Seashore Resources Partners Corp. has entered into an arm’s-length binding letter of intent dated July 16, 2020, with Kingfisher Resources Ltd. (KFR) whereby Seashore will acquire all of the issued and outstanding securities of KFR by way of a share exchange, amalgamation or such other form of business combination as the parties may determine.

Upon successful completion of the proposed acquisition of the securities of KFR (the “Transaction”), it is anticipated that the Company will be listed as a Tier 2 Mining issuer on the TSX-V and will carry on the business of KFR. The Transaction is intended to constitute the Company’s `qualifying transaction’ pursuant to Policy 2.4 of the TSX-V.

Transaction Summary

Pursuant to the Transaction, the Company will issue common shares in the capital of SSH (“SSH Shares”) to the holders of common shares in the capital of KFR (“KFR Shares”) on the basis that SSH will issue up to one SSH Share for each KFR Share outstanding.

The Transaction is an arm’s length transaction. Upon the completion of the Transaction, it is expected that KFR will become a wholly owned subsidiary of the Company (the “Resulting Issuer”). No advances to be made by the Company to KFR are contemplated by the letter of intent and no finder’s fees are payable in connection with the Transaction.

The Company currently has 5,200,000 SSH Shares issued and outstanding, as well as 400,000 stock options and 42,000 broker warrants to acquire SSH Shares, each exercisable at $0.10 per share.

The Transaction is subject to a number of terms and conditions, including, but not limited to, the parties entering into a definitive agreement with respect to the Transaction on or before August 15, 2020 (such agreement to include representations, warranties, conditions and covenants typical for a transaction of this nature), the completion of satisfactory due diligence investigations, the completion of a private placement by KFR of subscription receipts for gross proceeds of a minimum of $750,000, as further described below, and the approval of the TSX-V and other applicable regulatory authorities. All dollar figures referenced herein, unless otherwise specified, refer to Canadian dollars.

As the Transaction is not a ‘non-arm’s length transaction’ as defined by TSX-V policies, it is not anticipated that shareholder approval for the Transaction will be required or sought.

Trading in SSH Shares will remain halted pending the satisfaction of all applicable requirements of Policy 2.4 of the TSX-V. There can be no assurance that trading of SSH Shares will resume prior to the completion of the Transaction. Further details concerning the Transaction (including additional financial and shareholder information regarding KFR) and other matters will be announced if and when a definitive agreement is reached.

Information Concerning KFR

KFR is a privately held mining exploration company with its head office in Vancouver, British Columbia. It currently has 28,103,802 common shares issued and outstanding. There are no persons holding a controlling interest in KFR.

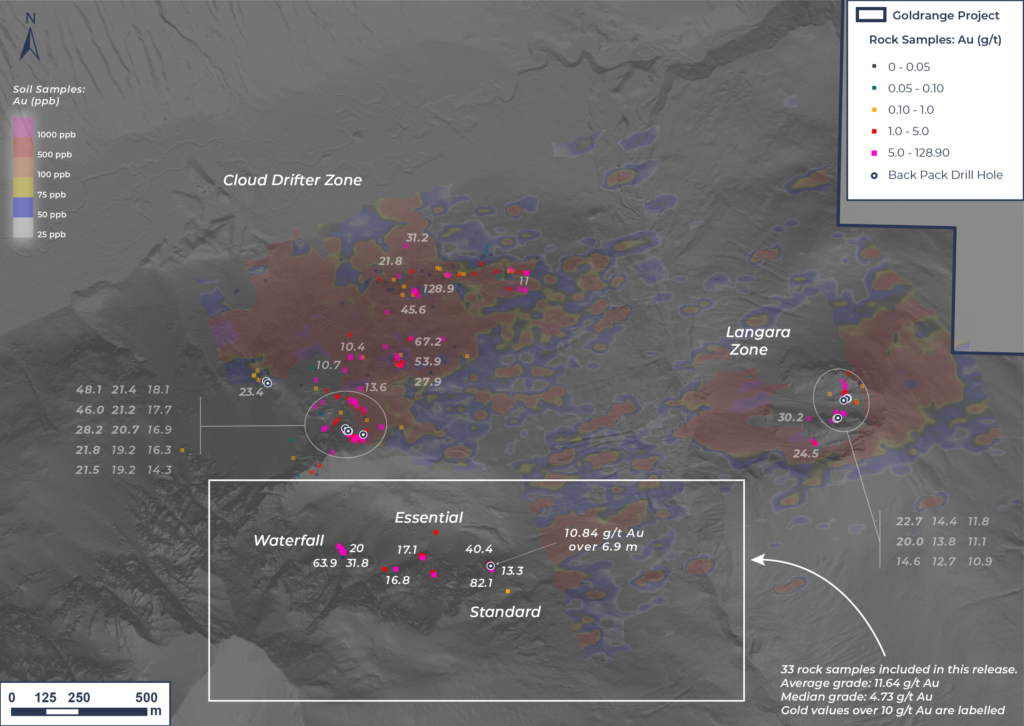

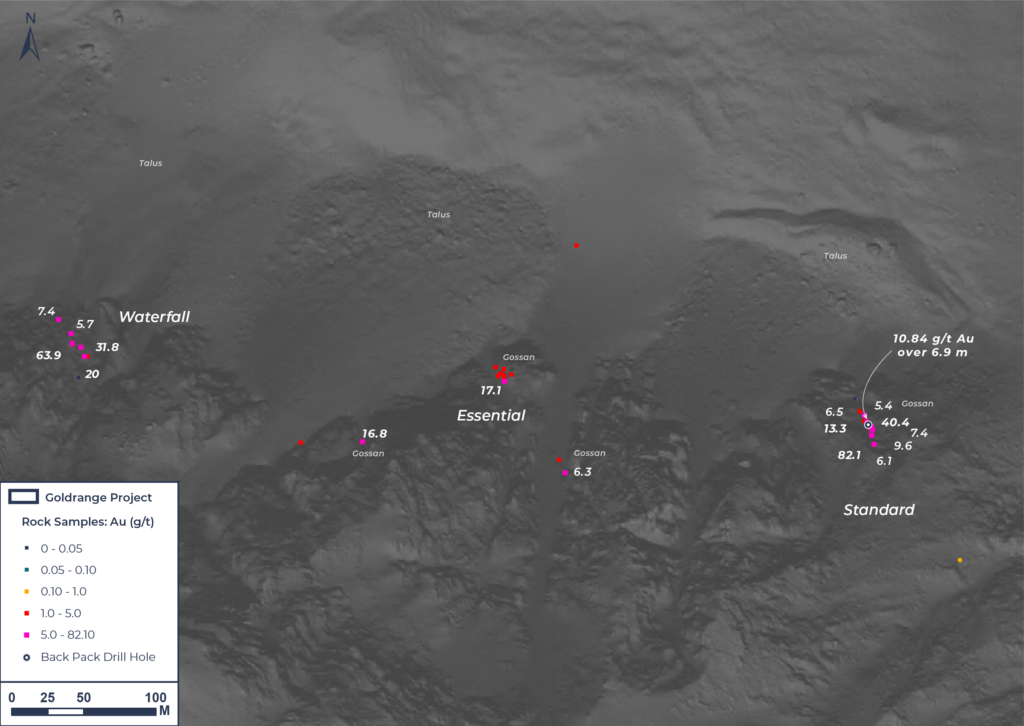

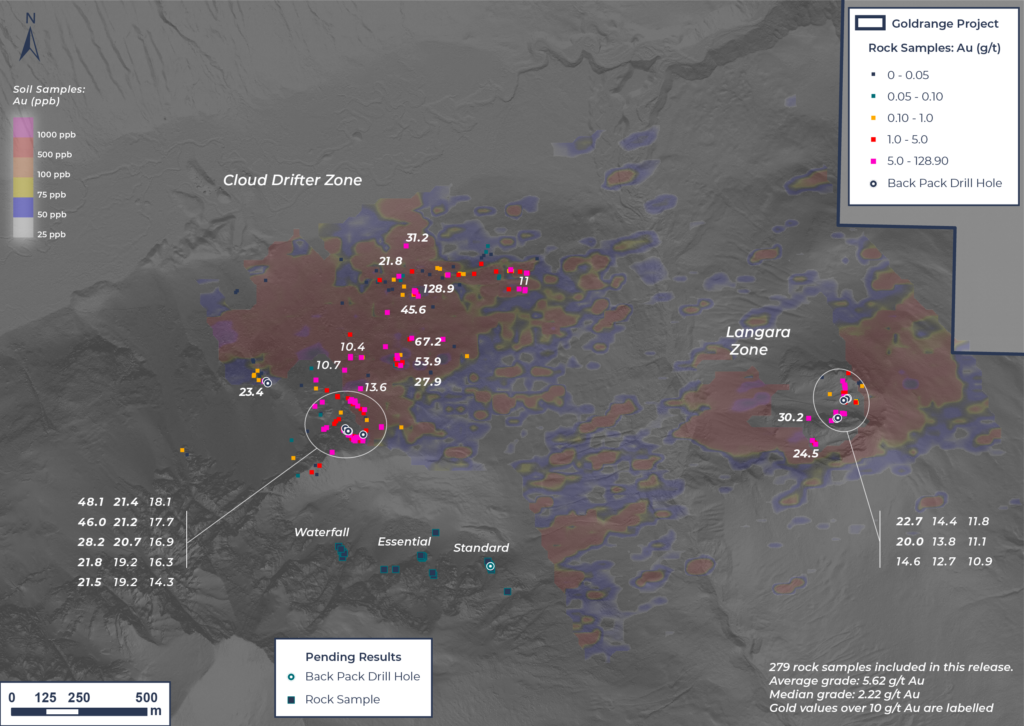

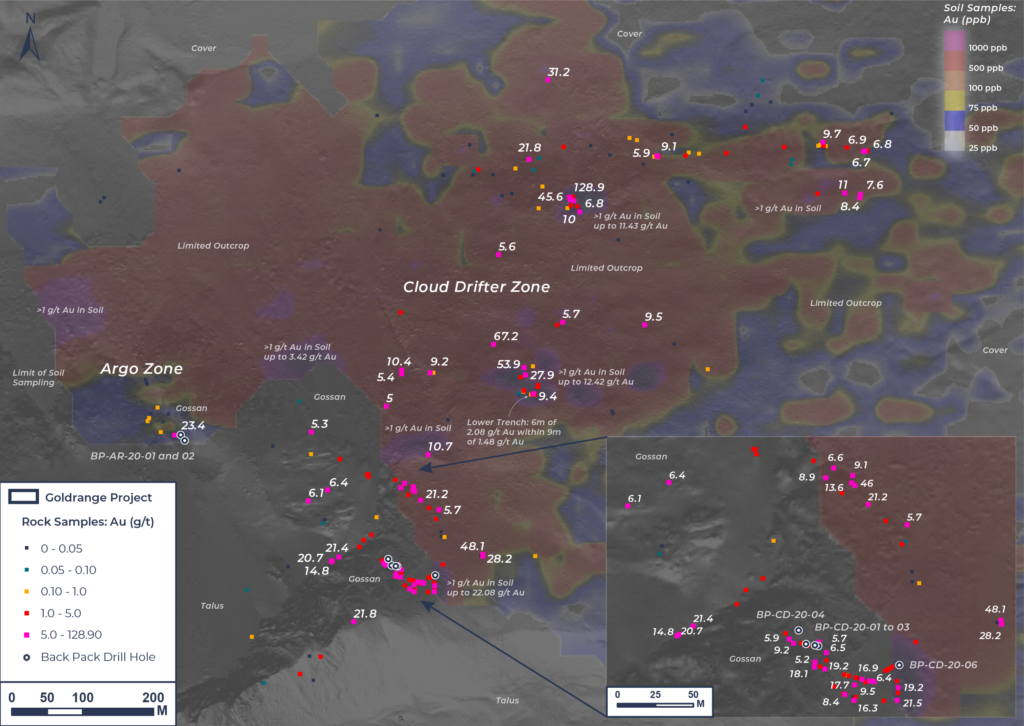

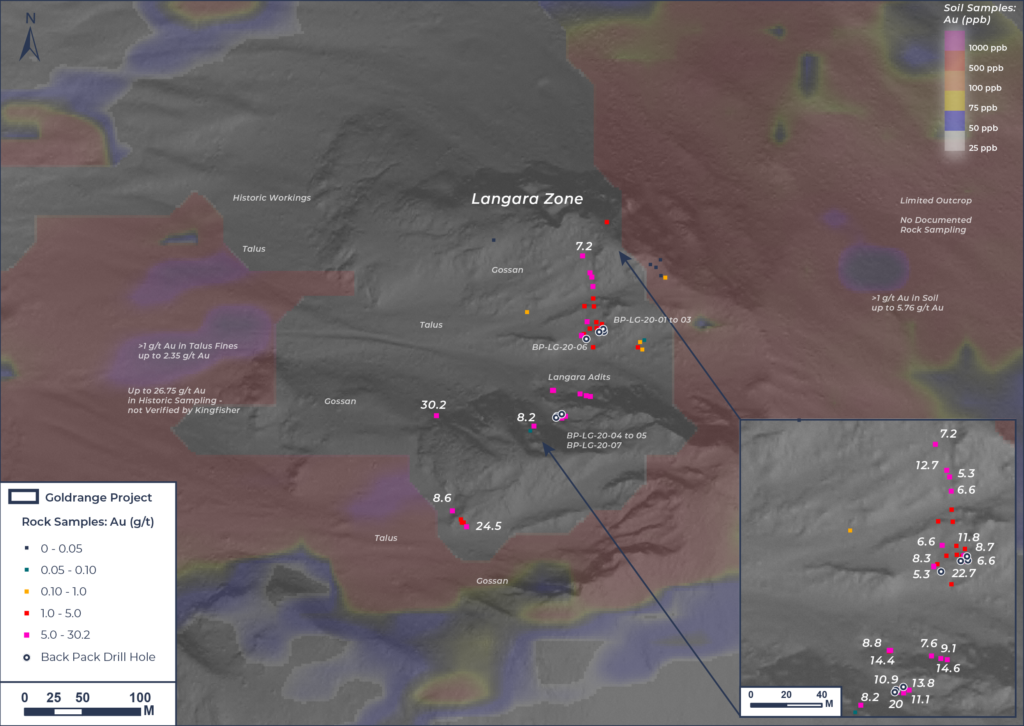

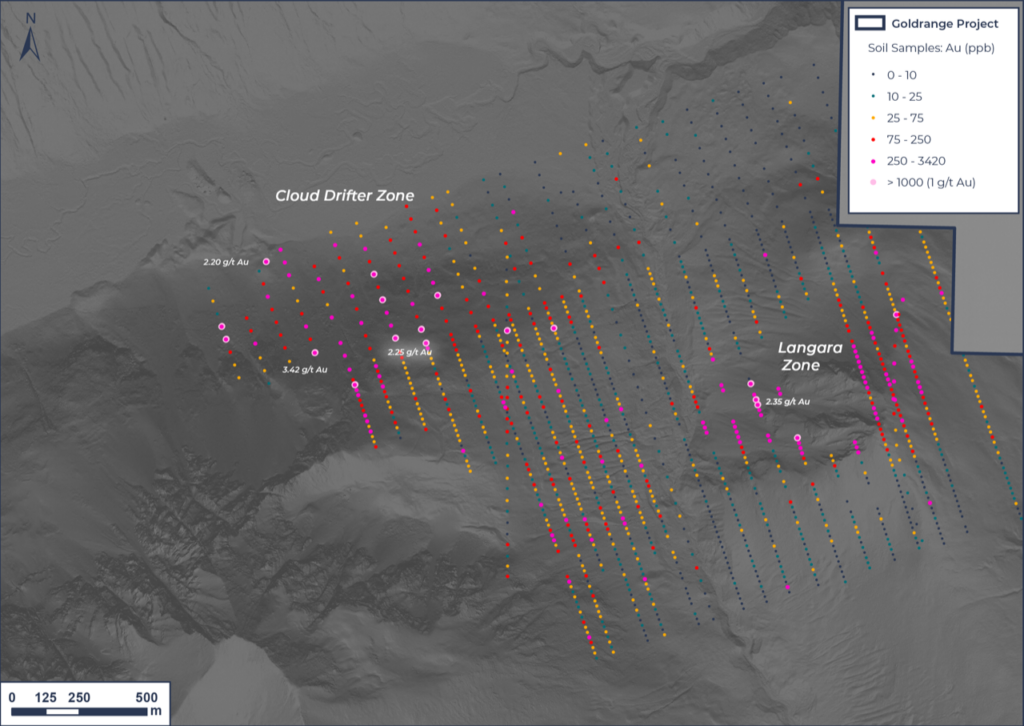

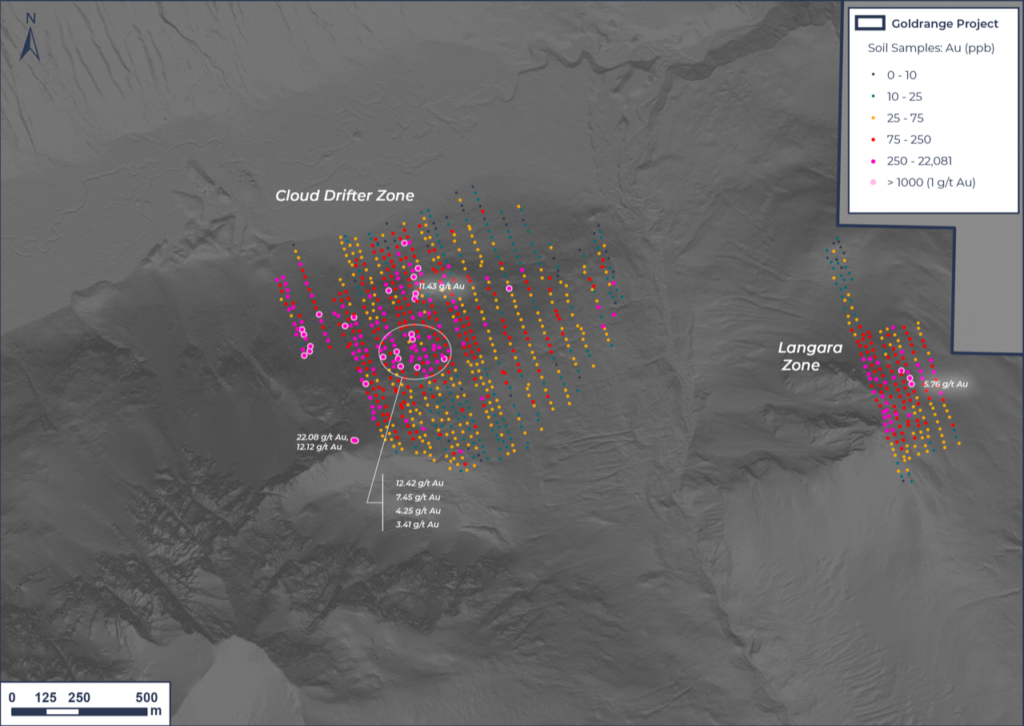

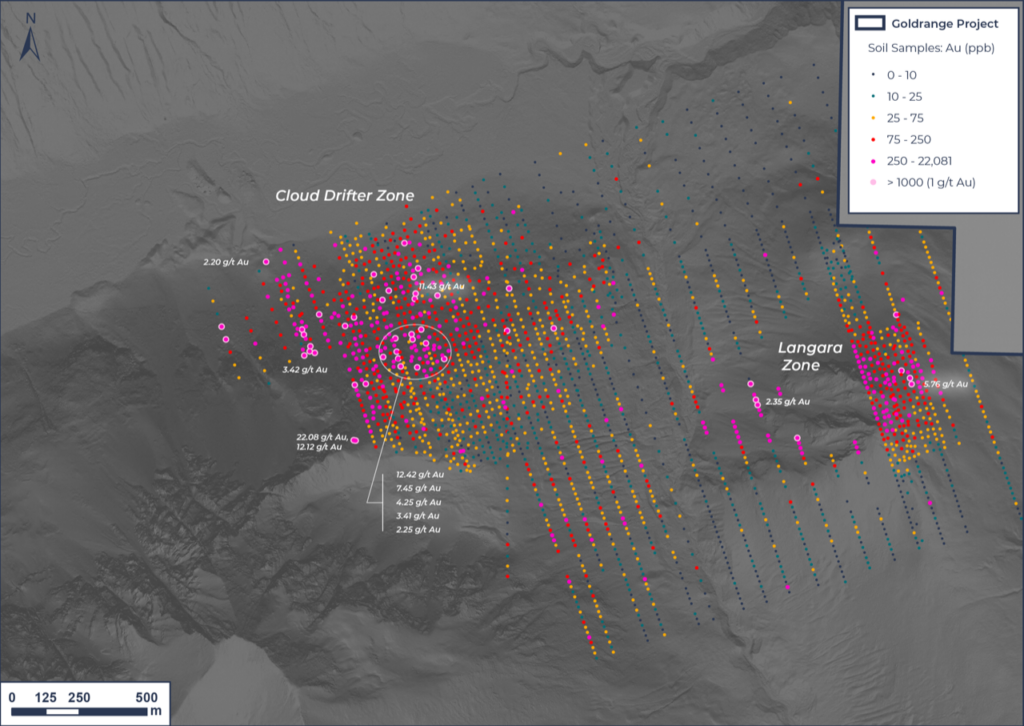

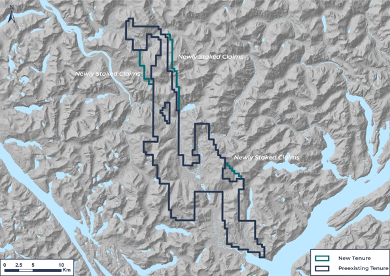

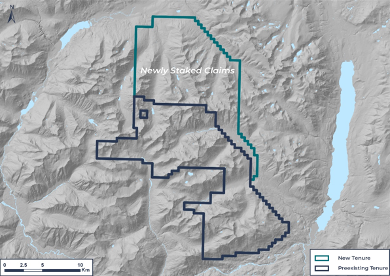

KFR’s operations are focused on world class and underexplored district scale properties in British Columbia, with three 100% owned district scale projects that offer potential exposure to high-grade gold, silver, copper, and zinc. More specifically, the properties consist of the Goldrange property located in south central British Columbia that consists of 22 mineral claims covering 16,328 hectares, the Thibert property located in northern British Columbia that consists of 8 mineral claims covering 12,475 hectares, and the Ecstall property (the “Property”), an early stage exploration property consisting of 28 mineral claims (25,017 hectares), located in the Skeena Mining Division, 56km southeast of Prince Rupert, British Columbia.

KFR completed a three-phase exploration program in 2019 on the Property that consisted of rock sampling, soil sampling, and stream sediment sampling, in addition to a 1501-line kilometer airborne VTEM survey consisting of variable time domain electromagnetics and magnetics. Results of the airborne geophysical survey indicate numerous electromagnetic conductors across the length of the 49km-long Property. Geochemical work in 2019 identified a new zone of mineralization, the “Shiner Zone”, where ~400m of mineralization typical of VMS deposits was discovered following up on the geophysical survey. The 2019 exploration program in addition to a review of historic data warrants future exploration to follow up on geophysical anomalies as well as further refining targets at the Shiner Zone. A $200,000 program consisting of mapping and detailed rock sampling is recommended with potential future drill testing contingent on initial work. To date, KFR has spent approximately $541,687 on exploration activities on the Property.

The technical information in this news release has been prepared by Christopher Dyakowski, P. Geo., the author of the technical report on the Property, which will be filed under the SEDAR profile of the Company in due course, and a qualified person within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Selected Financial Information about KFR

The following table sets out selected financial information from Kingfisher’s unaudited financial statements as of March 31, 2020. The information provided herein should be read in conjunction with such financial statements, which will be included in the filing statement being prepared in connection with the Transaction and will be filed on www.sedar.com in due course.

Interim Period Ended

March 31, 2020

Total Assets $1,067,417

Total Liabilities $2,367

Deficit ($149,575)

Working Capital $259,897

Revenues Nil

Expenses $80,154

Net Earnings (Loss) ($80,154)

Management and Board of Directors

Upon completion of the Transaction, it is expected that all the directors and officers of SSH, other than Chris Beltgens, will resign and be replaced by nominees of KFR. The following sets out the names and backgrounds of all persons who are expected to be the officers and directors of the Resulting Issuer, with the addition of a CFO to be announced at a later date:

Dustin Perry, CEO and Director. Mr. Perry is an exploration geologist and entrepreneur with over 13 years in the mining sector. He has worked on over 50 exploration projects throughout British Columbia, the Yukon and Mexico. He received a B.Sc Geology from the University of British Columbia and is a registered professional geologist with the Association of Professional Engineers and Geoscientists of BC.

David Loretto, President and Director. Mr. Loretto is an exploration geologist and entrepreneur, having received a B.Sc (Hons) in Geological Sciences from Queen’s University and was an exploration team member on the Brucejack deposit with Pretium Resources Inc. (TSX: PVG). He has over 10 years of experience in the resource sector working in both technical and management capacities and has been involved with exploration in British Columbia, the United States and New Zealand. Mr. Loretto currently serves as a director for Interlapse Technologies Corp. (TSX-V: INLA) and PLB Capital Corp. (TSX-V: PLB.P).

Chris Beltgens, Director. Mr. Beltgens has over 10 years of investment, business development and corporate finance experience. Since April 2016, he has been the Vice President of Corporate Development for TAG Oil Ltd. (TSX-V: TAO). Prior thereto from 2013 to 2016, he was the corporate development manager for East West Petroleum Corp. (TSX-V: EW). Mr. Beltgens previously spent six years in London working in investment banking covering international oil & gas exploration and production companies and where he assisted in raising capital for the sector. Mr. Beltgens has completed the CFA program, received an MBA from the University of Toronto and a B.Sc from the University of Victoria.

Zach Flood, Director. Mr. Flood is an experienced geologist who has managed mineral exploration in countries around the world for the past 15 years. Zach is co-founder, President and a Director of Kenorland Minerals Ltd., an established project generator, focussed on exploration in North America, as well as President, CEO and a Director of Northway Resources Corp. (TSX-V: NTW).

Giuseppe (Pino) Perone, Corporate Secretary. Mr. Perone is a lawyer by background and has extensive corporate experience that stems from practicing as corporate counsel, as well as serving as an executive and director, for various public and private companies in the resource and technology sectors. Mr. Perone currently acts as General Counsel and Corporate Secretary of TAG Oil Ltd. (TSX-V: TAO), as President, Corporate Secretary and a director of Interlapse Technologies Corp. (TSX-V: INLA), as CEO, CFO, Corporate Secretary and a director of PLB Capital Corp. (TSX-V: PLB.P) and as a director of McorpCX, Inc. (TSX-V: MCX). Mr. Perone holds a B.A. from the University of Victoria and an LL.B. from the University of Alberta and has been a member in good standing of the Law Society of British Columbia since 2006.

Private Placement

Pursuant to the letter of intent, it is a condition of the Transaction that KFR will be responsible for the completion of a private placement (the “Private Placement”) to raise a minimum of $750,000 at a price per common share to be determined and completed with the Transaction. The Private Placement may be completed in KFR or the Resulting Issuer or both, as agreed by the parties. KFR intends to use the net proceeds of the Private Placement to fund the Transaction, to develop its business and for working capital and general corporate purposes.

Sponsorship

The Transaction is subject to the sponsorship requirements of the TSX-V unless an exemption from those requirements is granted. The Company intends to apply for an exemption from the sponsorship requirements; however, there can be no assurance that an exemption will be obtained. If an exemption from the sponsorship requirements is not obtained, a sponsor will be identified at a later date. An agreement to act as sponsor in respect of the Transaction should not be construed as any assurance with respect to the merits of the Transaction or the likelihood of its completion.

Trading Halt

Trading in SSH Shares has been halted as of July 20, 2020 and will remain halted pending the satisfaction of all applicable requirements pursuant to Policy 2.4 of the TSX-V.

Name Change

Upon completion of the Transaction, the Company intends to change its name to “Kingfisher Metals Corp.” or such other name as KFR may determine, and the parties expect that the TSX-V will assign a new trading symbol for the Resulting Issuer.