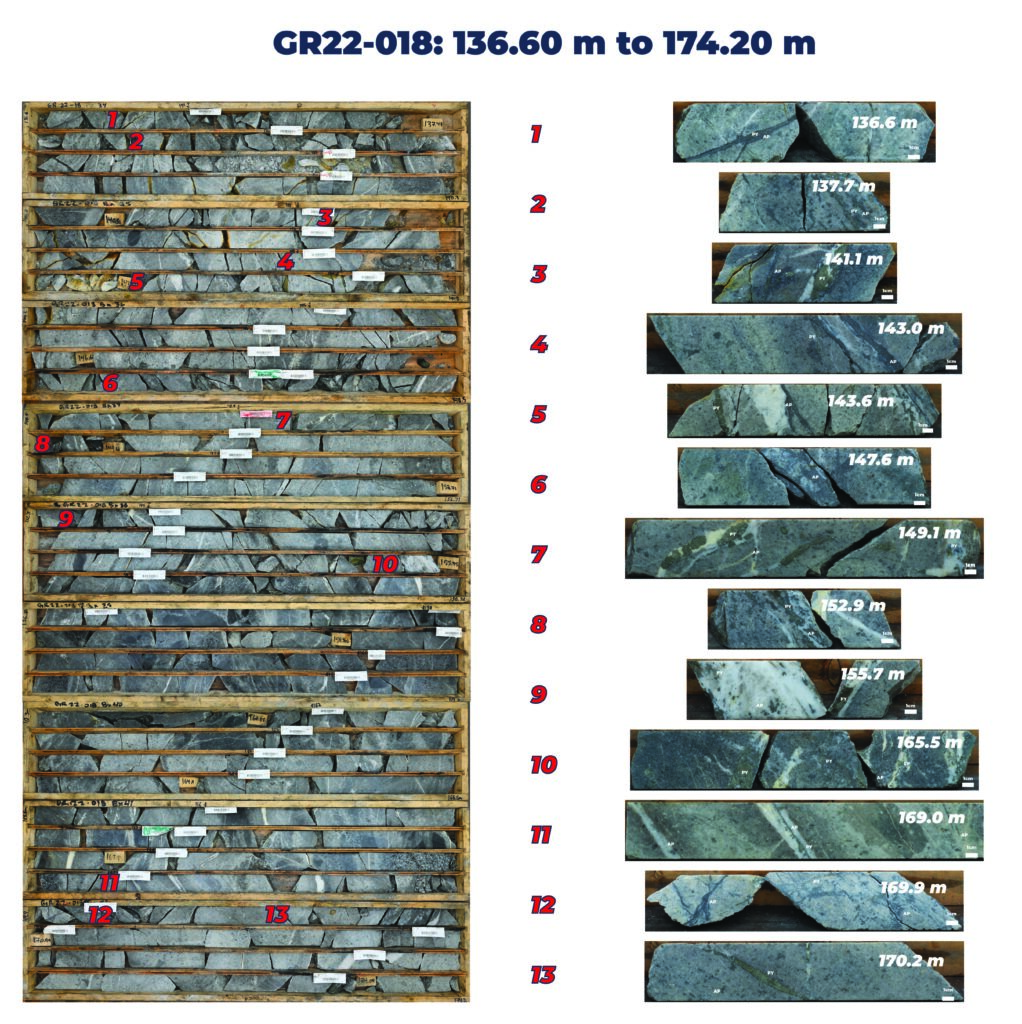

| GRR-22-018 | 392218 | 5702361 | 2271 | 54.86 | 247 | 80 |

| GRR-22-019 | 392218 | 5702361 | 2271 | 57.91 | 69 | 70 |

| GRR-22-020 | 392190 | 5702458 | 2276 | 60.96 | 248 | 55 |

| GRR-22-021 | 392190 | 5702458 | 2276 | 51.82 | 248 | 70 |

| GRR-22-022 | 392140 | 5702442 | 2266 | 36.58 | 248 | 65 |

| GRR-22-023 | 392140 | 5702442 | 2266 | 39.62 | 248 | 90 |

| GRR-22-024 | 392080 | 5702424 | 2246 | 74.68 | 68 | 70 |

| GRR-22-025 | 392080 | 5702424 | 2244 | 64.01 | 248 | 65 |

| GRR-22-026 | 392064 | 5702395 | 2236 | 77.72 | 247 | 60 |

| GRR-22-027 | 392064 | 5702395 | 2236 | 70.10 | 190 | 60 |

| GRR-22-028 | 392181 | 5702401 | 2266 | 18.92 | 247 | 70 |

| GRR-22-029 | 392181 | 5702401 | 2266 | 22.80 | 0 | 90 |

| GRR-22-030 | 392307 | 5702283 | 2272 | 28.96 | 68 | 58 |

| GRR-22-031 | 392307 | 5702283 | 2272 | 36.58 | 141 | 60 |

| GRR-22-032 | 392307 | 5702283 | 2272 | 30.48 | 148 | 90 |

Table 2. RAB Drill Hole Locations (NAD83, Zone 10).

Induced Polarization (IP) Geophysical Survey Results

A deep penetrating Induced Polarization (IP) survey was conducted to prepare for deeper diamond drilling targeting. The survey was extended more than 1100 m west of the original survey and target area due to the discovery of high-grade gold in outcrop ~1 km from the RAB drill area. The geophysical survey identified two large conductive anomalies beneath the RAB drill area and to the west. Conductivity can be associated with sulfide breccias and veins and related alteration. Numerous chargeability anomalies were also identified throughout the survey area. Chargeability highs can be caused by the presence of disseminated sulfides.

The highest quality geophysical targets are where both chargeability and conductivity are anomalous. The area of RAB drilling confirmed the coincidence between hydrothermal alteration, elevated sulfide abundance and anomalous gold with chargeable rocks. Two anomalies are yet to be tested where chargeability and conductivity are both anomalous: 1) at depth below the RAB drill area, and 2) at depth below the new outcrop discovery ~1 km to the west where rocks returned up to 49.8 g/t Au.

Rock Sampling Results

Highly weathered sulfide rubble was located ~1km west of the area of drilling and was followed up with hand trenching that led to the discovery of an outcropping sulfide vein up to 50 cm wide and grading up to 49.8 g/t Au over 0.5 m. Sulfide mineralization includes arsenopyrite, stibnite, boulangerite, and chalcopyrite. Samples show a strong correlation with Ag, Cu, Pb, Sb, Bi, and Te. Results are shown in Table 3.

| Sample No | Width (cm) | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Sb (%) | Bi (ppm) | Te (ppm) |

| c0135801 | 50 | 7.05 | 52.91 | 0.14 | 0.10 | 0.30 | 388.85 | 11.55 |

| c0135802 | 30 | 17.29 | 78.77 | 0.06 | 0.42 | 0.38 | 73.55 | 5.76 |

| c0135803 | 15 | 10.97 | 6.28 | 0.01 | 0.09 | 0.05 | 38.83 | 1.04 |

| c0135804 | 50 | 49.78 | 51.47 | 0.13 | 0.07 | 0.21 | 547.49 | 11.18 |

| c0135805 | 15 | 18.13 | 43.24 | 0.16 | 0.24 | 0.18 | 333.38 | 11.46 |

| c0135806 | 10 | 0.16 | 19.71 | 0.70 | 0.00 | 0.01 | 17.49 | 1.79 |

Table 3: 2021 Rock Sampling Results

About RAB Drilling

Kingfisher is using RAB drills as a cost effective and efficient first pass exploration tool. The RAB is a heli-portable, track mounted drill that can drill a wide range of dips (50-90°) to depths of up to 100 meters. Rock cuttings from the drill hammer are returned to surface between the outside of the rods and the open hole. Under certain conditions, cross contamination between samples is a concern. The assay results from the RAB drill provide a strong indication of the grade and thickness of gold intercepted in a given hole. Kingfisher intends to follow up encouraging RAB assay results with a diamond drill to fully quantify the grade and thickness of these mineralized intercepts.

QAQC

Grab and chip rock samples are selective by nature and values reported in this news release may not be representative of mineralized zones. Blank and unlabeled certified reference materials (CRM) were inserted into the sample sequence every 20th sample.

RAB drill holes at the Goldrange Project are NWJ sized (2 5/8”). Samples are collected continuously from surface from each 5 ft (1.52 m) rod length. Collected sample material is put through a 1:8 riffle splitter, with the smaller portion of the sample bagged to be sent to the lab for Au Chrysos PhotonAssayTMand Au Fire Assay checks. Certified reference materials and blanks are inserted into the sample sequence every 20th sample. Duplicates were collected from every 40th sample by running the 7:8 reject material through the riffle splitter again, and collecting the 1:8 split for submission to the lab. The total number of blanks, duplicates and CRM samples equals approximately 5% of the samples submitted to the lab for analysis.

RAB and rock chip samples were shipped to MSALABS, located in Langley, British Columbia for preparation and analysis. MSALABS is an ISO17025 and ISO9001 accredited laboratory and is independent of Kingfisher Metals and its Qualified Person. Samples were prepped using the SPL430, CRU-220. Rock chip samples were then analyzed for 48 major and trace elements with ICP-MS after a four-acid digestion (method code IMS-230). Following sample preparation, a 500 g split from each sample was sent to MSALABS Val-D’Or location for Au analysis using Chrysos PhotonAssayTM (method code CPA-Au1). Selected samples were also subjected to Au fire assay and gravimetric check assays. A 30 g split from each check assay sample was analyzed for Au using a lead collection fire assay fusion that was digested and analyzed using AA (method code FAS-111). A 30g split from the check assay samples that assayed >10 ppm Au was analyzed using a lead collection fire assay fusion with a gravimetric finish (method code FAS-415).

Qualified Person

Dustin Perry, P.Geo., Kingfisher’s CEO, is the Company’s Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has prepared the technical information presented in this release.

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on underexplored district-scale projects in British Columbia. Kingfisher has three 100% owned district-scale projects that offer potential exposure to high-grade gold, copper, silver, and zinc. The Company currently has 103,057,272 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 778 606 2507

E-Mail: [email protected]

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property. This news release contains forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. All statements, other than statements of historical fact, are forward-looking statements or information. Forward-looking statements or information in this news release relate to, among other things: formulation of plans for drill testing; and the success related to any future exploration or development programs.

These forward-looking statements and information reflect the Company’s current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include; success of the Company’s projects; prices for gold remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company’s projects; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour- related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: risks related to the COVID-19 pandemic; fluctuations in gold prices; fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation); fluctuations in currency markets (such as the Canadian dollar versus the U.S. dollar); operational risks and hazards inherent with the business of mineral exploration; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards; our ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; changes in laws, regulations and government practices, including environmental, export and import laws and regulations; legal restrictions relating to mineral exploration; increased competition in the mining industry for equipment and qualified personnel; the availability of additional capital; title matters and the additional risks identified in our filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described, or intended. Investors are cautioned against undue reliance on forward-looking statements or information. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances.